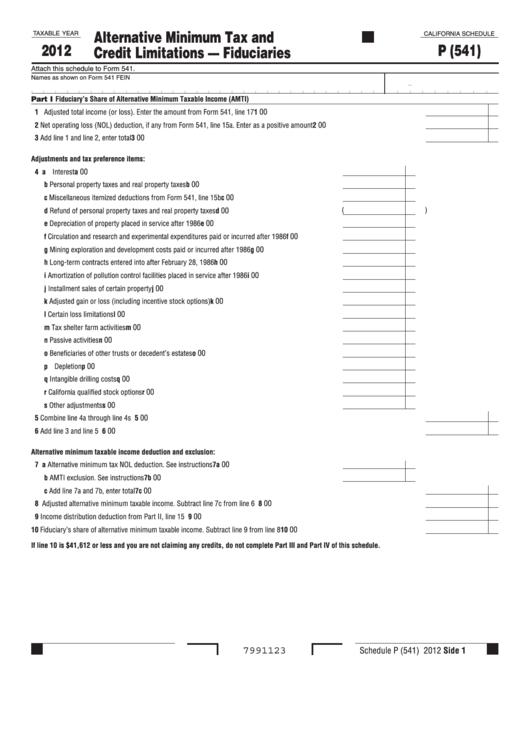

California Schedule P (541) - Attach To Form 541 - Alternative Minimum Tax And Credit Limitations - Fiduciaries - 2012

ADVERTISEMENT

Alternative Minimum Tax and

TAXABLE YEAR

CALIFORNIA SCHEDULE

2012

P (541)

Credit Limitations — Fiduciaries

Attach this schedule to Form 541.

Names as shown on Form 541

FEIN

-

Part I Fiduciary’s Share of Alternative Minimum Taxable Income (AMTI)

00

1 Adjusted total income (or loss). Enter the amount from Form 541, line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 Net operating loss (NOL) deduction, if any from Form 541, line 15a. Enter as a positive amount . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Add line 1 and line 2, enter total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Adjustments and tax preference items:

00

4 a Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . a

00

b Personal property taxes and real property taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . b

00

c Miscellaneous itemized deductions from Form 541, line 15b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . c

(

)

00

d Refund of personal property taxes and real property taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . d

00

e Depreciation of property placed in service after 1986 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . e

f

Circulation and research and experimental expenditures paid or incurred after 1986 . . . . . . . . . . . f

00

00

g Mining exploration and development costs paid or incurred after 1986. . . . . . . . . . . . . . . . . . . . . . g

00

h Long-term contracts entered into after February 28, 1986. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . h

00

i

Amortization of pollution control facilities placed in service after 1986 . . . . . . . . . . . . . . . . . . . . . . i

00

j

Installment sales of certain property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . j

00

k Adjusted gain or loss (including incentive stock options) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . k

00

l

Certain loss limitations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . l

00

m Tax shelter farm activities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . m

n Passive activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . n

00

00

o Beneficiaries of other trusts or decedent’s estates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . o

00

p Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . p

00

q Intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . q

00

r

California qualified stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . r

00

s Other adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . s

00

5 Combine line 4a through line 4s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Add line 3 and line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

Alternative minimum taxable income deduction and exclusion:

00

7 a Alternative minimum tax NOL deduction. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7a

00

b AMTI exclusion. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

c Add line 7a and 7b, enter total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7c

00

8 Adjusted alternative minimum taxable income. Subtract line 7c from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

00

9 Income distribution deduction from Part II, line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

00

10 Fiduciary’s share of alternative minimum taxable income. Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

If line 10 is $41,612 or less and you are not claiming any credits, do not complete Part III and Part IV of this schedule.

Schedule P (541) 2012 Side 1

7991123

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3