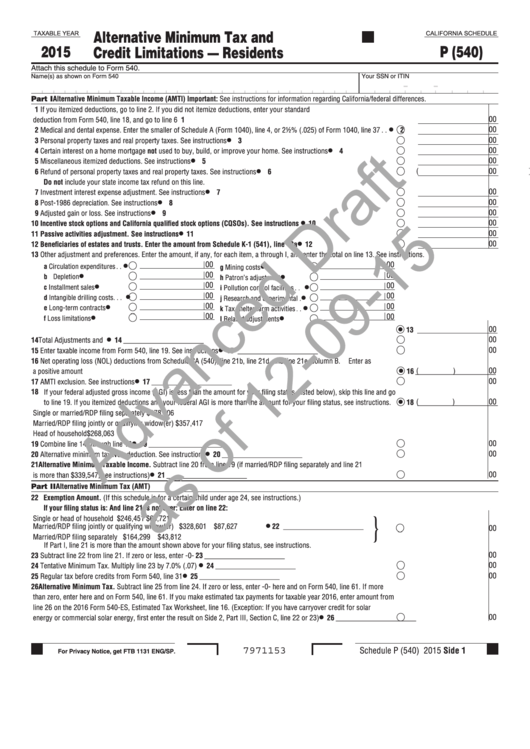

California Schedule P(540) Draft - Alternative Minimum Tax And Credit Limitations - Residents - 2015

ADVERTISEMENT

Alternative Minimum Tax and

TAXABLE YEAR

CALIFORNIA SCHEDULE

2015

P (540)

Credit Limitations — Residents

Attach this schedule to Form 540.

Name(s) as shown on Form 540

Your SSN or ITIN

-

-

Part I

Alternative Minimum Taxable Income (AMTI) Important: See instructions for information regarding California/federal differences.

1 If you itemized deductions, go to line 2. If you did not itemize deductions, enter your standard

00

deduction from Form 540, line 18, and go to line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 Medical and dental expense. Enter the smaller of Schedule A (Form 1040), line 4, or 2½% (.025) of Form 1040, line 37 . .

2

00

3 Personal property taxes and real property taxes. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Certain interest on a home mortgage not used to buy, build, or improve your home. See instructions . . . . . . . . . . . . . . . . .

4

00

5 Miscellaneous itemized deductions. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

(

00

)

6 Refund of personal property taxes and real property taxes. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Do not include your state income tax refund on this line.

00

7 Investment interest expense adjustment. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Post-1986 depreciation. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Adjusted gain or loss. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Incentive stock options and California qualified stock options (CQSOs). See instructions . . . . . . . . . . . . . . . . . . . . .

10

00

11 Passive activities adjustment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Beneficiaries of estates and trusts. Enter the amount from Schedule K-1 (541), line 12a . . . . . . . . . . . . . . . . . . . . .

12

13 Other adjustment and preferences. Enter the amount, if any, for each item, a through I, and enter the total on line 13. See instructions.

00

00

a Circulation expenditures . .

g Mining costs . . . . . . . . . . . .

00

00

b Depletion . . . . . . . . . . . . . .

h Patron’s adjustment. . . . . . .

00

00

c Installment sales . . . . . . . .

i

Pollution control facilities . .

00

00

d Intangible drilling costs . . .

j

Research and experimental .

00

00

e Long-term contracts . . . . .

k Tax shelter farm activities . .

00

00

f

Loss limitations . . . . . . . . .

l

Related adjustments . . . . . .

00

13 ______________________

00

14 Total Adjustments and Preferences. Combine line 1 through line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 ______________________

00

15 Enter taxable income from Form 540, line 19. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 ______________________

16 Net operating loss (NOL) deductions from Schedule CA (540), line 21b, line 21d, and line 21e, column B. Enter as

00

(

)

a positive amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 ______________________

00

17 AMTI exclusion. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 ______________________

18 If your federal adjusted gross income (AGI) is less than the amount for your filing status (listed below), skip this line and go

00

to line 19. If you itemized deductions and your federal AGI is more than the amount for your filing status, see instructions.

18 ______________________

(

)

Single or married/RDP filing separately . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $178,706

Married/RDP filing jointly or qualifying widow(er) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $357,417

Head of household . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $268,063

00

19 Combine line 14 through line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 ______________________

00

20 Alternative minimum tax NOL deduction. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 ______________________

21 Alternative Minimum Taxable Income. Subtract line 20 from line 19 (if married/RDP filing separately and line 21

00

is more than $339,547, see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21 ______________________

Part II Alternative Minimum Tax (AMT)

22 Exemption Amount. (If this schedule is for a certain child under age 24, see instructions.)

If your filing status is:

And line 21 is not over:

Enter on line 22:

}

Single or head of household

$246,451

$65,721

00

Married/RDP filing jointly or qualifying widow(er)

$328,601

$87,627

22 ______________________

Married/RDP filing separately

$164,299

$43,812

If Part I, line 21 is more than the amount shown above for your filing status, see instructions.

00

23 Subtract line 22 from line 21. If zero or less, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 ______________________

00

24 Tentative Minimum Tax. Multiply line 23 by 7.0% (.07) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24 ______________________

00

25 Regular tax before credits from Form 540, line 31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25 ______________________

26 Alternative Minimum Tax. Subtract line 25 from line 24. If zero or less, enter -0- here and on Form 540, line 61. If more

than zero, enter here and on Form 540, line 61. If you make estimated tax payments for taxable year 2016, enter amount from

line 26 on the 2016 Form 540-ES, Estimated Tax Worksheet, line 16. (Exception: If you have carryover credit for solar

00

energy or commercial solar energy, first enter the result on Side 2, Part III, Section C, line 22 or 23) . . . . . . . . . . . . . . . . .

26 ______________________

Schedule P (540) 2015 Side 1

7971153

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2