Instructions For Preparing Quarterly Payroll Report

ADVERTISEMENT

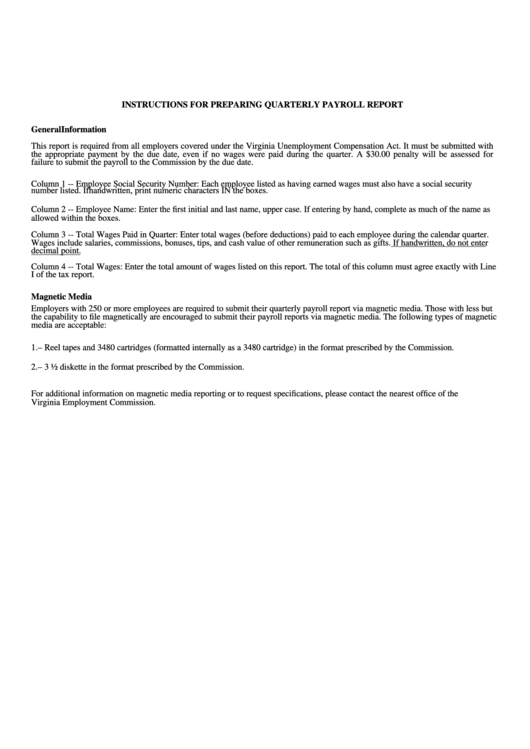

INSTRUCTIONS FOR PREPARING QUARTERLY PAYROLL REPORT

General Information

This report is required from all employers covered under the Virginia Unemployment Compensation Act. It must be submitted with

the appropriate payment by the due date, even if no wages were paid during the quarter. A $30.00 penalty will be assessed for

failure to submit the payroll to the Commission by the due date.

Column 1 -- Employee Social Security Number: Each employee listed as having earned wages must also have a social security

number listed. If handwritten, print numeric characters IN the boxes.

Column 2 -- Employee Name: Enter the first initial and last name, upper case. If entering by hand, complete as much of the name as

allowed within the boxes.

Column 3 -- Total Wages Paid in Quarter: Enter total wages (before deductions) paid to each employee during the calendar quarter.

Wages include salaries, commissions, bonuses, tips, and cash value of other remuneration such as gifts. If handwritten, do not enter

decimal point.

Column 4 -- Total Wages: Enter the total amount of wages listed on this report. The total of this column must agree exactly with Line

I of the tax report.

Magnetic Media

Employers with 250 or more employees are required to submit their quarterly payroll report via magnetic media. Those with less but

the capability to file magnetically are encouraged to submit their payroll reports via magnetic media. The following types of magnetic

media are acceptable:

1. – Reel tapes and 3480 cartridges (formatted internally as a 3480 cartridge) in the format prescribed by the Commission.

2. – 3 ½ diskette in the format prescribed by the Commission.

For additional information on magnetic media reporting or to request specifications, please contact the nearest office of the

Virginia Employment Commission.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1