41

41

1998

1998

F

41

41

41

1998

1998

1998

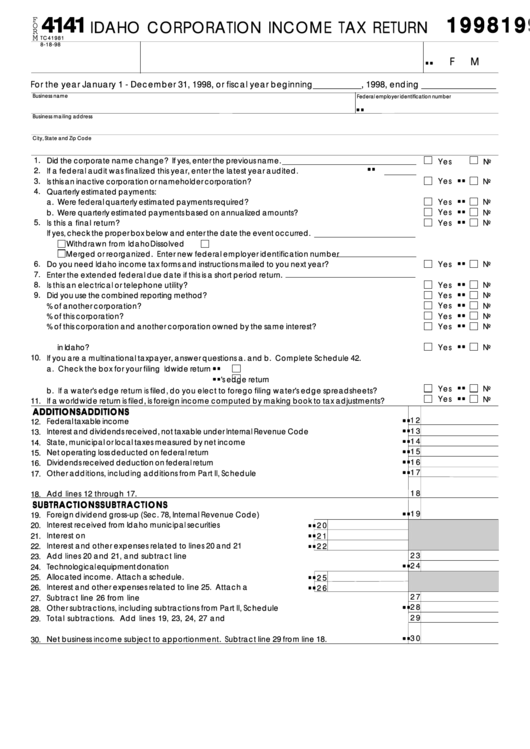

IDAHO CORPORATION INCOME TAX RETURN

O

R

M

TC41981

8-18-98

. . . . .

F

M

For the year January 1 - December 31, 1998, or fiscal year beginning___________, 1998, ending _________________

Business name

Federal employer identification number

. . . . .

Business mailing address

City, State and Zip Code

1.

Did the corporate name change? If yes, enter the previous name.

Yes

. . . . .

No

2.

If a federal audit was finalized this year, enter the latest year audited. ................................

19

. . . . .

3.

Is this an inactive corporation or nameholder corporation? ..........................................................................

Yes

No

4.

Quarterly estimated payments:

. . . . .

Yes

a. Were federal quarterly estimated payments required? .............................................................................

No

. . . . .

Yes

b. Were quarterly estimated payments based on annualized amounts? ......................................................

No

. . . . .

5.

Yes

Is this a final return? .......................................................................................................................................

No

If yes, check the proper box below and enter the date the event occurred.

Withdrawn from Idaho

Dissolved

Merged or reorganized. Enter new federal employer identification number

. . . . .

6.

Yes

Do you need Idaho income tax forms and instructions mailed to you next year? .......................................

No

7.

Enter the extended federal due date if this is a short period return.

. . . . .

8.

Is this an electrical or telephone utility? ........................................................................................................

Yes

No

. . . . .

9.

Did you use the combined reporting method? ...............................................................................................

Yes

No

. . . . .

a. Does this corporation own more than 50% of another corporation? ......................................................

Yes

No

. . . . .

Yes

b. Does another corporation own more than 50% of this corporation? ......................................................

No

. . . . .

Yes

c. Are more than 50% of this corporation and another corporation owned by the same interest? ...........

No

d. Are two or more corporations included in this report operating in Idaho or authorized to do business

. . . . .

in Idaho? .....................................................................................................................................................

Yes

No

10.

If you are a multinational taxpayer, answer questions a. and b. Complete Schedule 42.

. . . . .

a. Check the box for your filing method.

1 .

worldwide return

. . . . .

2 .

water's edge return

. . . . .

Yes

No

b. If a water's edge return is filed, do you elect to forego filing water's edge spreadsheets? ...................

. . . . .

Yes

No

11.

If a worldwide return is filed, is foreign income computed by making book to tax adjustments? ..............

ADDITIONS

ADDITIONS

ADDITIONS

ADDITIONS

ADDITIONS

. . . . .

1 2

Federal taxable income ............................................................................................................................

12.

. . . . .

1 3

Interest and dividends received, not taxable under Internal Revenue Code .........................................

13.

. . . . .

1 4

State, municipal or local taxes measured by net income ......................................................................

14.

. . . . .

1 5

Net operating loss deducted on federal return .......................................................................................

15.

. . . . .

1 6

Dividends received deduction on federal return .....................................................................................

16.

. . . . .

1 7

Other additions, including additions from Part II, Schedule 42 .............................................................

17.

1 8

Add lines 12 through 17.

18.

SUBTRACTIONS

SUBTRACTIONS

SUBTRACTIONS

SUBTRACTIONS

SUBTRACTIONS

. . . . .

1 9

Foreign dividend gross-up (Sec. 78, Internal Revenue Code) ................................................................

19.

. . . . .

Interest received from Idaho municipal securities .....................................

2 0

20.

. . . . .

Interest on U.S. obligations ........................................................................

21.

2 1

. . . . .

Interest and other expenses related to lines 20 and 21 ...........................

22.

2 2

2 3

Add lines 20 and 21, and subtract line 22. ...........................................................................................

23.

. . . . .

2 4

Technological equipment donation ..........................................................................................................

24.

. . . . .

Allocated income. Attach a schedule. .......................................................

25.

2 5

. . . . .

Interest and other expenses related to line 25. Attach a schedule. .......

26.

2 6

2 7

Subtract line 26 from line 25. .................................................................................................................

27.

. . . . .

2 8

Other subtractions, including subtractions from Part II, Schedule 42 ..................................................

28.

2 9

Total subtractions. Add lines 19, 23, 24, 27 and 28. .........................................................................

29.

. . . . .

3 0

Net business income subject to apportionment. Subtract line 29 from line 18.

30.

1

1 2

2