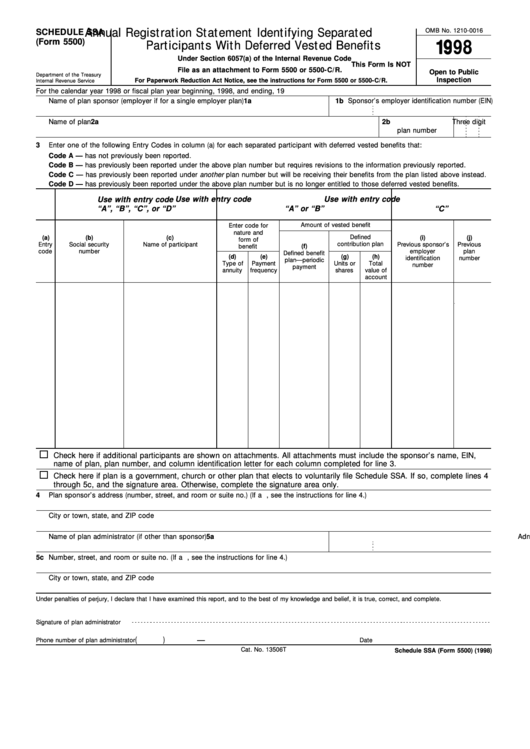

Annual Registration Statement Identifying Separated

OMB No. 1210-0016

SCHEDULE SSA

(Form 5500)

1998

Participants With Deferred Vested Benefits

Under Section 6057(a) of the Internal Revenue Code

This Form Is NOT

File as an attachment to Form 5500 or 5500-C/R.

Open to Public

Department of the Treasury

Inspection

For Paperwork Reduction Act Notice, see the instructions for Form 5500 or 5500-C/R.

Internal Revenue Service

For the calendar year 1998 or fiscal plan year beginning

, 1998, and ending

, 19

1a

Name of plan sponsor (employer if for a single employer plan)

1b

Sponsor’s employer identification number (EIN)

2a

Name of plan

2b

Three digit

plan number

3

Enter one of the following Entry Codes in column (a) for each separated participant with deferred vested benefits that:

Code A — has not previously been reported.

Code B — has previously been reported under the above plan number but requires revisions to the information previously reported.

Code C — has previously been reported under another plan number but will be receiving their benefits from the plan listed above instead.

Code D — has previously been reported under the above plan number but is no longer entitled to those deferred vested benefits.

Use with entry code

Use with entry code

Use with entry code

“A”, “B”, “C”, or “D”

“A” or “B”

“C”

Amount of vested benefit

Enter code for

nature and

Defined

(a)

(b)

(c)

(i)

(j)

form of

contribution plan

Entry

Social security

Name of participant

Previous sponsor’s

Previous

benefit

(f)

code

number

employer

plan

Defined benefit

(d)

(e)

(g)

(h)

identification

number

plan—periodic

Type of

Payment

Units or

Total

number

payment

annuity

frequency

shares

value of

account

Check here if additional participants are shown on attachments. All attachments must include the sponsor’s name, EIN,

name of plan, plan number, and column identification letter for each column completed for line 3.

Check here if plan is a government, church or other plan that elects to voluntarily file Schedule SSA. If so, complete lines 4

through 5c, and the signature area. Otherwise, complete the signature area only.

4

Plan sponsor’s address (number, street, and room or suite no.) (If a P.O. box, see the instructions for line 4.)

City or town, state, and ZIP code

5a

Name of plan administrator (if other than sponsor)

5b

Administrator’s EIN

5c

Number, street, and room or suite no. (If a P.O. box, see the instructions for line 4.)

City or town, state, and ZIP code

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is true, correct, and complete.

Signature of plan administrator

(

)

—

Phone number of plan administrator

Date

Cat. No. 13506T

Schedule SSA (Form 5500) (1998)

1

1