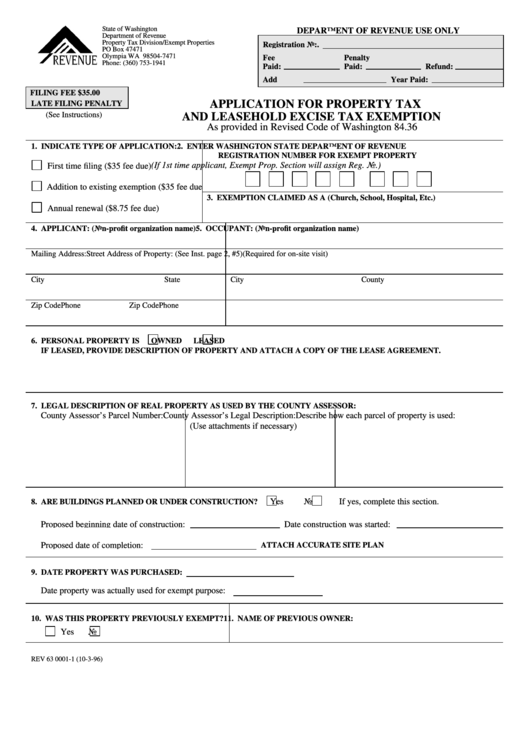

State of Washington

DEPARTMENT OF REVENUE USE ONLY

Department of Revenue

Property Tax Division/Exempt Properties

Registration No:.

PO Box 47471

Olympia WA 98504-7471

Fee

Penalty

Phone: (360) 753-1941

Paid:

Paid:

Refund:

Add

Year Paid:

FILING FEE $35.00

APPLICATION FOR PROPERTY TAX

LATE FILING PENALTY

(See Instructions)

AND LEASEHOLD EXCISE TAX EXEMPTION

As provided in Revised Code of Washington 84.36

1. INDICATE TYPE OF APPLICATION:

2. ENTER WASHINGTON STATE DEPARTMENT OF REVENUE

REGISTRATION NUMBER FOR EXEMPT PROPERTY

(If 1st time applicant, Exempt Prop. Section will assign Reg. No.)

First time filing ($35 fee due)

Addition to existing exemption ($35 fee due)

3. EXEMPTION CLAIMED AS A (Church, School, Hospital, Etc.)

Annual renewal ($8.75 fee due)

4. APPLICANT: (Non-profit organization name)

5. OCCUPANT: (Non-profit organization name)

Mailing Address:

Street Address of Property: (See Inst. page 2, #5)

(Required for on-site visit)

City

State

City

County

Zip Code

Phone

Zip Code

Phone

6. PERSONAL PROPERTY IS

OWNED

LEASED

IF LEASED, PROVIDE DESCRIPTION OF PROPERTY AND ATTACH A COPY OF THE LEASE AGREEMENT.

7. LEGAL DESCRIPTION OF REAL PROPERTY AS USED BY THE COUNTY ASSESSOR:

County Assessor’s Parcel Number:

County Assessor’s Legal Description:

Describe how each parcel of property is used:

(Use attachments if necessary)

Yes

No

If yes, complete this section.

8. ARE BUILDINGS PLANNED OR UNDER CONSTRUCTION?

Proposed beginning date of construction:

Date construction was started:

Proposed date of completion:

ATTACH ACCURATE SITE PLAN

9. DATE PROPERTY WAS PURCHASED:

Date property was actually used for exempt purpose:

10. WAS THIS PROPERTY PREVIOUSLY EXEMPT?

11. NAME OF PREVIOUS OWNER:

Yes

No

REV 63 0001-1 (10-3-96)

1

1 2

2