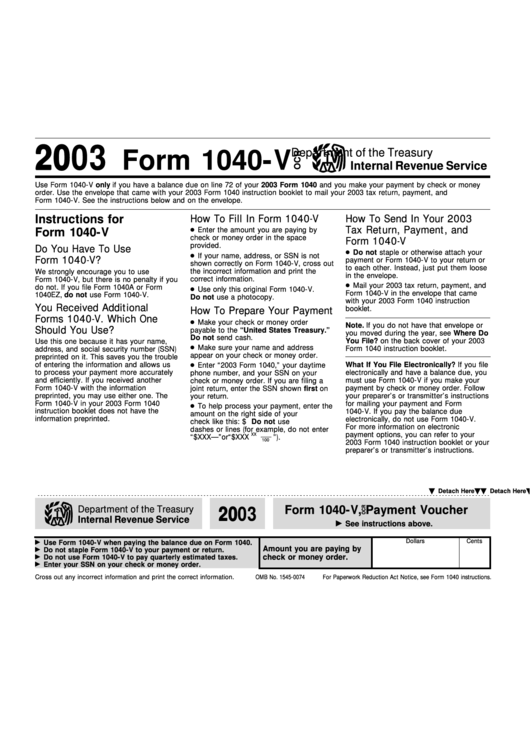

Form 1040-V - Payment Voucher - 2003

ADVERTISEMENT

2003

Department of the Treasury

Form 1040-V

Internal Revenue Service

Use Form 1040-V only if you have a balance due on line 72 of your 2003 Form 1040 and you make your payment by check or money

order. Use the envelope that came with your 2003 Form 1040 instruction booklet to mail your 2003 tax return, payment, and

Form 1040-V. See the instructions below and on the envelope.

Instructions for

How To Fill In Form 1040-V

How To Send In Your 2003

● Enter the amount you are paying by

Tax Return, Payment, and

Form 1040-V

check or money order in the space

Form 1040-V

provided.

Do You Have To Use

● Do not staple or otherwise attach your

● If your name, address, or SSN is not

Form 1040-V?

payment or Form 1040-V to your return or

shown correctly on Form 1040-V, cross out

to each other. Instead, just put them loose

the incorrect information and print the

We strongly encourage you to use

in the envelope.

correct information.

Form 1040-V, but there is no penalty if you

● Mail your 2003 tax return, payment, and

do not. If you file Form 1040A or Form

● Use only this original Form 1040-V.

Form 1040-V in the envelope that came

1040EZ, do not use Form 1040-V.

Do not use a photocopy.

with your 2003 Form 1040 instruction

You Received Additional

booklet.

How To Prepare Your Payment

Forms 1040-V. Which One

● Make your check or money order

Note. If you do not have that envelope or

Should You Use?

payable to the “United States Treasury.”

you moved during the year, see Where Do

Do not send cash.

You File? on the back cover of your 2003

Use this one because it has your name,

● Make sure your name and address

Form 1040 instruction booklet.

address, and social security number (SSN)

appear on your check or money order.

preprinted on it. This saves you the trouble

● Enter “2003 Form 1040,” your daytime

of entering the information and allows us

What If You File Electronically? If you file

to process your payment more accurately

electronically and have a balance due, you

phone number, and your SSN on your

and efficiently. If you received another

must use Form 1040-V if you make your

check or money order. If you are filing a

Form 1040-V with the information

joint return, enter the SSN shown first on

payment by check or money order. Follow

preprinted, you may use either one. The

your return.

your preparer’s or transmitter’s instructions

Form 1040-V in your 2003 Form 1040

for mailing your payment and Form

● To help process your payment, enter the

instruction booklet does not have the

1040-V. If you pay the balance due

amount on the right side of your

information preprinted.

electronically, do not use Form 1040-V.

check like this: $ XXX.XX. Do not use

For more information on electronic

dashes or lines (for example, do not enter

payment options, you can refer to your

XX

“$ XXX—” or “$ XXX

”).

100

2003 Form 1040 instruction booklet or your

preparer’s or transmitter’s instructions.

Detach Here

Cat. No. 32205N

Detach Here

Form 1040-V , Payment Voucher

Department of the Treasury

2003

Internal Revenue Service

See instructions above.

Dollars

Cents

Use Form 1040-V when paying the balance due on Form 1040.

Amount you are paying by

Do not staple Form 1040-V to your payment or return.

Do not use Form 1040-V to pay quarterly estimated taxes.

check or money order.

Enter your SSN on your check or money order.

Cross out any incorrect information and print the correct information.

OMB No. 1545-0074

For Paperwork Reduction Act Notice, see Form 1040 instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1