Sch. Bcs-Pit - Business Investment And Jobs Expansion Credit Claims Against Personal Income Tax

ADVERTISEMENT

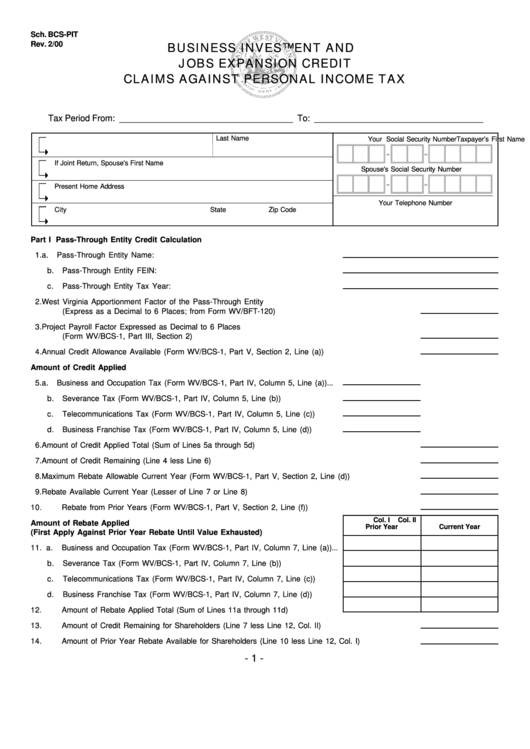

Sch. BCS-PIT

BUSINESS INVESTMENT AND

Rev. 2/00

JOBS EXPANSION CREDIT

CLAIMS AGAINST PERSONAL INCOME TAX

Tax Period From: ____________________________________ To: ___________________________________

Last Name

Taxpayer’s First Name

Your Social Security Number

If Joint Return, Spouse's First Name

Spouse's Social Security Number

Present Home Address

Your Telephone Number

City

State

Zip Code

Part I Pass-Through Entity Credit Calculation

1. a.

Pass-Through Entity Name: ......................................................................................

b.

Pass-Through Entity FEIN: ........................................................................................

c.

Pass-Through Entity Tax Year: .................................................................................

2.

West Virginia Apportionment Factor of the Pass-Through Entity

(Express as a Decimal to 6 Places; from Form WV/BFT-120) .....................................................................

3.

Project Payroll Factor Expressed as Decimal to 6 Places

(Form WV/BCS-1, Part III, Section 2) .............................................................................................................

4.

Annual Credit Allowance Available (Form WV/BCS-1, Part V, Section 2, Line (a)) ....................................

Amount of Credit Applied

5. a.

Business and Occupation Tax (Form WV/BCS-1, Part IV, Column 5, Line (a)) ...

b.

Severance Tax (Form WV/BCS-1, Part IV, Column 5, Line (b)) ............................

c.

Telecommunications Tax (Form WV/BCS-1, Part IV, Column 5, Line (c)) ............

d.

Business Franchise Tax (Form WV/BCS-1, Part IV, Column 5, Line (d)) .............

6.

Amount of Credit Applied Total (Sum of Lines 5a through 5d) .....................................................................

7.

Amount of Credit Remaining (Line 4 less Line 6) ..........................................................................................

8.

Maximum Rebate Allowable Current Year (Form WV/BCS-1, Part V, Section 2, Line (d)) .......................

9.

Rebate Available Current Year (Lesser of Line 7 or Line 8) .........................................................................

10.

Rebate from Prior Years (Form WV/BCS-1, Part V, Section 2, Line (f)) .....................................................

Col. I

Col. II

Amount of Rebate Applied

Prior Year

Current Year

(First Apply Against Prior Year Rebate Until Value Exhausted)

11. a.

Business and Occupation Tax (Form WV/BCS-1, Part IV, Column 7, Line (a)) ...

b.

Severance Tax (Form WV/BCS-1, Part IV, Column 7, Line (b)) ............................

c.

Telecommunications Tax (Form WV/BCS-1, Part IV, Column 7, Line (c)) ............

d.

Business Franchise Tax (Form WV/BCS-1, Part IV, Column 7, Line (d)) .............

12.

Amount of Rebate Applied Total (Sum of Lines 11a through 11d) ........................

13.

Amount of Credit Remaining for Shareholders (Line 7 less Line 12, Col. II) ...............................................

14.

Amount of Prior Year Rebate Available for Shareholders (Line 10 less Line 12, Col. I) ............................

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3