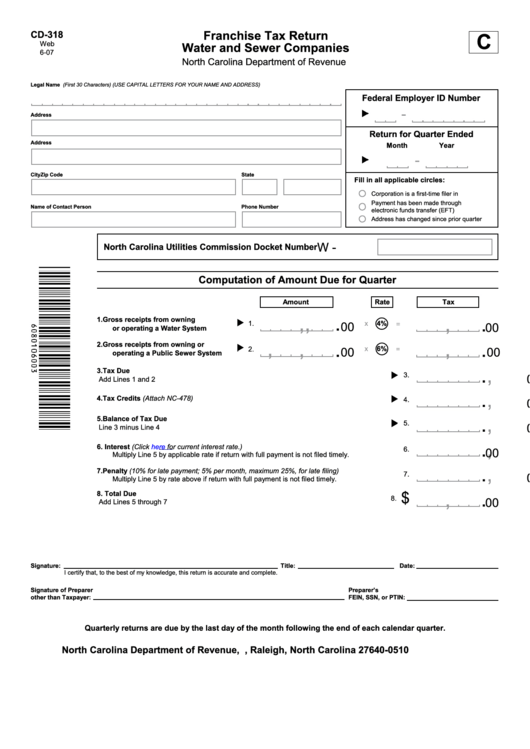

Form Cd-318 - Franchise Tax Return For Water And Sewer Companies - North Carolina Department Of Revenue

ADVERTISEMENT

Franchise Tax Return

CD-318

C

Web

Water and Sewer Companies

6-07

North Carolina Department of Revenue

Legal Name (First 30 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Federal Employer ID Number

-

Address

Return for Quarter Ended

Address

Month

Year

-

City

State

Zip Code

Fill in all applicable circles:

Corporation is a first-time filer in N.C.

Payment has been made through

Name of Contact Person

Phone Number

electronic funds transfer (EFT)

Address has changed since prior quarter

W -

North Carolina Utilities Commission Docket Number

Computation of Amount Due for Quarter

Amount

Rate

Tax

,

,

.

,

.

1.

Gross receipts from owning

1.

00

x

4%

=

00

or operating a Water System

,

,

,

.

.

2.

Gross receipts from owning or

00

x

6%

00

2.

=

operating a Public Sewer System

,

.

3.

Tax Due

3.

00

Add Lines 1 and 2

,

.

4.

Tax Credits (Attach NC-478)

4.

00

,

.

5.

Balance of Tax Due

5.

00

Line 3 minus Line 4

,

.

6.

Interest (Click

here

for current interest rate.)

6.

00

Multiply Line 5 by applicable rate if return with full payment is not filed timely.

,

.

7.

Penalty (10% for late payment; 5% per month, maximum 25%, for late filing)

7.

00

Multiply Line 5 by rate above if return with full payment is not filed timely.

,

.

$

8.

Total Due

8.

00

Add Lines 5 through 7

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Signature of Preparer

Preparer’s

other than Taxpayer:

FEIN, SSN, or PTIN:

Quarterly returns are due by the last day of the month following the end of each calendar quarter.

North Carolina Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0510

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1