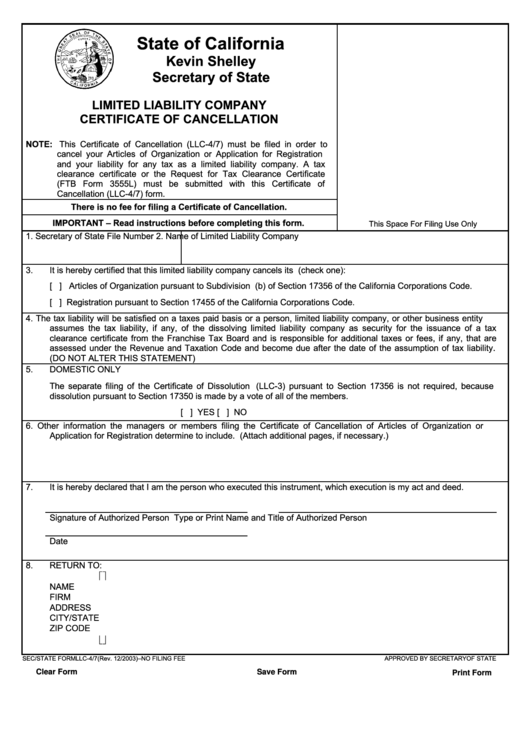

State of California

Kevin Shelley

Secretary of State

LIMITED LIABILITY COMPANY

CERTIFICATE OF CANCELLATION

NOTE: This Certificate of Cancellation (LLC-4/7) must be filed in order to

cancel your Articles of Organization or Application for Registration

and your liability for any tax as a limited liability company. A tax

clearance certificate or the Request for Tax Clearance Certificate

(FTB Form 3555L) must be submitted with this Certificate of

Cancellation (LLC-4/7) form.

There is no fee for filing a Certificate of Cancellation.

IMPORTANT – Read instructions before completing this form.

This Space For Filing Use Only

1.

Secretary of State File Number

2.

Name of Limited Liability Company

3.

It is hereby certified that this limited liability company cancels its (check one):

[ ]

Articles of Organization pursuant to Subdivision (b) of Section 17356 of the California Corporations Code.

[ ]

Registration pursuant to Section 17455 of the California Corporations Code.

4.

The tax liability will be satisfied on a taxes paid basis or a person, limited liability company, or other business entity

assumes the tax liability, if any, of the dissolving limited liability company as security for the issuance of a tax

clearance certificate from the Franchise Tax Board and is responsible for additional taxes or fees, if any, that are

assessed under the Revenue and Taxation Code and become due after the date of the assumption of tax liability.

(DO NOT ALTER THIS STATEMENT)

5.

DOMESTIC ONLY

The separate filing of the Certificate of Dissolution (LLC-3) pursuant to Section 17356 is not required, because

dissolution pursuant to Section 17350 is made by a vote of all of the members.

[ ]

YES

[ ]

NO

6.

Other information the managers or members filing the Certificate of Cancellation of Articles of Organization or

Application for Registration determine to include. (Attach additional pages, if necessary.)

7.

It is hereby declared that I am the person who executed this instrument, which execution is my act and deed.

Signature of Authorized Person

Type or Print Name and Title of Authorized Person

Date

8.

RETURN TO:

NAME

FIRM

ADDRESS

CITY/STATE

ZIP CODE

SEC/STATE FORM LLC-4/7 (Rev. 12/2003) – NO FILING FEE

APPROVED BY SECRETARY OF STATE

Clear Form

Save Form

Print Form

1

1