Tax Credit For Dependent Health Benefits Paid Worksheet For Tax Year 2011

ADVERTISEMENT

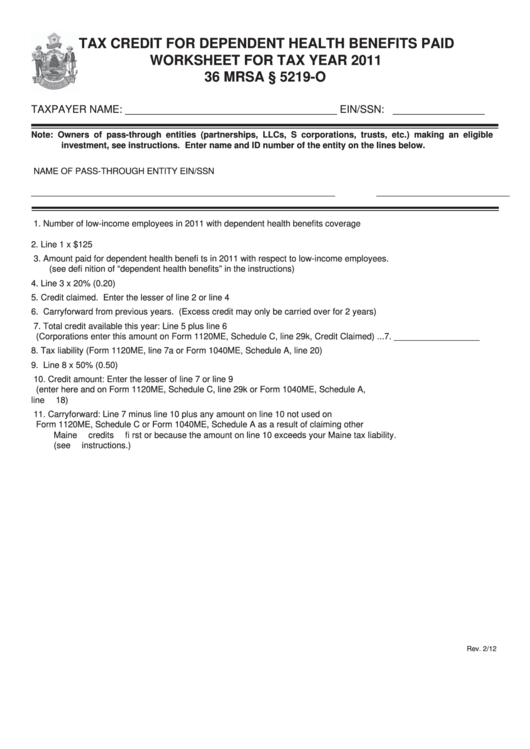

TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID

WORKSHEET FOR TAX YEAR 2011

36 MRSA § 5219-O

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Enter name and ID number of the entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1. Number of low-income employees in 2011 with dependent health benefi ts coverage ...........1. __________________

2. Line 1 x $125 ..........................................................................................................................2. __________________

3. Amount paid for dependent health benefi ts in 2011 with respect to low-income employees.

(see defi nition of “dependent health benefi ts” in the instructions)...........................................3. __________________

4. Line 3 x 20% (0.20) ................................................................................................................4. __________________

5. Credit claimed. Enter the lesser of line 2 or line 4 .................................................................5. __________________

6. Carryforward from previous years. (Excess credit may only be carried over for 2 years) .....6. __________________

7. Total credit available this year: Line 5 plus line 6

(Corporations enter this amount on Form 1120ME, Schedule C, line 29k, Credit Claimed) ...7. __________________

8. Tax liability (Form 1120ME, line 7a or Form 1040ME, Schedule A, line 20) ...........................8. __________________

9. Line 8 x 50% (0.50) ................................................................................................................9. __________________

10. Credit amount: Enter the lesser of line 7 or line 9

(enter here and on Form 1120ME, Schedule C, line 29k or Form 1040ME, Schedule A,

line 18) ..................................................................................................................................10. __________________

11. Carryforward: Line 7 minus line 10 plus any amount on line 10 not used on

Form 1120ME, Schedule C or Form 1040ME, Schedule A as a result of claiming other

Maine credits fi rst or because the amount on line 10 exceeds your Maine tax liability.

(see instructions.) .................................................................................................................. 11. __________________

Rev. 2/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1