2

Page

FinCEN Form 103-N (Rev. 12-03) (Formally Form 8852)

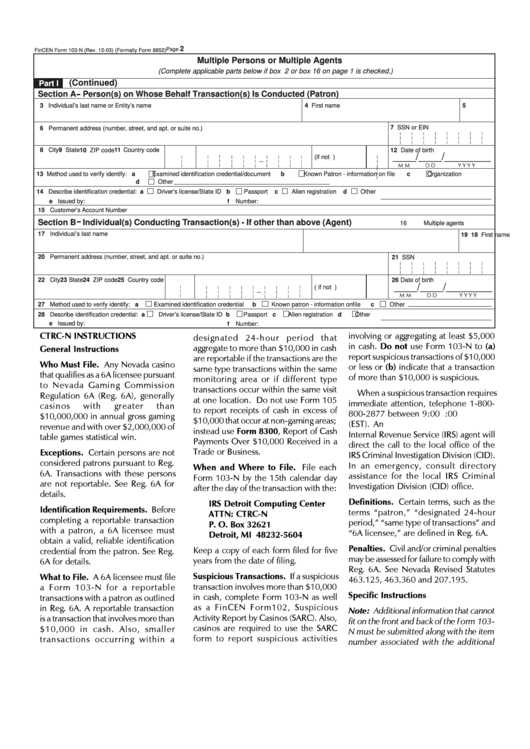

Multiple Persons or Multiple Agents

(Complete applicable parts below if box 2 or box 16 on page 1 is checked.)

(Continued)

Part I

Section A Person(s) on Whose Behalf Transaction(s) Is Conducted (Patron)

3 Individual’s last name or Entity’s name

4 First name

5 M.I.

7 SSN or EIN

6 Permanent address (number, street, and apt. or suite no.)

8 City

9 State

11 Country code

12 Date of birth

10 ZIP code

____/____/________

(if not U.S.)

M M

D D

Y Y Y Y

13 Method used to verify identify:

a

Examined identification credential/document

b

Known Patron - information on file

c

Organization

d

Other

14 Describe identification credential: a

Driver’s license/State ID b

Passport

c

Alien registration

d

Other

e Issued by:

f

Number:

15 Customer’s Account Number

Section B Individual(s) Conducting Transaction(s) - If other than above (Agent)

16

Multiple agents

17 Individual’s last name

18 First name

19 M.I.

20 Permanent address (number, street, and apt. or suite no.)

21 SSN

22 City

23 State

24 ZIP code

25 Country code

26 Date of birth

____/____/________

( if not U.S.)

M M

D D

Y Y Y Y

27 Method used to verify identify: a

Examined identification credential

b

Known patron - information onfile

c

Other

28 Describe identification credential: a

Driver’s license/State ID b

Passport

c

Alien registration

d

Other

e Issued by:

f

Number:

CTRC-N INSTRUCTIONS

involving or aggregating at least $5,000

designated 24-hour period that

in cash. Do not use Form 103-N to (a)

aggregate to more than $10,000 in cash

General Instructions

report suspicious transactions of $10,000

are reportable if the transactions are the

Who Must File. Any Nevada casino

or less or (b) indicate that a transaction

same type transactions within the same

that qualifies as a 6A licensee pursuant

of more than $10,000 is suspicious.

monitoring area or if different type

to Nevada Gaming Commission

transactions occur within the same visit

When a suspicious transaction requires

Regulation 6A (Reg. 6A), generally

at one location. Do not use Form 105

immediate attention, telephone 1-800-

casinos

with

greater

than

to report receipts of cash in excess of

800-2877 between 9:00 a.m. and 6:00

$10,000,000 in annual gross gaming

$10,000 that occur at non-gaming areas;

p.m. Eastern Standard Time (EST). An

revenue and with over $2,000,000 of

instead use Form 8300, Report of Cash

Internal Revenue Service (IRS) agent will

table games statistical win.

Payments Over $10,000 Received in a

direct the call to the local office of the

Trade or Business.

Exceptions. Certain persons are not

IRS Criminal Investigation Division (CID).

considered patrons pursuant to Reg.

In an emergency, consult directory

When and Where to File. File each

6A. Transactions with these persons

assistance for the local IRS Criminal

Form 103-N by the 15th calendar day

are not reportable. See Reg. 6A for

Investigation Division (CID) office.

after the day of the transaction with the:

details.

Definitions. Certain terms, such as the

IRS Detroit Computing Center

Identification Requirements. Before

terms “patron,” “designated 24-hour

ATTN: CTRC-N

completing a reportable transaction

period,” “same type of transactions” and

P. O. Box 32621

with a patron, a 6A licensee must

“6A licensee,” are defined in Reg. 6A.

Detroit, MI 48232-5604

obtain a valid, reliable identification

Penalties. Civil and/or criminal penalties

Keep a copy of each form filed for five

credential from the patron. See Reg.

may be assessed for failure to comply with

years from the date of filing.

6A for details.

Reg. 6A. See Nevada Revised Statutes

Suspicious Transactions. If a suspicious

What to File. A 6A licensee must file

463.125, 463.360 and 207.195.

transaction involves more than $10,000

a Form 103-N for a reportable

Specific Instructions

in cash, complete Form 103-N as well

transactions with a patron as outlined

as a FinCEN Form102, Suspicious

in Reg. 6A. A reportable transaction

Note: Additional information that cannot

Activity Report by Casinos (SARC). Also,

is a transaction that involves more than

fit on the front and back of the Form 103-

casinos are required to use the SARC

$10,000 in cash. Also, smaller

N must be submitted along with the item

form to report suspicious activities

transactions occurring within a

number associated with the additional

1

1 2

2 3

3