Form Dr-601c - Intangible Tax Return For Corporation, Partnership And Fiduciary Filers - 1999

ADVERTISEMENT

DR-601CN

R. 01/99

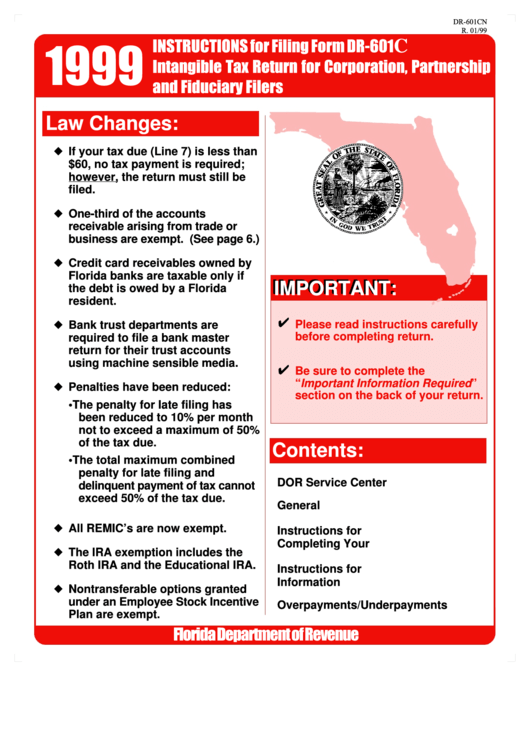

INSTRUCTIONS for Filing Form DR-601

C

1999

Intangible Tax Return for Corporation, Partnership

and Fiduciary Filers

Law Changes:

If your tax due (Line 7) is less than

$60, no tax payment is required;

however, the return must still be

filed.

One-third of the accounts

receivable arising from trade or

business are exempt. (See page 6.)

Credit card receivables owned by

Florida banks are taxable only if

IMPORTANT:

IMPORTANT:

the debt is owed by a Florida

resident.

Please read instructions carefully

Bank trust departments are

before completing return.

required to file a bank master

return for their trust accounts

using machine sensible media.

Be sure to complete the

“ Important Information Required ”

Penalties have been reduced:

section on the back of your return.

• The penalty for late filing has

been reduced to 10% per month

not to exceed a maximum of 50%

of the tax due.

Contents:

• The total maximum combined

penalty for late filing and

DOR Service Center Listing ............. 2

delinquent payment of tax cannot

exceed 50% of the tax due.

General Information .......................... 5

All REMIC’s are now exempt.

Instructions for

Completing Your Return ................... 5

The IRA exemption includes the

Roth IRA and the Educational IRA.

Instructions for

Information Notices .......................... 9

Nontransferable options granted

under an Employee Stock Incentive

Overpayments/Underpayments ......11

Plan are exempt.

Florida Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12