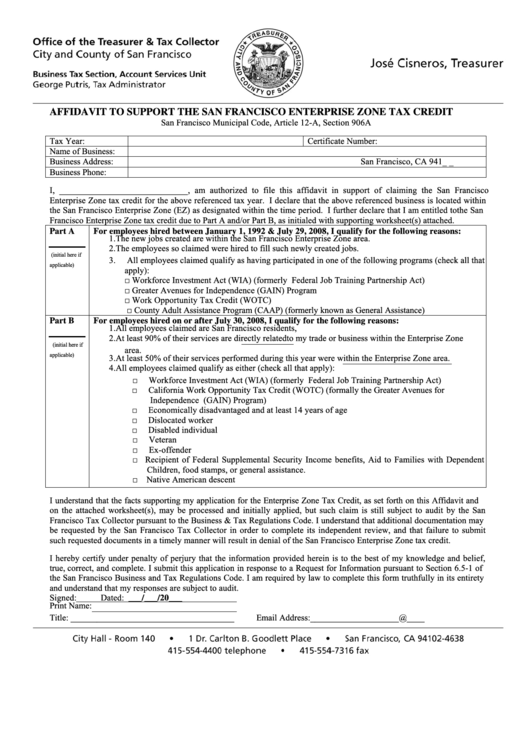

AFFIDAVIT TO SUPPORT THE SAN FRANCISCO ENTERPRISE ZONE TAX CREDIT

San Francisco Municipal Code, Article 12-A, Section 906A

Tax Year:

Certificate Number:

Name of Business:

Business Address:

San Francisco, CA 941_ _

Business Phone:

I, ___ __________________________, a m a uthorized t o f ile t his a ffidavit i n s upport of c laiming the San F rancisco

Enterprise Zone tax credit for the above referenced tax year. I declare that the above referenced business is located within

the San Francisco Enterprise Zone (EZ) as designated within the time period. I further declare that I am entitled to the San

Francisco Enterprise Zone tax credit due to Part A and/or Part B, as initialed with supporting worksheet(s) attached.

Part A

For employees hired between January 1, 1992 & July 29, 2008, I qualify for the following reasons:

1.

The new jobs created are within the San Francisco Enterprise Zone area.

2.

The employees so claimed were hired to fill such newly created jobs.

(initial here if

3.

All employees claimed qualify as having participated in one of the following programs (check all that

applicable)

apply):

□ Workforce Investment Act (WIA) (formerly Federal Job Training Partnership Act)

□ Greater Avenues for Independence (GAIN) Program

□ Work Opportunity Tax Credit (WOTC)

□ County Adult Assistance Program (CAAP) (formerly known as General Assistance)

Part B

For employees hired on or after July 30, 2008, I qualify for the following reasons:

1.

All employees claimed are San Francisco residents,

2.

At least 90% of their services are directly related to my trade or business within the Enterprise Zone

(initial here if

area.

applicable)

3.

At least 50% of their services performed during this year were within the Enterprise Zone area.

4.

All employees claimed qualify as either (check all that apply):

□

Workforce Investment Act (WIA) (formerly Federal Job Training Partnership Act)

□

California Work Opportunity Tax Credit (WOTC) (formally the Greater Avenues for

Independence (GAIN) Program)

□

Economically disadvantaged and at least 14 years of age

□

Dislocated worker

□

Disabled individual

□

Veteran

□

Ex-offender

□

Recipient o f F ederal S upplemental S ecurity I ncome b enefits, Aid t o F amilies with D ependent

Children, food stamps, or general assistance.

□ Native American descent

I understand that the facts supporting my application for the Enterprise Zone Tax Credit, as set forth on this Affidavit and

on the attached worksheet(s), may be processed and initially applied, but such claim is still subject to audit by the San

Francisco Tax Collector pursuant to the Business & Tax Regulations Code. I understand that additional documentation may

be r equested b y t he S an F rancisco T ax C ollector i n o rder to co mplete i ts i ndependent r eview, an d t hat failure to s ubmit

such requested documents in a timely manner will result in denial of the San Francisco Enterprise Zone tax credit.

I hereby certify under penalty of perjury that the information provided herein is to the b est of my knowledge and belief,

true, correct, and complete. I submit this application in response to a Request for Information pursuant to Section 6.5-1 of

the San Francisco Business and Tax Regulations Code. I am required by law to complete this form truthfully in its entirety

and understand that my responses are subject to audit.

Signed:

Dated:

___/___/20___

Print Name:

Title: _____________________________________

Email Address:____________________@____

1

1