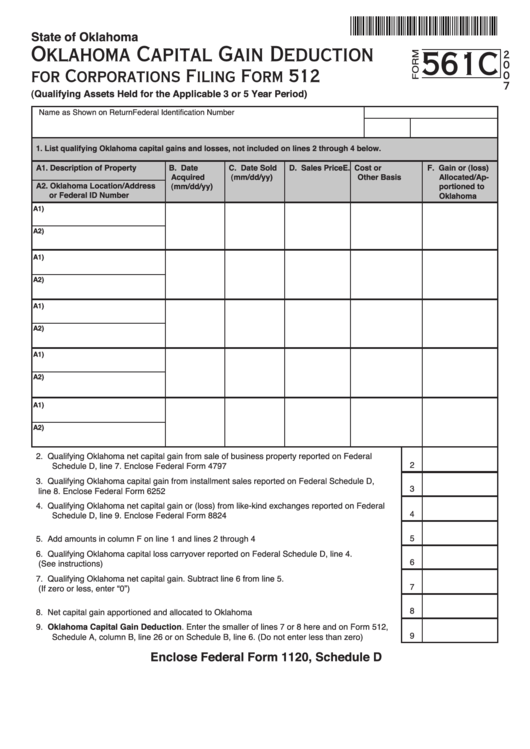

Form 561c - Oklahoma Capital Gain Deduction For Corporations Filing Form 512 - 2007

ADVERTISEMENT

State of Oklahoma

Oklahoma Capital Gain Deduction

561C

2

0

for Corporations Filing Form 512

0

7

(Qualifying Assets Held for the Applicable 3 or 5 Year Period)

Name as Shown on Return

Federal Identification Number

1. List qualifying Oklahoma capital gains and losses, not included on lines 2 through 4 below.

A1. Description of Property

B. Date

C. Date Sold

D. Sales Price

E. Cost or

F. Gain or (loss)

Acquired

(mm/dd/yy)

Other Basis

Allocated/Ap-

A2. Oklahoma Location/Address

(mm/dd/yy)

portioned to

or Federal ID Number

Oklahoma

A1)

A2)

A1)

A2)

A1)

A2)

A1)

A2)

A1)

A2)

2.

Qualifying Oklahoma net capital gain from sale of business property reported on Federal

2

Schedule D, line 7. Enclose Federal Form 4797 .........................................................................

3.

Qualifying Oklahoma capital gain from installment sales reported on Federal Schedule D,

3

line 8. Enclose Federal Form 6252 ..............................................................................................

4.

Qualifying Oklahoma net capital gain or (loss) from like-kind exchanges reported on Federal

4

Schedule D, line 9. Enclose Federal Form 8824 .........................................................................

5

5.

Add amounts in column F on line 1 and lines 2 through 4 ...........................................................

6.

Qualifying Oklahoma capital loss carryover reported on Federal Schedule D, line 4.

6

(See instructions) .........................................................................................................................

7.

Qualifying Oklahoma net capital gain. Subtract line 6 from line 5.

7

(If zero or less, enter “0”) .............................................................................................................

8

8.

Net capital gain apportioned and allocated to Oklahoma ............................................................

9. Oklahoma Capital Gain Deduction. Enter the smaller of lines 7 or 8 here and on Form 512,

9

Schedule A, column B, line 26 or on Schedule B, line 6. (Do not enter less than zero) ..............

Enclose Federal Form 1120, Schedule D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2