Form Fol-7 - Claim For Refund Of Overpayment Of Occupational License Tax Withheld For Schools

ADVERTISEMENT

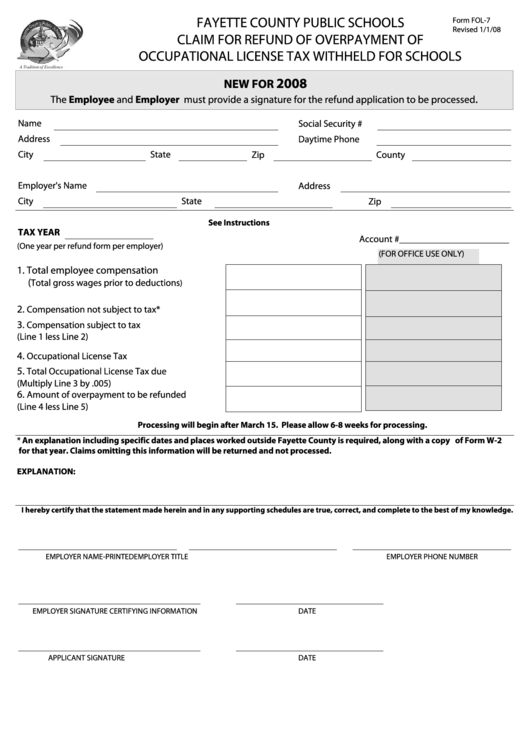

FAYETTE COUNTY PUBLIC SCHOOLS

Form FOL-7

Revised 1/1/08

CLAIM FOR REFUND OF OVERPAYMENT OF

OCCUPATIONAL LICENSE TAX WITHHELD FOR SCHOOLS

2008

NEW FOR

.

The Employee and Employer must provide a signature for the refund application to be processed

Name

Social Security #

Address

Daytime Phone

City

State

Zip

County

Employer's Name

Address

City

State

Zip

See Instructions

TAX YEAR

_____________________

Account #

(One year per refund form per employer)

(FOR OFFICE USE ONLY)

1. Total employee compensation

(

Total gross wages prior to deductions

).......................

2.

Compensation not subject to tax*...............................

3.

Compensation subject to tax

(Line 1 less Line 2)...............................................................

4.

Occupational License Tax withheld.............................

5.

Total Occupational License Tax due

(Multiply Line 3 by .005)..................................................

6.

Amount of overpayment to be refunded

(Line 4 less Line 5)...............................................................

Processing will begin after March 15. Please allow 6-8 weeks for processing.

* An explanation including specific dates and places worked outside Fayette County is required, along with a copy of Form W-2

for that year. Claims omitting this information will be returned and not processed.

EXPLANATION:

I hereby certify that the statement made herein and in any supporting schedules are true, correct, and complete to the best of my knowledge.

EMPLOYER NAME-PRINTED

EMPLOYER TITLE

EMPLOYER PHONE NUMBER

EMPLOYER SIGNATURE CERTIFYING INFORMATION

DATE

APPLICANT SIGNATURE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1