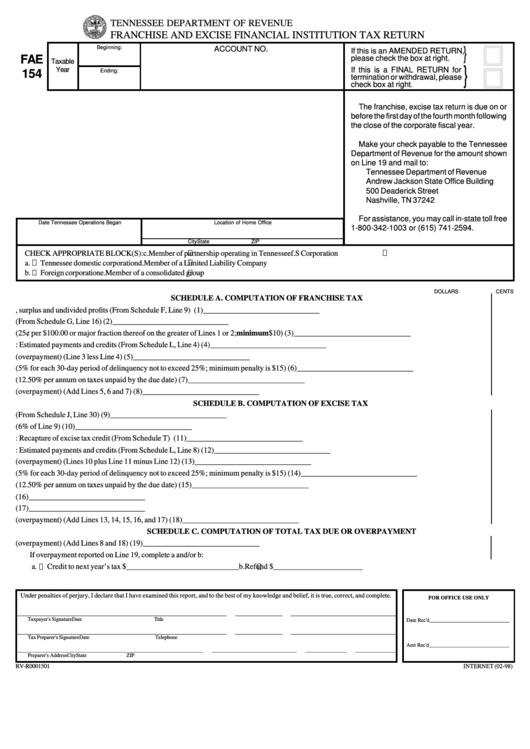

TENNESSEE DEPARTMENT OF REVENUE

FRANCHISE AND EXCISE FINANCIAL INSTITUTION TAX RETURN

Beginning:

ACCOUNT NO.

}

If this is an AMENDED RETURN,

FAE

please check the box at right.

Taxable

}

If this is a FINAL RETURN for

Year

Ending:

154

termination or withdrawal, please

check box at right.

The franchise, excise tax return is due on or

before the first day of the fourth month following

the close of the corporate fiscal year.

Make your check payable to the Tennessee

Department of Revenue for the amount shown

on Line 19 and mail to:

Tennessee Department of Revenue

Andrew Jackson State Office Building

500 Deaderick Street

Nashville, TN 37242

For assistance, you may call in-state toll free

Date Tennessee Operations Began

Location of Home Office

1-800-342-1003 or (615) 741-2594.

City

State

ZIP

CHECK APPROPRIATE BLOCK(S):

c.

Member of partnership operating in Tennessee

f.

S Corporation

a.

Tennessee domestic corporation

d.

Member of a Limited Liability Company

b.

Foreign corporation

e.

Member of a consolidated group

DOLLARS

CENTS

SCHEDULE A. COMPUTATION OF FRANCHISE TAX

1. Total Capital stock, surplus and undivided profits (From Schedule F, Line 9) ............................................................. (1) ______________________________

2. Value of real and tangible personal property (From Schedule G, Line 16) .................................................................. (2) ______________________________

3. Franchise tax (25¢ per $100.00 or major fraction thereof on the greater of Lines 1 or 2; minimum $10) .................. (3) ______________________________

4. Less: Estimated payments and credits (From Schedule L, Line 4) .............................................................................. (4) ______________________________

5. Net Franchise tax due (overpayment) (Line 3 less Line 4) ......................................................................................... (5) ______________________________

6. Penalty (5% for each 30-day period of delinquency not to exceed 25%; minimum penalty is $15) ............................ (6) ______________________________

7. Interest (12.50% per annum on taxes unpaid by the due date) ................................................................................... (7) ______________________________

8. Total franchise tax due (overpayment) (Add Lines 5, 6 and 7) ................................................................................... (8) ______________________________

SCHEDULE B. COMPUTATION OF EXCISE TAX

9. Taxable income (From Schedule J, Line 30) .............................................................................................................. (9) ______________________________

10. Excise tax (6% of Line 9) ........................................................................................................................................ (10) ______________________________

11. Add: Recapture of excise tax credit (From Schedule T) ............................................................................................. (11) ______________________________

12. Less: Estimated payments and credits (From Schedule L, Line 8) ............................................................................ (12) ______________________________

13. Net excise tax due (overpayment) (Lines 10 plus Line 11 minus Line 12) ............................................................... (13) ______________________________

14. Penalty (5% for each 30-day period of delinquency not to exceed 25%; minimum penalty is $15) .......................... (14) ______________________________

15. Interest (12.50% per annum on taxes unpaid by the due date) ................................................................................. (15) ______________________________

16. Penalty on estimated excise tax payments ................................................................................................................ (16) ______________________________

17. Interest on estimated excise tax payments ................................................................................................................ (17) ______________________________

18. Total excise tax due (overpayment) (Add Lines 13, 14, 15, 16, and 17) ................................................................... (18) ______________________________

SCHEDULE C. COMPUTATION OF TOTAL TAX DUE OR OVERPAYMENT

19. Total taxes due (overpayment) (Add Lines 8 and 18) ............................................................................................... (19) ______________________________

If overpayment reported on Line 19, complete a and/or b:

a.

Credit to next year’s tax $ _____________________________ b.

Refund $ _______________________

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is true, correct, and complete.

FOR OFFICE USE ONLY

________________________________________________________________________

________________

____________________________________

Taxpayer's Signature

Date

Title

Date Rec'd ______________________________

________________________________________________________________________

________________

____________________________________

Tax Preparer's Signature

Date

Telephone

Amt Rec'd ______________________________

________________________________________________________________

_____________________________

______________

______________

Preparer's Address

City

State

ZIP

INTERNET (02-98)

RV-R0001501

1

1 2

2 3

3 4

4 5

5