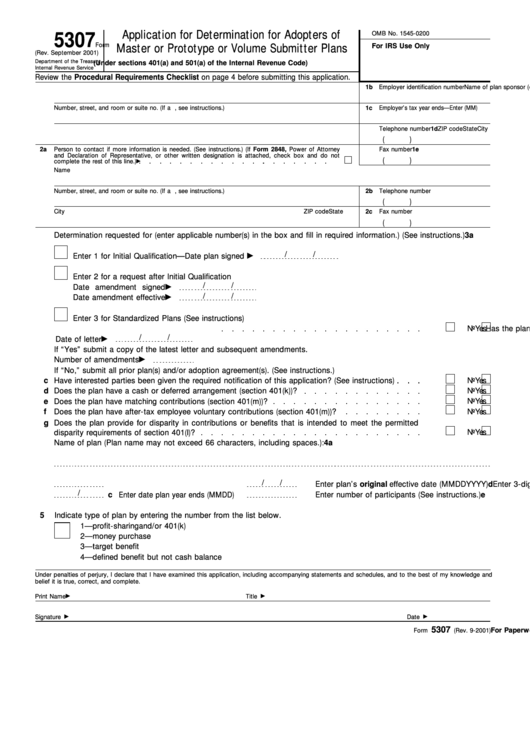

Application for Determination for Adopters of

5307

OMB No. 1545-0200

Form

For IRS Use Only

Master or Prototype or Volume Submitter Plans

(Rev. September 2001)

Department of the Treasury

(Under sections 401(a) and 501(a) of the Internal Revenue Code)

Internal Revenue Service

Review the Procedural Requirements Checklist on page 4 before submitting this application.

1a

Name of plan sponsor (employer if single-employer plan)

1b Employer identification number

Number, street, and room or suite no. (If a P.O. box, see instructions.)

1c

Employer’s tax year ends—Enter (MM)

City

State

ZIP code

1d

Telephone number

(

)

2a

Person to contact if more information is needed. (See instructions.) (If Form 2848, Power of Attorney

1e

Fax number

and Declaration of Representative, or other written designation is attached, check box and do not

(

)

complete the rest of this line.)

Name

Number, street, and room or suite no. (If a P.O. box, see instructions.)

2b

Telephone number

(

)

City

State

ZIP code

2c

Fax number

(

)

3a

Determination requested for (enter applicable number(s) in the box and fill in required information.) (See instructions.)

/

/

Enter 1 for Initial Qualification—Date plan signed

Enter 2 for a request after Initial Qualification

/

/

Date amendment signed

/

/

Date amendment effective

Enter 3 for Standardized Plans (See instructions)

b

Has the plan received a determination letter?

Yes

No

/

/

Date of letter

If “Yes” submit a copy of the latest letter and subsequent amendments.

Number of amendments

If “No,” submit all prior plan(s) and/or adoption agreement(s). (See instructions.)

c

Have interested parties been given the required notification of this application? (See instructions)

Yes

No

d

Does the plan have a cash or deferred arrangement (section 401(k))?

Yes

No

e

Does the plan have matching contributions (section 401(m))?

Yes

No

f

Does the plan have after-tax employee voluntary contributions (section 401(m))?

Yes

No

g

Does the plan provide for disparity in contributions or benefits that is intended to meet the permitted

disparity requirements of section 401(l)?

Yes

No

4a

Name of plan (Plan name may not exceed 66 characters, including spaces.):

/

/

b

Enter 3-digit plan number

d

Enter plan’s original effective date (MMDDYYYY)

/

c

Enter date plan year ends (MMDD)

e

Enter number of participants (See instructions.)

5

Indicate type of plan by entering the number from the list below.

1—profit-sharing and/or 401(k)

2—money purchase

3—target benefit

4—defined benefit but not cash balance

Under penalties of perjury, I declare that I have examined this application, including accompanying statements and schedules, and to the best of my knowledge and

belief it is true, correct, and complete.

Print Name

Title

Signature

Date

5307

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 11832Y

Form

(Rev. 9-2001)

1

1 2

2 3

3 4

4