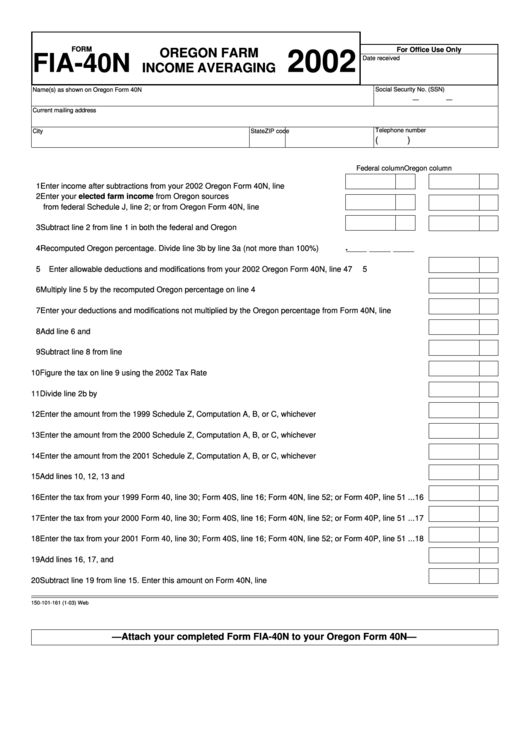

Form Fia-40n - Oregon Farm Income Averaging - 2002

ADVERTISEMENT

FORM

For Office Use Only

OREGON FARM

2002

FIA-40N

Date received

INCOME AVERAGING

Social Security No. (SSN)

Name(s) as shown on Oregon Form 40N

—

—

Current mailing address

Telephone number

City

State

ZIP code

(

)

Federal column

Oregon column

1 Enter income after subtractions from your 2002 Oregon Form 40N, line 39 ............... 1a

1b

2 Enter your elected farm income from Oregon sources

from federal Schedule J, line 2; or from Oregon Form 40N, line 18b .......................... 2a

2b

3 Subtract line 2 from line 1 in both the federal and Oregon columns ........................... 3a

3b

.

4 Recomputed Oregon percentage. Divide line 3b by line 3a (not more than 100%) .... 4

5 Enter allowable deductions and modifications from your 2002 Oregon Form 40N, line 47 ............................... 5

6 Multiply line 5 by the recomputed Oregon percentage on line 4 ........................................................................ 6

7 Enter your deductions and modifications not multiplied by the Oregon percentage from Form 40N, line 49 .... 7

8 Add line 6 and 7 ................................................................................................................................................. 8

9 Subtract line 8 from line 3b ................................................................................................................................. 9

10 Figure the tax on line 9 using the 2002 Tax Rate Charts ................................................................................... 10

11 Divide line 2b by 3.0 ........................................................................................................................................... 11

12 Enter the amount from the 1999 Schedule Z, Computation A, B, or C, whichever applies ................................ 12

13 Enter the amount from the 2000 Schedule Z, Computation A, B, or C, whichever applies ................................ 13

14 Enter the amount from the 2001 Schedule Z, Computation A, B, or C, whichever applies ................................ 14

15 Add lines 10, 12, 13 and 14 ................................................................................................................................ 15

16 Enter the tax from your 1999 Form 40, line 30; Form 40S, line 16; Form 40N, line 52; or Form 40P, line 51 ... 16

17 Enter the tax from your 2000 Form 40, line 30; Form 40S, line 16; Form 40N, line 52; or Form 40P, line 51 ... 17

18 Enter the tax from your 2001 Form 40, line 30; Form 40S, line 16; Form 40N, line 52; or Form 40P, line 51 ... 18

19 Add lines 16, 17, and 18 ..................................................................................................................................... 19

20 Subtract line 19 from line 15. Enter this amount on Form 40N, line 53 .............................................................. 20

150-101-161 (1-03) Web

—Attach your completed Form FIA-40N to your Oregon Form 40N—

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1