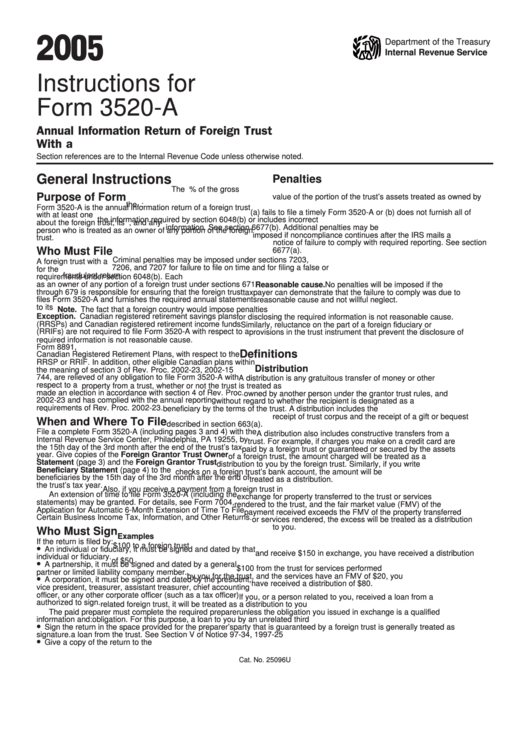

Instructions For Form 3520-A - Annual Information Return Of Foreign Trust With A U.s. Owner - 2005

ADVERTISEMENT

05

2 0

Department of the Treasury

Internal Revenue Service

Instructions for

Form 3520-A

Annual Information Return of Foreign Trust

With a U.S. Owner

Section references are to the Internal Revenue Code unless otherwise noted.

General Instructions

Penalties

The U.S. owner is subject to a penalty equal to 5% of the gross

Purpose of Form

value of the portion of the trust’s assets treated as owned by

the U.S. person at the close of that year if the foreign trust:

Form 3520-A is the annual information return of a foreign trust

(a) fails to file a timely Form 3520-A or (b) does not furnish all of

with at least one U.S. owner. The form provides information

the information required by section 6048(b) or includes incorrect

about the foreign trust, its U.S. beneficiaries, and any U.S.

information. See section 6677(b). Additional penalties may be

person who is treated as an owner of any portion of the foreign

imposed if noncompliance continues after the IRS mails a

trust.

notice of failure to comply with required reporting. See section

Who Must File

6677(a).

Criminal penalties may be imposed under sections 7203,

A foreign trust with a U.S. owner must file Form 3520-A in order

7206, and 7207 for failure to file on time and for filing a false or

for the U.S. owner to satisfy its annual information reporting

fraudulent return.

requirements under section 6048(b). Each U.S. person treated

as an owner of any portion of a foreign trust under sections 671

Reasonable cause. No penalties will be imposed if the

through 679 is responsible for ensuring that the foreign trust

taxpayer can demonstrate that the failure to comply was due to

files Form 3520-A and furnishes the required annual statements

reasonable cause and not willful neglect.

to its U.S. owners and U.S. beneficiaries.

Note. The fact that a foreign country would impose penalties

Exception. Canadian registered retirement savings plans

for disclosing the required information is not reasonable cause.

(RRSPs) and Canadian registered retirement income funds

Similarly, reluctance on the part of a foreign fiduciary or

(RRIFs) are not required to file Form 3520-A with respect to a

provisions in the trust instrument that prevent the disclosure of

U.S. citizen or resident alien interest holder who is eligible to file

required information is not reasonable cause.

Form 8891, U.S. Information Return for Beneficiaries of Certain

Definitions

Canadian Registered Retirement Plans, with respect to the

RRSP or RRIF. In addition, other eligible Canadian plans within

Distribution

the meaning of section 3 of Rev. Proc. 2002-23, 2002-15 I.R.B.

744, are relieved of any obligation to file Form 3520-A with

A distribution is any gratuitous transfer of money or other

respect to a U.S. citizen or resident alien beneficiary who has

property from a trust, whether or not the trust is treated as

made an election in accordance with section 4 of Rev. Proc.

owned by another person under the grantor trust rules, and

2002-23 and has complied with the annual reporting

without regard to whether the recipient is designated as a

requirements of Rev. Proc. 2002-23.

beneficiary by the terms of the trust. A distribution includes the

receipt of trust corpus and the receipt of a gift or bequest

When and Where To File

described in section 663(a).

File a complete Form 3520-A (including pages 3 and 4) with the

A distribution also includes constructive transfers from a

Internal Revenue Service Center, Philadelphia, PA 19255, by

trust. For example, if charges you make on a credit card are

the 15th day of the 3rd month after the end of the trust’s tax

paid by a foreign trust or guaranteed or secured by the assets

year. Give copies of the Foreign Grantor Trust Owner

of a foreign trust, the amount charged will be treated as a

Statement (page 3) and the Foreign Grantor Trust

distribution to you by the foreign trust. Similarly, if you write

Beneficiary Statement (page 4) to the U.S. owners and U.S.

checks on a foreign trust’s bank account, the amount will be

beneficiaries by the 15th day of the 3rd month after the end of

treated as a distribution.

the trust’s tax year.

Also, if you receive a payment from a foreign trust in

An extension of time to file Form 3520-A (including the

exchange for property transferred to the trust or services

statements) may be granted. For details, see Form 7004,

rendered to the trust, and the fair market value (FMV) of the

Application for Automatic 6-Month Extension of Time To File

payment received exceeds the FMV of the property transferred

Certain Business Income Tax, Information, and Other Returns.

or services rendered, the excess will be treated as a distribution

to you.

Who Must Sign

Examples

If the return is filed by:

•

1. If you sell stock with an FMV of $100 to a foreign trust

An individual or fiduciary, it must be signed and dated by that

and receive $150 in exchange, you have received a distribution

individual or fiduciary.

•

of $50.

A partnership, it must be signed and dated by a general

2. If you receive $100 from the trust for services performed

partner or limited liability company member.

•

by you for the trust, and the services have an FMV of $20, you

A corporation, it must be signed and dated by the president,

have received a distribution of $80.

vice president, treasurer, assistant treasurer, chief accounting

officer, or any other corporate officer (such as a tax officer)

If you, or a person related to you, received a loan from a

authorized to sign.

related foreign trust, it will be treated as a distribution to you

The paid preparer must complete the required preparer

unless the obligation you issued in exchange is a qualified

information and:

obligation. For this purpose, a loan to you by an unrelated third

•

Sign the return in the space provided for the preparer’s

party that is guaranteed by a foreign trust is generally treated as

signature.

a loan from the trust. See Section V of Notice 97-34, 1997-25

•

Give a copy of the return to the filer.

I.R.B. 22.

Cat. No. 25096U

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4