Quality Child-Care Investment Tax Credit Worksheet For Tax Year 2015

ADVERTISEMENT

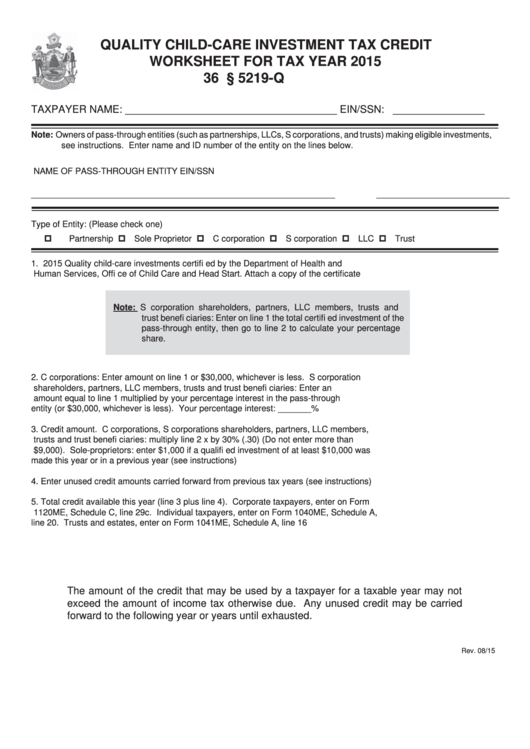

QUALITY CHILD-CARE INVESTMENT TAX CREDIT

WORKSHEET FOR TAX YEAR 2015

36 M.R.S. § 5219-Q

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (such as partnerships, LLCs, S corporations, and trusts) making eligible investments,

see instructions. Enter name and ID number of the entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

Type of Entity: (Please check one)

Partnership

Sole Proprietor

C corporation

S corporation

LLC

Trust

1.

2015 Quality child-care investments certifi ed by the Department of Health and

Human Services, Offi ce of Child Care and Head Start. Attach a copy of the certifi cate ......... 1. __________________

Note: S corporation shareholders, partners, LLC members, trusts and

trust benefi ciaries: Enter on line 1 the total certifi ed investment of the

pass-through entity, then go to line 2 to calculate your percentage

share.

2.

C corporations: Enter amount on line 1 or $30,000, whichever is less. S corporation

shareholders, partners, LLC members, trusts and trust benefi ciaries: Enter an

amount equal to line 1 multiplied by your percentage interest in the pass-through

entity (or $30,000, whichever is less). Your percentage interest: _______% ......................... 2. __________________

3.

Credit amount. C corporations, S corporations shareholders, partners, LLC members,

trusts and trust benefi ciaries: multiply line 2 x by 30% (.30) (Do not enter more than

$9,000). Sole-proprietors: enter $1,000 if a qualifi ed investment of at least $10,000 was

made this year or in a previous year (see instructions) ........................................................... 3. __________________

4.

Enter unused credit amounts carried forward from previous tax years (see instructions)....... 4. __________________

5.

Total credit available this year (line 3 plus line 4). Corporate taxpayers, enter on Form

1120ME, Schedule C, line 29c. Individual taxpayers, enter on Form 1040ME, Schedule A,

line 20. Trusts and estates, enter on Form 1041ME, Schedule A, line 16 ............................. 5. __________________

The amount of the credit that may be used by a taxpayer for a taxable year may not

exceed the amount of income tax otherwise due. Any unused credit may be carried

forward to the following year or years until exhausted.

Rev. 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2