Instructions For Form Wr

ADVERTISEMENT

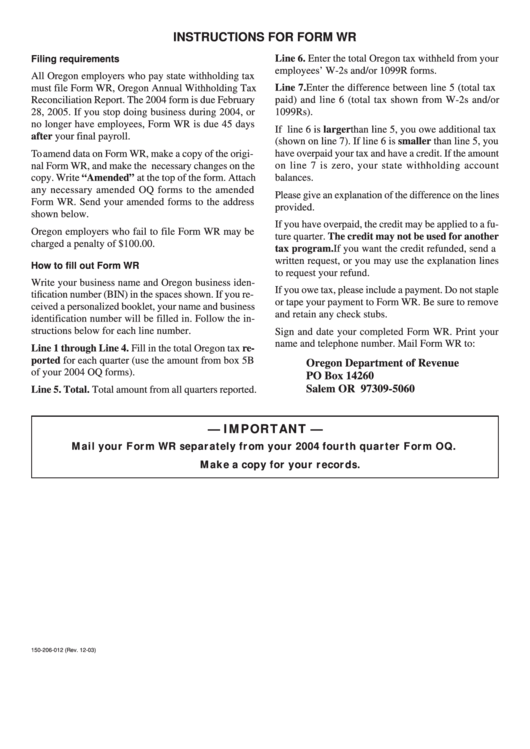

INSTRUCTIONS FOR FORM WR

Line 6. Enter the total Oregon tax withheld from your

Filing requirements

employees’ W-2s and/or 1099R forms.

All Oregon employers who pay state withholding tax

must file Form WR, Oregon Annual Withholding Tax

Line 7. Enter the difference between line 5 (total tax

paid) and line 6 (total tax shown from W-2s and/or

Reconciliation Report. The 2004 form is due February

1099Rs).

28, 2005. If you stop doing business during 2004, or

no longer have employees, Form WR is due 45 days

If line 6 is larger than line 5, you owe additional tax

after your final payroll.

(shown on line 7). If line 6 is smaller than line 5, you

have overpaid your tax and have a credit. If the amount

To amend data on Form WR, make a copy of the origi-

on line 7 is zero, your state withholding account

nal Form WR, and make the necessary changes on the

balances.

copy. Write “Amended” at the top of the form. Attach

any necessary amended OQ forms to the amended

Please give an explanation of the difference on the lines

Form WR. Send your amended forms to the address

provided.

shown below.

If you have overpaid, the credit may be applied to a fu-

Oregon employers who fail to file Form WR may be

ture quarter. The credit may not be used for another

charged a penalty of $100.00.

tax program. If you want the credit refunded, send a

written request, or you may use the explanation lines

How to fill out Form WR

to request your refund.

Write your business name and Oregon business iden-

If you owe tax, please include a payment. Do not staple

tification number (BIN) in the spaces shown. If you re-

or tape your payment to Form WR. Be sure to remove

ceived a personalized booklet, your name and business

and retain any check stubs.

identification number will be filled in. Follow the in-

structions below for each line number.

Sign and date your completed Form WR. Print your

name and telephone number. Mail Form WR to:

Line 1 through Line 4. Fill in the total Oregon tax re-

ported for each quarter (use the amount from box 5B

Oregon Department of Revenue

of your 2004 OQ forms).

PO Box 14260

Salem OR 97309-5060

Line 5. Total. Total amount from all quarters reported.

— IMPORTANT —

Mail your Form WR separately from your 2004 fourth quarter Form OQ.

Make a copy for your records.

150-206-012 (Rev. 12-03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1