Schedule Rz Of M-1040 - City Of Muskegon Income Tax

ADVERTISEMENT

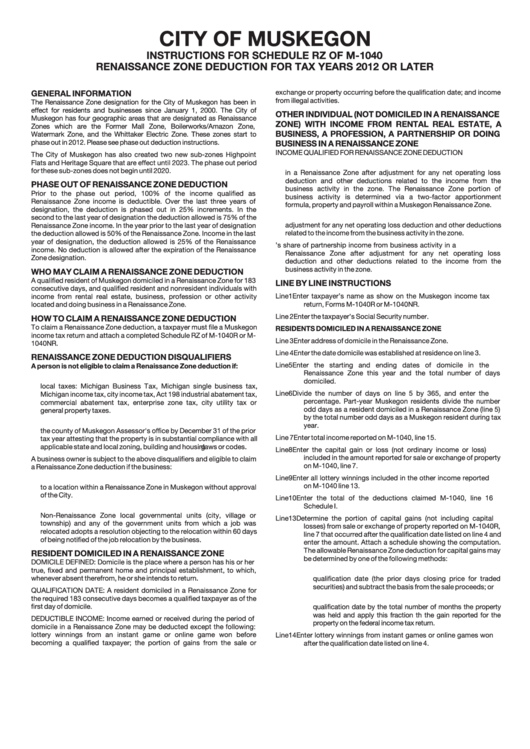

CITY OF MUSKEGON

INSTRUCTIONS FOR SCHEDULE RZ OF M-1040

RENAISSANCE ZONE DEDUCTION FOR TAX YEARS 2012 OR LATER

exchange or property occurring before the qualification date; and income

GENERAL INFORMATION

from illegal activities.

The Renaissance Zone designation for the City of Muskegon has been in

effect for residents and businesses since January 1, 2000. The City of

OTHER INDIVIDUAL (NOT DOMICILED IN A RENAISSANCE

Muskegon has four geographic areas that are designated as Renaissance

ZONE) WITH INCOME FROM RENTAL REAL ESTATE, A

Zones which are the Former Mall Zone, Boilerworks/Amazon Zone,

BUSINESS, A PROFESSION, A PARTNERSHIP OR DOING

Watermark Zone, and the Whittaker Electric Zone. These zones start to

phase out in 2012. Please see phase out deduction instructions.

BUSINESS IN A RENAISSANCE ZONE

INCOME QUALIFIED FOR RENAISSANCE ZONE DEDUCTION

The City of Muskegon has also created two new sub-zones Highpoint

Flats and Heritage Square that are effect until 2023. The phase out period

1. That portion of business or professional income from business activity

for these sub-zones does not begin until 2020.

in a Renaissance Zone after adjustment for any net operating loss

deduction and other deductions related to the income from the

PHASE OUT OF RENAISSANCE ZONE DEDUCTION

business activity in the zone. The Renaissance Zone portion of

Prior to the phase out period, 100% of the income qualified as

business activity is determined via a two-factor apportionment

Renaissance Zone income is deductible. Over the last three years of

formula, property and payroll within a Muskegon Renaissance Zone.

designation, the deduction is phased out in 25% increments. In the

2. Income from rental of real property located in a Renaissance Zone after

second to the last year of designation the deduction allowed is 75% of the

adjustment for any net operating loss deduction and other deductions

Renaissance Zone income. In the year prior to the last year of designation

related to the income from the business activity in the zone.

the deduction allowed is 50% of the Renaissance Zone. Income in the last

year of designation, the deduction allowed is 25% of the Renaissance

3. The partner’s share of partnership income from business activity in a

income. No deduction is allowed after the expiration of the Renaissance

Renaissance Zone after adjustment for any net operating loss

Zone designation.

deduction and other deductions related to the income from the

business activity in the zone.

