Form Ar1055 Draft - Request For Extension Of Time For Filing Income Tax Returns/form Ar1000es - Estimated Tax For Individuals (Payment With Extension) - 2008

ADVERTISEMENT

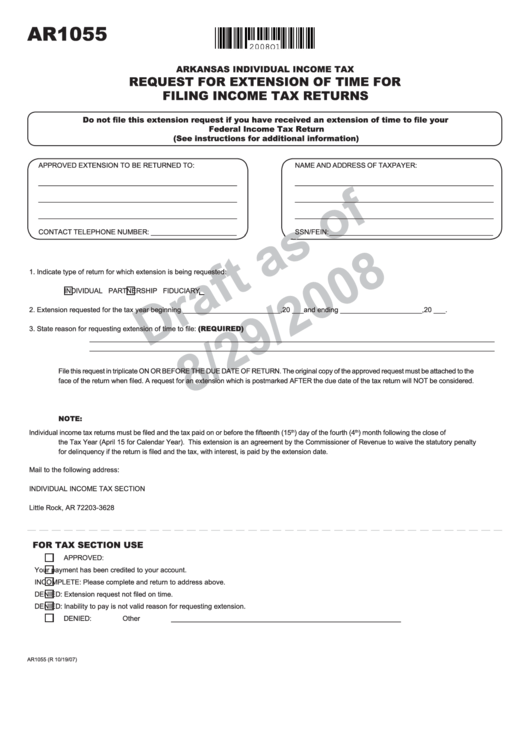

AR1055

2008O1

ARKANSAS INDIVIDUAL INCOME TAX

REQUEST FOR EXTENSION OF TIME FOR

FILING INCOME TAX RETURNS

Do not file this extension request if you have received an extension of time to file your

Federal Income Tax Return

(See instructions for additional information)

APPROVED EXTENSION TO BE RETURNED TO:

NAME AND ADDRESS OF TAXPAYER:

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

CONTACT TELEPHONE NUMBER: ______________________

SSN/FEIN: __________________________________________

1.

Indicate type of return for which extension is being requested:

INDIVIDUAL

PARTNERSHIP

FIDUCIARY

2.

Extension requested for the tax year beginning _________________________,20 ___ and ending _____________________ ,20 ___ .

3.

State reason for requesting extension of time to file: (REQUIRED)

________________________________________________________________________________________________________

________________________________________________________________________________________________________

File this request in triplicate ON OR BEFORE THE DUE DATE OF RETURN. The original copy of the approved request must be attached to the

face of the return when filed. A request for an extension which is postmarked AFTER the due date of the tax return will NOT be considered.

NOTE:

th

th

Individual income tax returns must be filed and the tax paid on or before the fifteenth (15

) day of the fourth (4

) month following the close of

the Tax Year (April 15 for Calendar Year). This extension is an agreement by the Commissioner of Revenue to waive the statutory penalty

for delinquency if the return is filed and the tax, with interest, is paid by the extension date.

Mail to the following address:

INDIVIDUAL INCOME TAX SECTION

P.O. Box 3628

Little Rock, AR 72203-3628

FOR TAX SECTION USE

APPROVED:

Your payment has been credited to your account.

INCOMPLETE: Please complete and return to address above.

DENIED: Extension request not filed on time.

DENIED: Inability to pay is not valid reason for requesting extension.

DENIED: Other ___________________________________________________________

AR1055 (R 10/19/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3