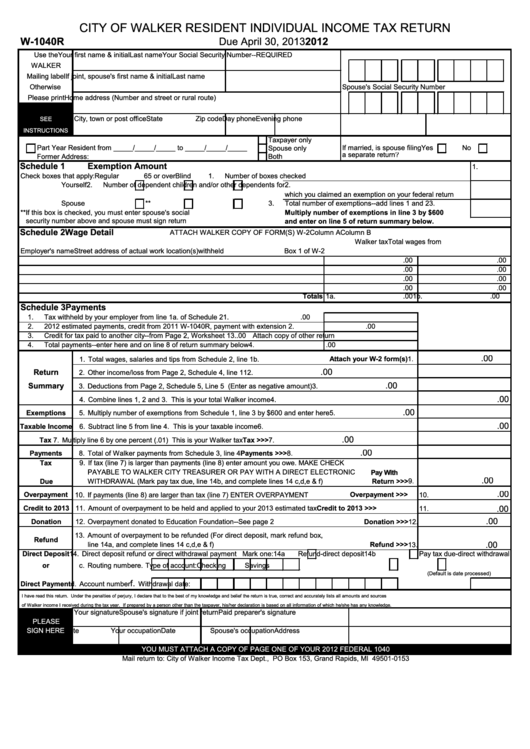

CITY OF WALKER RESIDENT INDIVIDUAL INCOME TAX RETURN

W-1040R

Due April 30, 2013

2012

Use the

Your first name & initial

Last name

Your Social Security Number--REQUIRED

WALKER

Mailing label

If joint, spouse's first name & initial

Last name

Otherwise

Spouse's Social Security Number

Please print

Home address (Number and street or rural route)

City, town or post office

State

Zip code

Day phone

Evening phone

SEE

INSTRUCTIONS

Taxpayer only

Part Year Resident from _____/_____/_____ to _____/_____/_____

If married, is spouse filing

Yes

No

Spouse only

a separate return?

Both

Former Address:

Schedule 1

Exemption Amount

1.

Check boxes that apply:

Regular

65 or over

Blind

1.

Number of boxes checked

Yourself

2.

Number of dependent children and/or other dependents for 2.

which you claimed an exemption on your federal return

Spouse

**

3.

Total number of exemptions--add lines 1 and 2

3.

**If this box is checked, you must enter spouse's social

Multiply number of exemptions in line 3 by $600

security number above and spouse must sign return

and enter on line 5 of return summary below.

Schedule 2

Wage Detail

ATTACH WALKER COPY OF FORM(S) W-2

Column A

Column B

Walker tax

Total wages from

Employer's name

Street address of actual work location(s)

withheld

Box 1 of W-2

.00

.00

.00

.00

.00

.00

.00

.00

Totals 1a.

.00 1b.

.00

Schedule 3

Payments

1.

Tax withheld by your employer from line 1a. of Schedule 2

1.

.00

2.

2012 estimated payments, credit from 2011 W-1040R, payment with extension

2.

.00

3.

Credit for tax paid to another city--from Page 2, Worksheet 1

3.

.00 Attach copy of other return

4.

Total payments--enter here and on line 8 of return summary below

4.

.00

.00

1. Total wages, salaries and tips from Schedule 2, line 1b.

Attach your W-2 form(s)

1.

.00

Return

2. Other income/loss from Page 2, Schedule 4, line 11

2.

.00

Summary

3. Deductions from Page 2, Schedule 5, Line 5 (Enter as negative amount)

3.

.00

4. Combine lines 1, 2 and 3. This is your total Walker income

4.

.00

Exemptions

5. Multiply number of exemptions from Schedule 1, line 3 by $600 and enter here

5.

.00

Taxable Income 6. Subtract line 5 from line 4. This is your taxable income

6.

.00

Tax

7. Multiply line 6 by one percent (.01) This is your Walker tax

Tax >>>

7.

.00

Payments

8. Total of Walker payments from Schedule 3, line 4

Payments >>>

8.

Tax

9. If tax (line 7) is larger than payments (line 8) enter amount you owe. MAKE CHECK

PAYABLE TO WALKER CITY TREASURER OR PAY WITH A DIRECT ELECTRONIC

Pay With

.00

Due

WITHDRAWAL (Mark pay tax due, line 14b, and complete lines 14 c,d,e & f)

9.

Return >>>

.00

Overpayment 10. If payments (line 8) are larger than tax (line 7) ENTER OVERPAYMENT

Overpayment >>>

10.

.00

Credit to 2013 11. Amount of overpayment to be held and applied to your 2013 estimated tax

Credit to 2013 >>>

11.

.00

Donation

12. Overpayment donated to Education Foundation--See page 2

Donation >>>

12.

13. Amount of overpayment to be refunded (For direct deposit, mark refund box,

Refund

.00

line 14a, and complete lines 14 c,d,e & f)

Refund >>>

13.

Direct Deposit 14. Direct deposit refund or direct withdrawal payment Mark one:

14a

Refund-direct deposit

14b

Pay tax due-direct withdrawal

or

c. Routing number

e. Type of account:

Checking

Savings

(Default is date processed)

f.

Direct Payment

d. Account number

Withdrawal date:

I have read this return. Under the penalties of perjury, I declare that to the best of my knowledge and belief the return is true, correct and accurately lists all amounts and sources

of Walker income I received during the tax year. If prepared by a person other than the taxpayer, his/her declaration is based on all information of which he/she has any knowledge.

Your signature

Spouse's signature if joint return

Paid preparer's signature

PLEASE

SIGN HERE

Date

Your occupation

Date

Spouse's occupation

Address

YOU MUST ATTACH A COPY OF PAGE ONE OF YOUR 2012 FEDERAL 1040

Mail return to: City of Walker Income Tax Dept., PO Box 153, Grand Rapids, MI 49501-0153

1

1 2

2