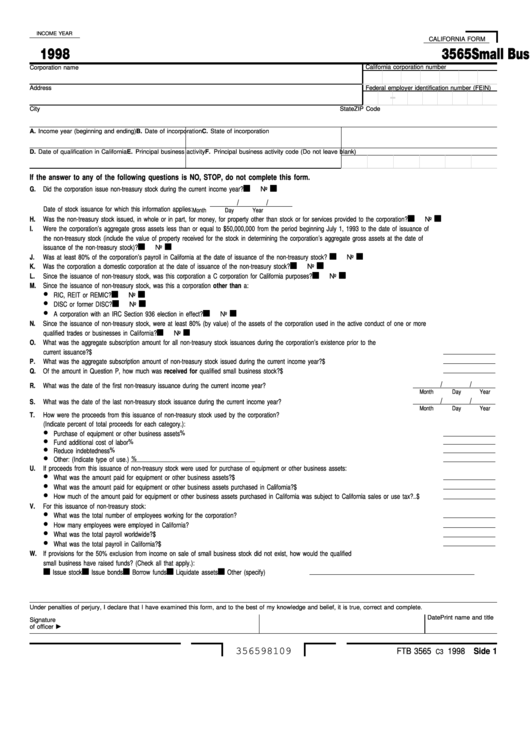

INCOME YEAR

CALIFORNIA FORM

1998

Small Business Stock Questionnaire

3565

California corporation number

Corporation name

Address

Federal employer identification number (FEIN)

City

State

ZIP Code

A. Income year (beginning and ending)

B. Date of incorporation

C. State of incorporation

D. Date of qualification in California

E. Principal business activity

F. Principal business activity code (Do not leave blank)

If the answer to any of the following questions is NO, STOP, do not complete this form.

G.

Did the corporation issue non-treasury stock during the current income year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

/

/

Date of stock issuance for which this information applies:

Month

Day

Year

H.

Was the non-treasury stock issued, in whole or in part, for money, for property other than stock or for services provided to the corporation? . . . . . .

Yes

No

I.

Were the corporation’s aggregate gross assets less than or equal to $50,000,000 from the period beginning July 1, 1993 to the date of issuance of

the non-treasury stock (include the value of property received for the stock in determining the corporation’s aggregate gross assets at the date of

issuance of the non-treasury stock)?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

J.

Was at least 80% of the corporation’s payroll in California at the date of issuance of the non-treasury stock? . . . . . . . . . . . . . . . . . . . . . .

Yes

No

K.

Was the corporation a domestic corporation at the date of issuance of the non-treasury stock? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

L.

Since the issuance of non-treasury stock, was this corporation a C corporation for California purposes? . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

M. Since the issuance of non-treasury stock, was this a corporation other than a:

•

RIC, REIT or REMIC? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

•

DISC or former DISC?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

•

A corporation with an IRC Section 936 election in effect? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

N.

Since the issuance of non-treasury stock, were at least 80% (by value) of the assets of the corporation used in the active conduct of one or more

qualified trades or businesses in California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

O.

What was the aggregate subscription amount for all non-treasury stock issuances during the corporation’s existence prior to the

current issuance? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

P.

What was the aggregate subscription amount of non-treasury stock issued during the current income year? . . . . . . . . . . . . . . . . . . . .

$

Q.

Of the amount in Question P, how much was received for qualified small business stock? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

/

/

R.

What was the date of the first non-treasury issuance during the current income year? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Month

Day

Year

/

/

S.

What was the date of the last non-treasury stock issuance during the current income year? . . . . . . . . . . . . . . . . . . . . . . . . .

Month

Day

Year

T.

How were the proceeds from this issuance of non-treasury stock used by the corporation?

(Indicate percent of total proceeds for each category.):

•

%

Purchase of equipment or other business assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

%

Fund additional cost of labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

%

Reduce indebtedness . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

%

Other: (Indicate type of use.)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

U.

If proceeds from this issuance of non-treasury stock were used for purchase of equipment or other business assets:

•

What was the amount paid for equipment or other business assets?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

•

What was the amount paid for equipment or other business assets purchased in California?. . . . . . . . . . . . . . . . . . . . . . . . . .

$

•

How much of the amount paid for equipment or other business assets purchased in California was subject to California sales or use tax? . .

$

V.

For this issuance of non-treasury stock:

•

What was the total number of employees working for the corporation?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

How many employees were employed in California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

What was the total payroll worldwide? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

•

What was the total payroll in California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

W. If provisions for the 50% exclusion from income on sale of small business stock did not exist, how would the qualified

small business have raised funds? (Check all that apply.):

Issue stock

Issue bonds

Borrow funds

Liquidate assets

Other (specify)

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge and belief, it is true, correct and complete.

Print name and title

Date

Signature

of officer

356598109

FTB 3565

1998 Side 1

C3

1

1