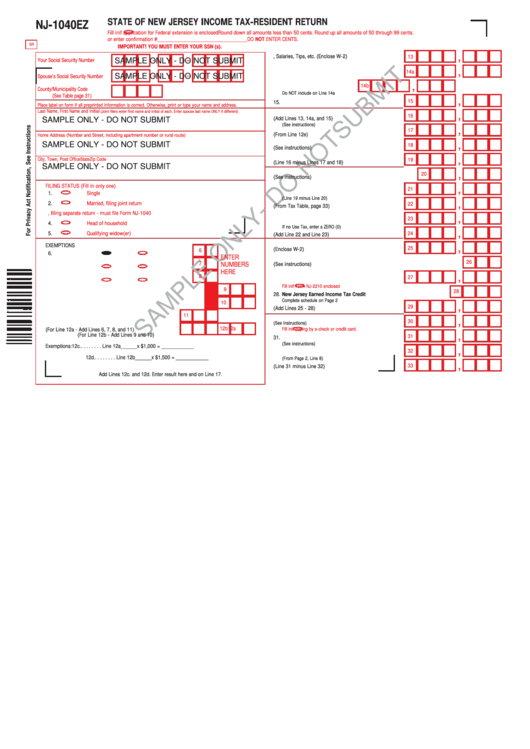

Form Nj-1040ez Sample - State Of New Jersey Income Tax-Resident Return

ADVERTISEMENT

STATE OF NEW JERSEY INCOME TAX-RESIDENT RETURN

NJ-1040EZ

Fill in

if application for Federal extension is enclosed

Round down all amounts less than 50 cents. Round up all amounts of 50 through 99 cents.

or enter confirmation #_________________________________

DO NOT ENTER CENTS.

5R

IMPORTANT! YOU MUST ENTER YOUR SSN (s).

,

13. Wages, Salaries, Tips, etc. (Enclose W-2) ......................

13

-

-

SAMPLE ONLY - DO NOT SUBMIT

Your Social Security Number

,

14a. Taxable Interest Income..................................................

14a

-

-

SAMPLE ONLY - DO NOT SUBMIT

Spouse’s Social Security Number

,

14b

14b. Tax-Exempt Interest Income .........

County/Municipality Code

Do NOT include on Line 14a

(See Table page 31)

,

15

15. Dividends ........................................................................

Place label on form if all preprinted information is correct. Otherwise, print or type your name and address.

Last Name, First Name and Initial

(Joint filers enter first name and initial of each. Enter spouse last name ONLY if different)

,

16

SAMPLE ONLY - DO NOT SUBMIT

16. NJ Gross Income (Add Lines 13, 14a, and 15)...............

(See instructions)

,

17

17. Total Exemption Amount (From Line 12e) ......................

Home Address (Number and Street, including apartment number or rural route)

,

SAMPLE ONLY - DO NOT SUBMIT

18

18. Medical Expenses (See instructions) ..............................

,

City, Town, Post Office

State

Zip Code

19

19. Taxable Income (Line 16 minus Lines 17 and 18) ..........

SAMPLE ONLY - DO NOT SUBMIT

,

20

20. Property Tax Deduction (See instructions) .....................

FILING STATUS (Fill in only one)

,

21

21. NEW JERSEY TAXABLE INCOME....................................

1.

Single

(Line 19 minus Line 20)

,

2.

Married, filing joint return

22

22. Tax (From Tax Table, page 33) ........................................

3. Married, filing separate return - must file Form NJ-1040

,

23

23. Use Tax Due on Out-of-State Purchases.........................

4.

Head of household

If no Use Tax, enter a ZERO (0)

,

5.

Qualifying widow(er)

24

24. Total Tax (Add Line 22 and Line 23) ...............................

EXEMPTIONS

,

25

25. NJ Income Tax Withheld (Enclose W-2) .........................

6

6. Regular

Yourself

Spouse.................

ENTER

26

7

NUMBERS

26. Property Tax Credit (See instructions)............................

7. Age 65 or Over

Yourself

Spouse.................

HERE

,

8

27

27. Estimated Payments/Credit from 2001 return ................

8. Blind or Disabled

Yourself

Spouse.................

Fill in

if Form NJ-2210 enclosed

9

28

9. Number of your qualified dependent children

28. New Jersey Earned Income Tax Credit..........................

Complete schedule on Page 2

10

,

10. Number of other dependents .........................................................

29

29. Total Payments and Credits (Add Lines 25 - 28) ............

11

,

11. Dependents attending colleges ........................................

30

30. AMOUNT OF TAX YOU OWE

(See instructions)

.................

12a

12b

Fill in

if paying by e-check or credit card.

12. Totals

(For Line 12a - Add Lines 6, 7, 8, and 11)

,

(For Line 12b - Add Lines 9 and 10)

31

31. OVERPAYMENT...............................................................

(See instructions)

Exemptions:

12c. . . . . . . . . Line 12a______x $1,000 = ____________

,

32

32. Total Deductions From

Overpayment..............................

12d.. . . . . . . . Line 12b______x $1,500 = ____________

(From Page 2, Line 8)

,

33

33. REFUND (Line 31 minus Line

32)...................................

12e. Total Exemption Amount . . . . . . . . . . ____________

Add Lines 12c. and 12d. Enter result here and on Line 17.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2