Instructions For Michigan Business Tax (Mbt) Miscellaneous Nonrefundable Credits Form 4573

ADVERTISEMENT

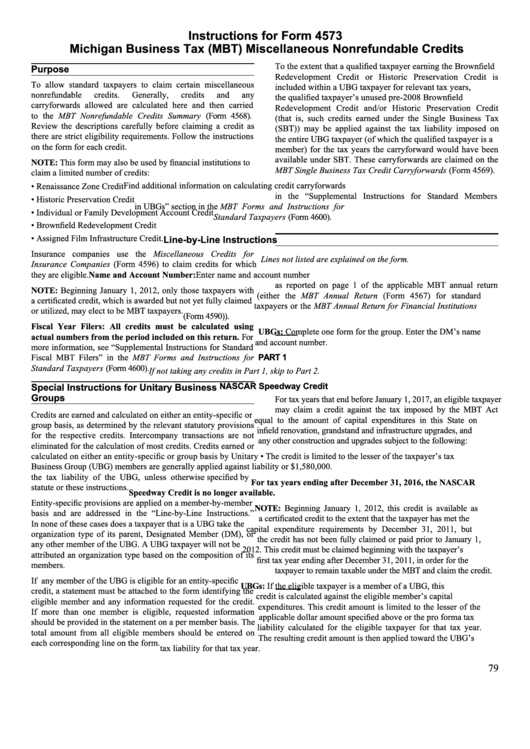

Instructions for Form 4573

Michigan Business Tax (MBT) Miscellaneous Nonrefundable Credits

To the extent that a qualified taxpayer earning the Brownfield

Purpose

Redevelopment Credit or Historic Preservation Credit is

To allow standard taxpayers to claim certain miscellaneous

included within a UBG taxpayer for relevant tax years,

nonrefundable

credits.

Generally,

credits

and

any

the

qualified

taxpayer’s

unused

pre-2008

Brownfield

carryforwards allowed are calculated here and then carried

Redevelopment Credit and/or Historic Preservation Credit

to the MBT Nonrefundable Credits Summary (Form 4568).

(that is, such credits earned under the Single Business Tax

Review the descriptions carefully before claiming a credit as

(SBT)) may be applied against the tax liability imposed on

there are strict eligibility requirements. Follow the instructions

the entire UBG taxpayer (of which the qualified taxpayer is a

on the form for each credit.

member) for the tax years the carryforward would have been

available under SBT. These carryforwards are claimed on the

Note: This form may also be used by financial institutions to

MBT Single Business Tax Credit Carryforwards (Form 4569).

claim a limited number of credits:

Find additional information on calculating credit carryforwards

• Renaissance Zone Credit

in the “Supplemental Instructions for Standard Members

• Historic Preservation Credit

in UBGs” section in the MBT Forms and Instructions for

• Individual or Family Development Account Credit

Standard Taxpayers (Form 4600).

• Brownfield Redevelopment Credit

• Assigned Film Infrastructure Credit.

Line-by-Line Instructions

Insurance companies use the Miscellaneous Credits for

Lines not listed are explained on the form.

Insurance Companies (Form 4596) to claim credits for which

they are eligible.

Name and Account Number: Enter name and account number

as reported on page 1 of the applicable MBT annual return

Note: Beginning January 1, 2012, only those taxpayers with

(either the MBT Annual Return (Form 4567) for standard

a certificated credit, which is awarded but not yet fully claimed

taxpayers or the MBT Annual Return for Financial Institutions

or utilized, may elect to be MBT taxpayers.

(Form 4590)).

Fiscal Year Filers: All credits must be calculated using

UBGs: Complete one form for the group. Enter the DM’s name

actual numbers from the period included on this return. For

and account number.

more information, see “Supplemental Instructions for Standard

Fiscal MBT Filers” in the MBT Forms and Instructions for

PART 1

Standard Taxpayers (Form 4600).

If not taking any credits in Part 1, skip to Part 2.

NASCAR Speedway Credit

Special Instructions for Unitary Business

Groups

For tax years that end before January 1, 2017, an eligible taxpayer

may claim a credit against the tax imposed by the MBT Act

Credits are earned and calculated on either an entity-specific or

equal to the amount of capital expenditures in this State on

group basis, as determined by the relevant statutory provisions

infield renovation, grandstand and infrastructure upgrades, and

for the respective credits. Intercompany transactions are not

any other construction and upgrades subject to the following:

eliminated for the calculation of most credits. Credits earned or

calculated on either an entity-specific or group basis by Unitary

• The credit is limited to the lesser of the taxpayer’s tax

Business Group (UBG) members are generally applied against

liability or $1,580,000.

the tax liability of the UBG, unless otherwise specified by

For tax years ending after December 31, 2016, the NASCAR

statute or these instructions.

Speedway Credit is no longer available.

Entity-specific provisions are applied on a member-by-member

Note: Beginning January 1, 2012, this credit is available as

basis and are addressed in the “Line-by-Line Instructions.”

a certificated credit to the extent that the taxpayer has met the

In none of these cases does a taxpayer that is a UBG take the

capital expenditure requirements by December 31, 2011, but

organization type of its parent, Designated Member (DM), or

the credit has not been fully claimed or paid prior to January 1,

any other member of the UBG. A UBG taxpayer will not be

2012. This credit must be claimed beginning with the taxpayer’s

attributed an organization type based on the composition of its

first tax year ending after December 31, 2011, in order for the

members.

taxpayer to remain taxable under the MBT and claim the credit.

If any member of the UBG is eligible for an entity-specific

UBGs: If the eligible taxpayer is a member of a UBG, this

credit, a statement must be attached to the form identifying the

credit is calculated against the eligible member’s capital

eligible member and any information requested for the credit.

expenditures. This credit amount is limited to the lesser of the

If more than one member is eligible, requested information

applicable dollar amount specified above or the pro forma tax

should be provided in the statement on a per member basis. The

liability calculated for the eligible taxpayer for that tax year.

total amount from all eligible members should be entered on

The resulting credit amount is then applied toward the UBG’s

each corresponding line on the form.

tax liability for that tax year.

79

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7