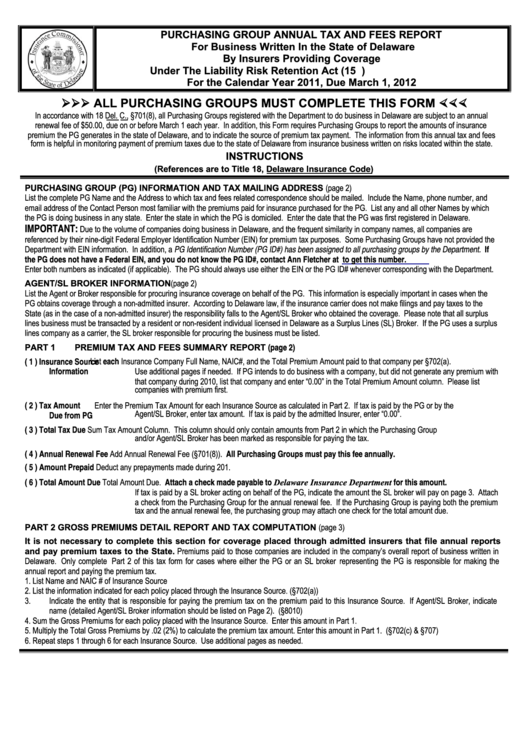

PURCHASING GROUP ANNUAL TAX AND FEES REPORT

For Business Written In the State of Delaware

By Insurers Providing Coverage

Under The Liability Risk Retention Act (15 U.S.C. 3901 Et Seq.)

For the Calendar Year 2011, Due March 1, 2012

ALL PURCHASING GROUPS MUST COMPLETE THIS FORM

In accordance with 18 Del. C., §701(8), all Purchasing Groups registered with the Department to do business in Delaware are subject to an annual

renewal fee of $50.00, due on or before March 1 each year. In addition, this Form requires Purchasing Groups to report the amounts of insurance

premium the PG generates in the state of Delaware, and to indicate the source of premium tax payment. The information from this annual tax and fees

form is helpful in monitoring payment of premium taxes due to the state of Delaware from insurance business written on risks located within the state.

INSTRUCTIONS

(References are to Title 18, Delaware Insurance Code)

PURCHASING GROUP (PG) INFORMATION AND TAX MAILING ADDRESS (page 2)

List the complete PG Name and the Address to which tax and fees related correspondence should be mailed. Include the Name, phone number, and

email address of the Contact Person most familiar with the premiums paid for insurance purchased for the PG. List any and all other Names by which

the PG is doing business in any state. Enter the state in which the PG is domiciled. Enter the date that the PG was first registered in Delaware.

IMPORTANT:

Due to the volume of companies doing business in Delaware, and the frequent similarity in company names, all companies are

referenced by their nine-digit Federal Employer Identification Number (EIN) for premium tax purposes. Some Purchasing Groups have not provided the

Department with EIN information. In addition, a PG Identification Number (PG ID#) has been assigned to all purchasing groups by the Department. If

the PG does not have a Federal EIN, and you do not know the PG ID#, contact Ann Fletcher at

Ann.Fletcher@state.de.us

to get this number.

Enter both numbers as indicated (if applicable). The PG should always use either the EIN or the PG ID# whenever corresponding with the Department.

AGENT/SL BROKER INFORMATION (page 2)

List the Agent or Broker responsible for procuring insurance coverage on behalf of the PG. This information is especially important in cases when the

PG obtains coverage through a non-admitted insurer. According to Delaware law, if the insurance carrier does not make filings and pay taxes to the

State (as in the case of a non-admitted insurer) the responsibility falls to the Agent/SL Broker who obtained the coverage. Please note that all surplus

lines business must be transacted by a resident or non-resident individual licensed in Delaware as a Surplus Lines (SL) Broker. If the PG uses a surplus

lines company as a carrier, the SL broker responsible for procuring the business must be listed.

PART 1

PREMIUM TAX AND FEES SUMMARY REPORT (page 2)

List each Insurance Company Full Name, NAIC#, and the Total Premium Amount paid to that company per §702(a).

( 1 )

Insurance Source

Use additional pages if needed. If PG intends to do business with a company, but did not generate any premium with

Information

that company during 2010, list that company and enter “0.00” in the Total Premium Amount column. Please list

companies with premium first.

Enter the Premium Tax Amount for each Insurance Source as calculated in Part 2. If tax is paid by the PG or by the

( 2 )

Tax Amount

Agent/SL Broker, enter tax amount. If tax is paid by the admitted Insurer, enter “0.00”.

Due from PG

Sum Tax Amount Column. This column should only contain amounts from Part 2 in which the Purchasing Group

( 3 )

Total Tax Due

and/or Agent/SL Broker has been marked as responsible for paying the tax.

Add Annual Renewal Fee (§701(8)). All Purchasing Groups must pay this fee annually.

( 4 )

Annual Renewal Fee

Deduct any prepayments made during 201 .

( 5 )

Amount Prepaid

Total Amount Due. Attach a check made payable to Delaware Insurance Department for this amount.

( 6 )

Total Amount Due

If tax is paid by a SL broker acting on behalf of the PG, indicate the amount the SL broker will pay on page 3. Atta ch

a check from the Purchasing Group for the annu al renewal fee. If the Purchasing Group is paying both the premium

tax and the annual renewal fee, the purchasing group may attach one check for the total amount due.

GROSS PREMIUMS DETAIL REPORT AND TAX COMPUTATION (page 3)

PART 2

It is not ne cessary to complete this section for coverage placed through admitted in surers that file annual re ports

and pay premium taxes to the State. Premiums paid to those companies are included in the company’s overall report of business written in

Delaware. Only complete Part 2 of this tax form for cases where either the PG or an SL broker representing the PG is responsible for making the

annual report and paying the premium tax.

1.

List Name and NAIC # of Insurance Source

2.

List the information indicated for each policy placed through the Insurance Source. (§702(a))

3.

Indicate the ent ity that is respon sible for paying the premium tax on the premium paid to this Insurance Source. If Agent/SL Broker, indicate

name (detailed Agent/SL Broker information should be listed on Page 2). (§8010)

4.

Sum the Gross Premiums for each policy placed with the Insurance Source. Enter this amount in Part 1.

5.

Multiply the Total Gross Premiums by .02 (2%) to calculate the premium tax amount. Enter this amount in Part 1. (§702(c) & §707)

6.

Repeat steps 1 through 6 for each Insurance Source. Use additional pages as needed.

1

1 2

2 3

3 4

4