Instructions For Form 502h - Historic Property And Heritage Area Preservation - Maryland Revenue Administration Division

ADVERTISEMENT

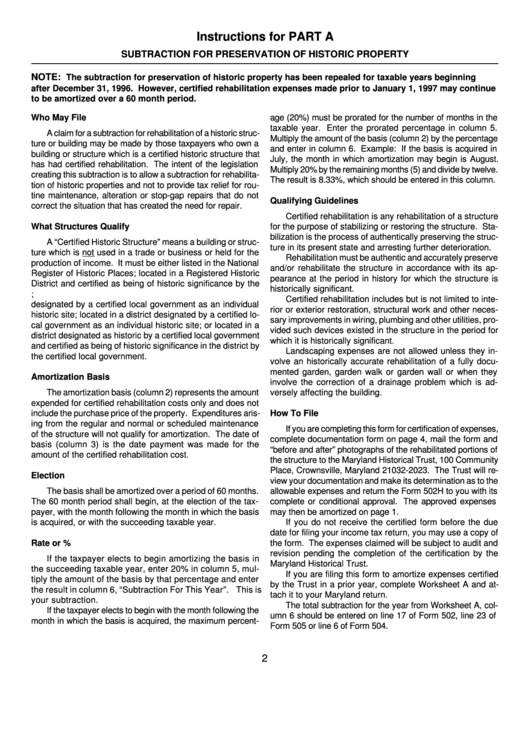

Instructions for PART A

SUBTRACTION FOR PRESERVATION OF HISTORIC PROPERTY

NOTE:

The subtraction for preservation of historic property has been repealed for taxable years beginning

after December 31, 1996. However, certified rehabilitation expenses made prior to January 1, 1997 may continue

to be amortized over a 60 month period.

Who May File

age (20%) must be prorated for the number of months in the

taxable year. Enter the prorated percentage in column 5.

A claim for a subtraction for rehabilitation of a historic struc-

Multiply the amount of the basis (column 2) by the percentage

ture or building may be made by those taxpayers who own a

and enter in column 6. Example: If the basis is acquired in

building or structure which is a certified historic structure that

July, the month in which amortization may begin is August.

has had certified rehabilitation. The intent of the legislation

Multiply 20% by the remaining months (5) and divide by twelve.

creating this subtraction is to allow a subtraction for rehabilita-

The result is 8.33%, which should be entered in this column.

tion of historic properties and not to provide tax relief for rou-

tine maintenance, alteration or stop-gap repairs that do not

Qualifying Guidelines

correct the situation that has created the need for repair.

Certified rehabilitation is any rehabilitation of a structure

What Structures Qualify

for the purpose of stabilizing or restoring the structure. Sta-

bilization is the process of authentically preserving the struc-

A “Certified Historic Structure” means a building or struc-

ture in its present state and arresting further deterioration.

ture which is not used in a trade or business or held for the

Rehabilitation must be authentic and accurately preserve

production of income. It must be either listed in the National

and/or rehabilitate the structure in accordance with its ap-

Register of Historic Places; located in a Registered Historic

pearance at the period in history for which the structure is

District and certified as being of historic significance by the

historically significant.

U.S. Secretary of the Interior or the Maryland Historical Trust;

Certified rehabilitation includes but is not limited to inte-

designated by a certified local government as an individual

rior or exterior restoration, structural work and other neces-

historic site; located in a district designated by a certified lo-

sary improvements in wiring, plumbing and other utilities, pro-

cal government as an individual historic site; or located in a

vided such devices existed in the structure in the period for

district designated as historic by a certified local government

which it is historically significant.

and certified as being of historic significance in the district by

Landscaping expenses are not allowed unless they in-

the certified local government.

volve an historically accurate rehabilitation of a fully docu-

mented garden, garden walk or garden wall or when they

Amortization Basis

involve the correction of a drainage problem which is ad-

The amortization basis (column 2) represents the amount

versely affecting the building.

expended for certified rehabilitation costs only and does not

include the purchase price of the property. Expenditures aris-

How To File

ing from the regular and normal or scheduled maintenance

If you are completing this form for certification of expenses,

of the structure will not qualify for amortization. The date of

complete documentation form on page 4, mail the form and

basis (column 3) is the date payment was made for the

“before and after” photographs of the rehabilitated portions of

amount of the certified rehabilitation cost.

the structure to the Maryland Historical Trust, 100 Community

Place, Crownsville, Maryland 21032-2023. The Trust will re-

Election

view your documentation and make its determination as to the

The basis shall be amortized over a period of 60 months.

allowable expenses and return the Form 502H to you with its

The 60 month period shall begin, at the election of the tax-

complete or conditional approval. The approved expenses

payer, with the month following the month in which the basis

may then be amortized on page 1.

is acquired, or with the succeeding taxable year.

If you do not receive the certified form before the due

date for filing your income tax return, you may use a copy of

Rate or %

the form. The expenses claimed will be subject to audit and

revision pending the completion of the certification by the

If the taxpayer elects to begin amortizing the basis in

Maryland Historical Trust.

the succeeding taxable year, enter 20% in column 5, mul-

If you are filing this form to amortize expenses certified

tiply the amount of the basis by that percentage and enter

by the Trust in a prior year, complete Worksheet A and at-

the result in column 6, “Subtraction For This Year”. This is

tach it to your Maryland return.

your subtraction.

The total subtraction for the year from Worksheet A, col-

If the taxpayer elects to begin with the month following the

umn 6 should be entered on line 17 of Form 502, line 23 of

month in which the basis is acquired, the maximum percent-

Form 505 or line 6 of Form 504.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2