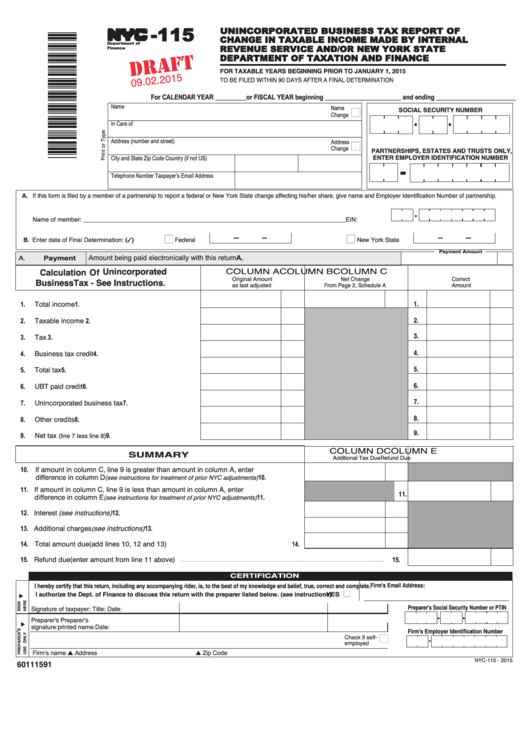

Form Nyc-115 Draft - Unincorporated Business Tax Report Of Change In Taxable Income Made By Internal Revenue Service And/or New York State Department Of Taxation And Finance - 2015

ADVERTISEMENT

-115

UN IN CORP O RAT ED BU SI NE S S TAX R EP ORT

OF

CHANGE IN TAXABLE INCOME MADE BY INTERNAL

TM

REVENUE SERVICE AND/OR NEW YORK STATE

Department of

Finance

DEPARTMENT OF TAXATION AND FINANCE

FOR TAXABLE YEARS BEGINNING PRIOR TO JANUARY 1, 2015

TO BE FILED WITHIN 90 DAYS AFTER A FINAL DETERMINATION

For CALENDAR YEAR _________or FISCAL YEAR beginning ______________________ and ending _______________________

Name

Name

n

SOCIAL SECURITY NUMBER

Change

In Care of

Address (number and street)

Address

n

Change

PARTNERSHIPS, ESTATES AND TRUSTS ONLY,

ENTER EMPLOYER IDENTIFICATION NUMBER

City and State

Zip Code

Country (if not US)

Telephone Number

Taxpayer’s Email Address

A. If this form is filed by a member of a partnership to report a federal or New York State change affecting his/her share, give name and Employer Identification Number of partnership.

Name of member: _____________________________________________________________________________

EIN:

-

-

-

-

n

n

B. Enter date of Final Determination: (3)

Federal

New York State

Payment Amount

Payment

A.

A

Amount being paid electronically with this return

Calculation Of Unincorporated

COLUMN A

COLUMN B

COLUMN C

Business Tax - See Instructions.

Original Amount

Net Change

Correct

as last adjusted

From Page 2, Schedule A

Amount

1.

1.

Total income

1.

................................................................................

2.

2.

Taxable income

2.

.........................................................................

3.

Tax

3.

3.

....................................................................................................

4.

4.

Business tax credit

4.

...................................................................

5.

5.

Total tax

5.

.........................................................................................

6.

6.

UBT paid credit

6.

..........................................................................

7.

Unincorporated business tax

7.

7.

...............................................

8.

8.

Other credits

8.

................................................................................

9.

9.

Net tax

9.

(line 7 less line 8)

..........................................................

COLUMN D

COLUMN E

SUMMARY

Additional Tax Due

Refund Due

10. If amount in column C, line 9 is greater than amount in column A, enter

difference in column D

10.

(see instructions for treatment of prior NYC adjustments)

....................

11. If amount in column C, line 9 is less than amount in column A, enter

11.

difference in column E

11.

(see instructions for treatment of prior NYC adjustments)

.......................

12. Interest (see instructions)

12.

........................................................................................................................

see instructions)

13. Additional charges

13.

(

.................................................................................................

14. Total amount due (add lines 10, 12 and 13)

14.

...................................................................................

15. Refund due (enter amount from line 11 above)

15.

C E R T I F I C AT I O N

Firm's Email Address:

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions)....YES

n

_________________________________________

Preparer's Social Security Number or PTIN

Signature of taxpayer:

Title:

Date:

Preparer's

Preparer’s

signature:

printed name:

Date:

Firm's Employer Identification Number

n

Check if self-

employed

Firm's name

s Address

s Zip Code

60111591

NYC-115 - 2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4