Instructions For Michigan Historic Preservation Tax Credit Form 3581 2016

ADVERTISEMENT

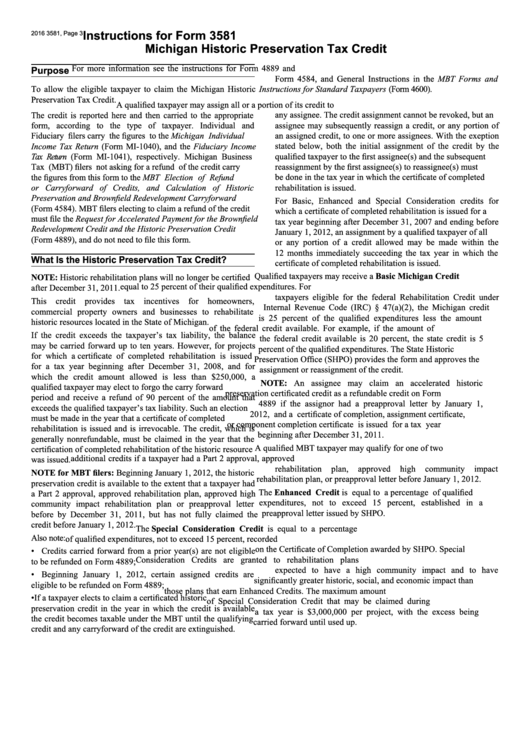

Instructions for Form 3581

2016 3581, Page 3

Michigan Historic Preservation Tax Credit

For more information see the instructions for Form 4889 and

Purpose

Form 4584, and General Instructions in the MBT Forms and

Instructions for Standard Taxpayers (Form 4600).

To allow the eligible taxpayer to claim the Michigan Historic

Preservation Tax Credit.

A qualified taxpayer may assign all or a portion of its credit to

The credit is reported here and then carried to the appropriate

any assignee. The credit assignment cannot be revoked, but an

form, according to the type of taxpayer. Individual and

assignee may subsequently reassign a credit, or any portion of

Fiduciary filers carry the figures to the Michigan Individual

an assigned credit, to one or more assignees. With the exeption

Income Tax Return (Form MI-1040), and the Fiduciary Income

stated below, both the initial assignment of the credit by the

Tax Return (Form MI-1041), respectively. Michigan Business

qualified taxpayer to the first assignee(s) and the subsequent

Tax (MBT) filers not asking for a refund of the credit carry

reassignment by the first assignee(s) to reassignee(s) must

the figures from this form to the MBT Election of Refund

be done in the tax year in which the certificate of completed

or Carryforward of Credits, and Calculation of Historic

rehabilitation is issued.

Preservation and Brownfield Redevelopment Carryforward

For Basic, Enhanced and Special Consideration credits for

(Form 4584). MBT filers electing to claim a refund of the credit

which a certificate of completed rehabilitation is issued for a

must file the Request for Accelerated Payment for the Brownfield

tax year beginning after December 31, 2007 and ending before

Redevelopment Credit and the Historic Preservation Credit

January 1, 2012, an assignment by a qualified taxpayer of all

(Form 4889), and do not need to file this form.

or any portion of a credit allowed may be made within the

12 months immediately succeeding the tax year in which the

What Is the Historic Preservation Tax Credit?

certificate of completed rehabilitation is issued.

Qualified taxpayers may receive a Basic Michigan Credit

NOTE: Historic rehabilitation plans will no longer be certified

equal to 25 percent of their qualified expenditures. For

after December 31, 2011.

taxpayers eligible for the federal Rehabilitation Credit under

This credit provides tax incentives for homeowners,

Internal Revenue Code (IRC) § 47(a)(2), the Michigan credit

commercial property owners and businesses to rehabilitate

is 25 percent of the qualified expenditures less the amount

historic resources located in the State of Michigan.

of the federal credit available. For example, if the amount of

If the credit exceeds the taxpayer’s tax liability, the balance

the federal credit available is 20 percent, the state credit is 5

may be carried forward up to ten years. However, for projects

percent of the qualified expenditures. The State Historic

for which a certificate of completed rehabilitation is issued

Preservation Office (SHPO) provides the form and approves the

for a tax year beginning after December 31, 2008, and for

assignment or reassignment of the credit.

which the credit amount allowed is less than $250,000, a

NOTE: An assignee may claim an accelerated historic

qualified taxpayer may elect to forgo the carry forward

preservation certificated credit as a refundable credit on Form

period and receive a refund of 90 percent of the amount that

4889 if the assignor had a preapproval letter by January 1,

exceeds the qualified taxpayer’s tax liability. Such an election

2012, and a certificate of completion, assignment certificate,

must be made in the year that a certificate of completed

or component completion certificate is issued for a tax year

rehabilitation is issued and is irrevocable. The credit, which is

beginning after December 31, 2011.

generally nonrefundable, must be claimed in the year that the

A qualified MBT taxpayer may qualify for one of two

certification of completed rehabilitation of the historic resource

additional credits if a taxpayer had a Part 2 approval, approved

was issued.

rehabilitation

plan,

approved

high

community

impact

NOTE for MBT filers: Beginning January 1, 2012, the historic

rehabilitation plan, or preapproval letter before January 1, 2012.

preservation credit is available to the extent that a taxpayer had

The Enhanced Credit is equal to a percentage of qualified

a Part 2 approval, approved rehabilitation plan, approved high

expenditures, not to exceed 15 percent, established in a

community impact rehabilitation plan or preapproval letter

preapproval letter issued by SHPO.

before by December 31, 2011, but has not fully claimed the

credit before January 1, 2012.

The Special Consideration Credit is equal to a percentage

Also note:

of qualified expenditures, not to exceed 15 percent, recorded

on the Certificate of Completion awarded by SHPO. Special

• Credits carried forward from a prior year(s) are not eligible

Consideration Credits are granted to rehabilitation plans

to be refunded on Form 4889;

expected to have a high community impact and to have

• Beginning January 1, 2012, certain assigned credits are

significantly greater historic, social, and economic impact than

eligible to be refunded on Form 4889;

those plans that earn Enhanced Credits. The maximum amount

• If a taxpayer elects to claim a certificated historic

of Special Consideration Credit that may be claimed during

preservation credit in the year in which the credit is available

a tax year is $3,000,000 per project, with the excess being

the credit becomes taxable under the MBT until the qualifying

carried forward until used up.

credit and any carryforward of the credit are extinguished.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3