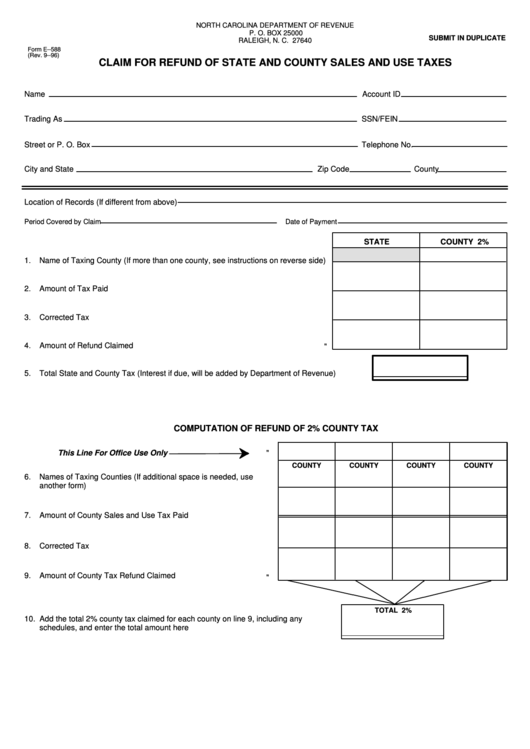

NORTH CAROLINA DEPARTMENT OF REVENUE

P. O. BOX 25000

SUBMIT IN DUPLICATE

RALEIGH, N. C. 27640

Form E--588

(Rev. 9--96)

CLAIM FOR REFUND OF STATE AND COUNTY SALES AND USE TAXES

Name

Account ID

Trading As

SSN/FEIN

Street or P. O. Box

Telephone No.

City and State

Zip Code

County

Location of Records (If different from above)

Period Covered by Claim

Date of Payment

STATE

COUNTY 2%

1.

Name of Taxing County (If more than one county, see instructions on reverse side)

2.

Amount of Tax Paid

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Corrected Tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Amount of Refund Claimed

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

"

5.

Total State and County Tax (Interest if due, will be added by Department of Revenue)

. . . . . . .

COMPUTATION OF REFUND OF 2% COUNTY TAX

This Line For Office Use Only

"

COUNTY

COUNTY

COUNTY

COUNTY

6.

Names of Taxing Counties (If additional space is needed, use

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

another form)

7.

Amount of County Sales and Use Tax Paid

. . . . . . . . . . . . . . . . . . . .

8.

Corrected Tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

Amount of County Tax Refund Claimed

. . . . . . . . . . . . . . . . . . . .

"

TOTAL 2%

10. Add the total 2% county tax claimed for each county on line 9, including any

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

schedules, and enter the total amount here

1

1