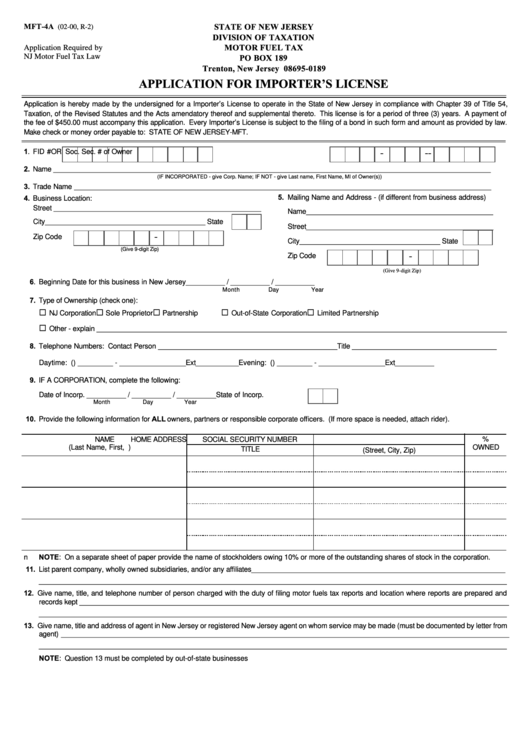

MFT-4A

STATE OF NEW JERSEY

(02-00, R-2)

DIVISION OF TAXATION

MOTOR FUEL TAX

Application Required by

PO BOX 189

NJ Motor Fuel Tax Law

Trenton, New Jersey 08695-0189

APPLICATION FOR IMPORTER’S LICENSE

Application is hereby made by the undersigned for a Importer’s License to operate in the State of New Jersey in compliance with Chapter 39 of Title 54,

Taxation, of the Revised Statutes and the Acts amendatory thereof and supplemental thereto. This license is for a period of three (3) years. A payment of

the fee of $450.00 must accompany this application. Every Importer’s License is subject to the filing of a bond in such form and amount as provided by law.

Make check or money order payable to: STATE OF NEW JERSEY-MFT.

1. FID #

-

OR Soc. Sec. # of Owner

-

-

2. Name ________________________________________________________________________________________________________________

(IF INCORPORATED - give Corp. Name; IF NOT - give Last name, First Name, MI of Owner(s))

3. Trade Name ___________________________________________________________________________________________________________

5. Mailing Name and Address - (if different from business address)

4. Business Location:

Street _____________________________________________________

Name________________________________________________

City_________________________________________ State

Street________________________________________________

-

Zip Code

City____________________________________ State

(Give 9-digit Zip)

-

Zip Code

(Give 9-digit Zip)

6. Beginning Date for this business in New Jersey

__________ / __________ / __________

Month

Day

Year

7. Type of Ownership (check one):

¨

¨

¨

¨

¨

NJ Corporation

Sole Proprietor

Partnership

Out-of-State Corporation

Limited Partnership

¨

Other - explain _________________________________________________________________________________________________________

8. Telephone Numbers: Contact Person ______________________________________________

Title _____________________________________

Daytime: (

) _________ - _________________Ext___________

Evening: (

) _________ - _________________Ext__________

9. IF A CORPORATION, complete the following:

Date of Incorp. __________ / __________ / __________

State of Incorp.

Month

Day

Year

10. Provide the following information for ALL owners, partners or responsible corporate officers. (If more space is needed, attach rider).

%

NAME

SOCIAL SECURITY NUMBER

HOME ADDRESS

(Last Name, First, M.I.)

OWNED

TITLE

(Street, City, Zip)

NOTE: On a separate sheet of paper provide the name of stockholders owing 10% or more of the outstanding shares of stock in the corporation.

n

11. List parent company, wholly owned subsidiaries, and/or any affiliates_________________________________________________________________

________________________________________________________________________________________________________________________

12. Give name, title, and telephone number of person charged with the duty of filing motor fuels tax reports and location where reports are prepared and

records kept ______________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

13. Give name, title and address of agent in New Jersey or registered New Jersey agent on whom service may be made (must be documented by letter from

agent) ___________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

NOTE: Question 13 must be completed by out-of-state businesses

1

1 2

2