Taxable Travel Allowance Payroll Report - Alaska Department Of Administration

ADVERTISEMENT

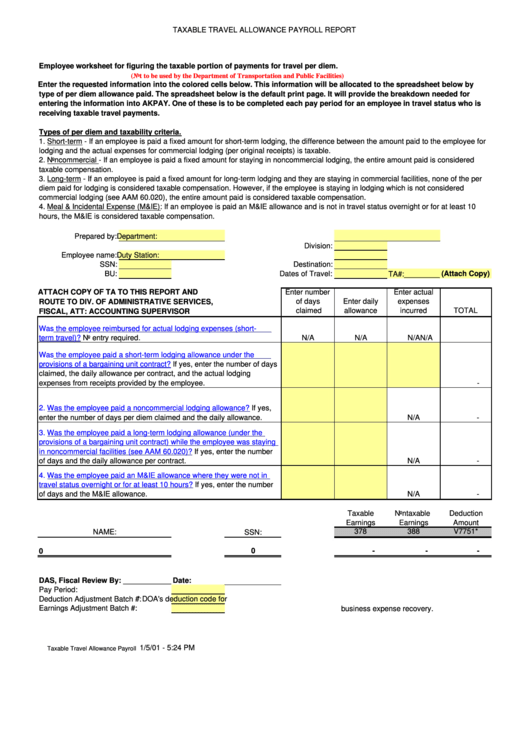

TAXABLE TRAVEL ALLOWANCE PAYROLL REPORT

Employee worksheet for figuring the taxable portion of payments for travel per diem.

(Not to be used by the Department of Transportation and Public Facilities)

Enter the requested information into the colored cells below. This information will be allocated to the spreadsheet below by

type of per diem allowance paid. The spreadsheet below is the default print page. It will provide the breakdown needed for

entering the information into AKPAY. One of these is to be completed each pay period for an employee in travel status who is

receiving taxable travel payments.

Types of per diem and taxability criteria.

1. Short-term - If an employee is paid a fixed amount for short-term lodging, the difference between the amount paid to the employee for

lodging and the actual expenses for commercial lodging (per original receipts) is taxable.

2. Noncommercial - If an employee is paid a fixed amount for staying in noncommercial lodging, the entire amount paid is considered

taxable compensation.

3. Long-term - If an employee is paid a fixed amount for long-term lodging and they are staying in commercial facilities, none of the per

diem paid for lodging is considered taxable compensation. However, if the employee is staying in lodging which is not considered

commercial lodging (see AAM 60.020), the entire amount paid is considered taxable compensation.

4. Meal & Incidental Expense (M&IE): If an employee is paid an M&IE allowance and is not in travel status overnight or for at least 10

hours, the M&IE is considered taxable compensation.

Prepared by:

Department:

Division:

Employee name:

Duty Station:

SSN:

Destination:

BU:

Dates of Travel:

TA#:_________(Attach Copy)

Enter number

Enter actual

ATTACH COPY OF TA TO THIS REPORT AND

of days

Enter daily

expenses

ROUTE TO DIV. OF ADMINISTRATIVE SERVICES,

claimed

allowance

incurred

TOTAL

FISCAL, ATT: ACCOUNTING SUPERVISOR

1.a. Was the employee reimbursed for actual lodging expenses (short-

term travel)?

No entry required.

N/A

N/A

N/A

N/A

1.b. Was the employee paid a short-term lodging allowance under the

provisions of a bargaining unit contract?

If yes, enter the number of days

claimed, the daily allowance per contract, and the actual lodging

expenses from receipts provided by the employee.

-

2. Was the employee paid a noncommercial lodging allowance?

If yes,

enter the number of days per diem claimed and the daily allowance.

N/A

-

3. Was the employee paid a long-term lodging allowance (under the

provisions of a bargaining unit contract) while the employee was staying

in noncommercial facilities (see AAM 60.020)?

If yes, enter the number

of days and the daily allowance per contract.

N/A

-

4. Was the employee paid an M&IE allowance where they were not in

travel status overnight or for at least 10 hours?

If yes, enter the number

of days and the M&IE allowance.

N/A

-

Taxable

Nontaxable

Deduction

Earnings

Earnings

Amount

378

388

V7751*

NAME:

SSN:

0

0

-

-

-

DAS, Fiscal Review By: ________________________

Date:

Pay Period:

Deduction Adjustment Batch #:

* DOA's deduction code for

Earnings Adjustment Batch #:

business expense recovery.

1/5/01 - 5:24 PM

Taxable Travel Allowance Payroll Report.xls 5/18/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1