WHO MAY CLAIM A RENAISSANCE ZONE DEDUCTION

A qualified resident of Muskegon domiciled in a Renaissance Zone for 183

LINE BY LINE INSTRUCTIONS

consecutive days, and qualified resident and nonresident individuals with

Line 1

Enter taxpayer’s name as show on the Muskegon income tax

income from rental real estate, business, profession or other activity

return, Forms M-1040R or M-1040NR.

located and doing business in a Renaissance Zone.

Line 2

Enter the taxpayer’s Social Security number.

HOW TO CLAIM A RENAISSANCE ZONE DEDUCTION

To claim a Renaissance Zone deduction, a taxpayer must file a Muskegon

RESIDENTS DOMICILED IN A RENAISSANCE ZONE

income tax return and attach a completed Schedule RZ of M-1040R or M-

Line 3

Enter address of domicile in the Renaissance Zone.

1040NR.

Line 4

Enter the date domicile was established at residence on line 3.

RENAISSANCE ZONE DEDUCTION DISQUALIFIERS

Line 5

Enter the starting and ending dates of domicile in the

A person is not eligible to claim a Renaissance Zone deduction if:

Renaissance Zone this year and the total number of days

1. The person is delinquent in filing or paying any of the following state or

domiciled.

local taxes: Michigan Business Tax, Michigan single business tax,

Line 6

Divide the number of days on line 5 by 365, and enter the

Michigan income tax, city income tax, Act 198 industrial abatement tax,

percentage. Part-year Muskegon residents divide the number

commercial abatement tax, enterprise zone tax, city utility tax or

odd days as a resident domiciled in a Renaissance Zone (line 5)

general property taxes.

by the total number odd days as a Muskegon resident during tax

2. The person owns residential property and did not file an affidavit with

year.

the

county of Muskegon Assessor's office by December 31 of the prior

Line 7

Enter total income reported on M-1040, line 15.

tax year attesting that the property is in substantial compliance with all

applicable state and local zoning, building and housin laws or codes.

g

Line 8

Enter the capital gain or loss (not ordinary income or loss)

included in the amount reported for sale or exchange of property

A business owner is subject to the above disqualifiers and eligible to claim

on M-1040, line 7.

a Renaissance Zone deduction if the business:

Line 9

Enter all lottery winnings included in the other income reported

1. Is located within Muskegon outside of a Renaissance Zone and moves

on M-1040 line 13.

to a location within a Renaissance Zone in Muskegon without approval

of the City.

Line 10 Enter the total of the deductions claimed M-1040, line 16

Schedule I.

2. Relocates more than 25 full-time equivalent jobs from one or more

Non-Renaissance Zone local governmental units (city, village or

Line 13 Determine the portion of capital gains (not including capital

township) and any of the government units from which a job was

losses) from sale or exchange of property reported on M-1040R,

relocated adopts a resolution objecting to the relocation within 60 days

line 7 that occurred after the qualification date listed on line 4 and

of being notified of the job relocation by the business.

enter the amount. Attach a schedule showing the computation.

The allowable Renaissance Zone deduction for capital gains may

RESIDENT DOMICILED IN A RENAISSANCE ZONE

be determined by one of the following methods:

DOMICILE DEFINED: Domicile is the place where a person has his or her

true, fixed and permanent home and principal establishment, to which,

A. Adjust the basis for the property to the fair market value on the

whenever absent therefrom, he or she intends to return.

qualification date (the prior days closing price for traded

securities) and subtract the basis from the sale proceeds; or

QUALIFICATION DATE: A resident domiciled in a Renaissance Zone for

the required 183 consecutive days becomes a qualified taxpayer as of the

B. Divide the number of months the property was held since the

first day of domicile.

qualification date by the total number of months the property

was held and apply this fraction th the gain reported for the

DEDUCTIBLE INCOME: Income earned or received during the period of

property on the federal income tax return.

domicile in a Renaissance Zone may be deducted except the following:

lottery winnings from an instant game or online game won before

Line 14 Enter lottery winnings from instant games or online games won

becoming a qualified taxpayer; the portion of gains from the sale or

after the qualification date listed on line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4