Instructions For Amended Return Form - Maine Revenue Services - 2004

ADVERTISEMENT

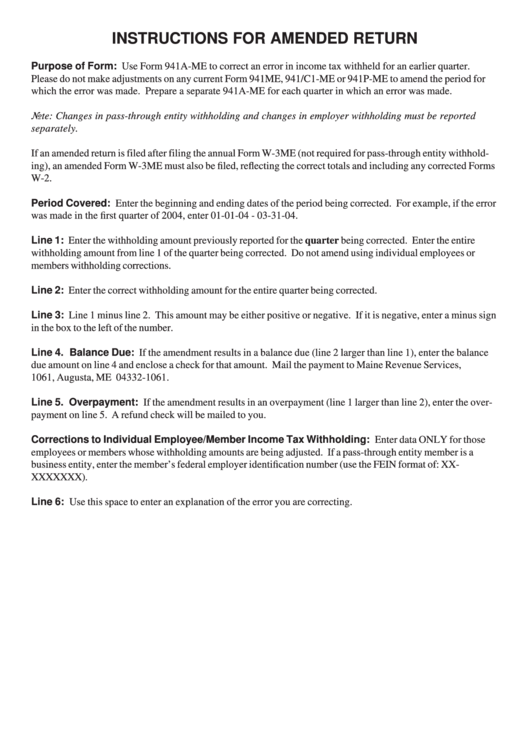

INSTRUCTIONS FOR AMENDED RETURN

Purpose of Form: Use Form 941A-ME to correct an error in income tax withheld for an earlier quarter.

Please do not make adjustments on any current Form 941ME, 941/C1-ME or 941P-ME to amend the period for

which the error was made. Prepare a separate 941A-ME for each quarter in which an error was made.

Note: Changes in pass-through entity withholding and changes in employer withholding must be reported

separately.

If an amended return is filed after filing the annual Form W-3ME (not required for pass-through entity withhold-

ing), an amended Form W-3ME must also be filed, reflecting the correct totals and including any corrected Forms

W-2.

Period Covered: Enter the beginning and ending dates of the period being corrected. For example, if the error

was made in the first quarter of 2004, enter 01-01-04 - 03-31-04.

Line 1: Enter the withholding amount previously reported for the quarter being corrected. Enter the entire

withholding amount from line 1 of the quarter being corrected. Do not amend using individual employees or

members withholding corrections.

Line 2: Enter the correct withholding amount for the entire quarter being corrected.

Line 3: Line 1 minus line 2. This amount may be either positive or negative. If it is negative, enter a minus sign

in the box to the left of the number.

Line 4. Balance Due: If the amendment results in a balance due (line 2 larger than line 1), enter the balance

due amount on line 4 and enclose a check for that amount. Mail the payment to Maine Revenue Services, P.O. Box

1061, Augusta, ME 04332-1061.

Line 5. Overpayment: If the amendment results in an overpayment (line 1 larger than line 2), enter the over-

payment on line 5. A refund check will be mailed to you.

Corrections to Individual Employee/Member Income Tax Withholding: Enter data ONLY for those

employees or members whose withholding amounts are being adjusted. If a pass-through entity member is a

business entity, enter the member’s federal employer identification number (use the FEIN format of: XX-

XXXXXXX).

Line 6: Use this space to enter an explanation of the error you are correcting.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1