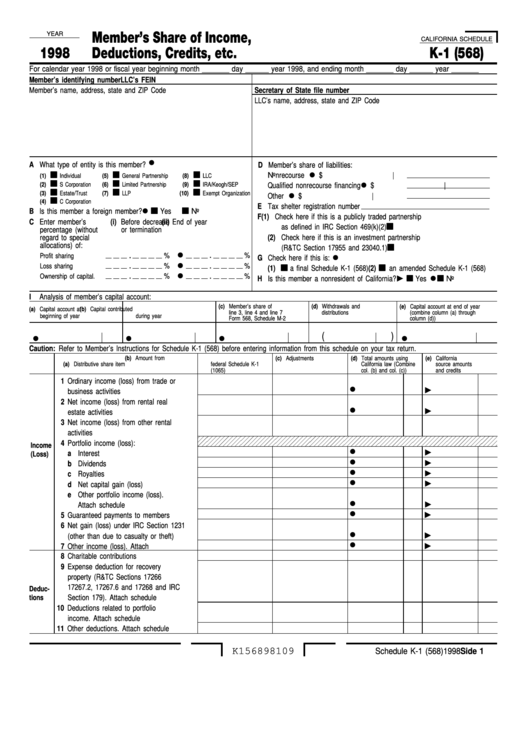

YEAR

Member’s Share of Income,

CALIFORNIA SCHEDULE

1998

Deductions, Credits, etc.

K-1 (568)

For calendar year 1998 or fiscal year beginning month _______ day ______ year 1998, and ending month _______ day ______ year _______

Member’s identifying number

LLC’s FEIN

Member’s name, address, state and ZIP Code

Secretary of State file number

LLC’s name, address, state and ZIP Code

•

A What type of entity is this member?

D Member’s share of liabilities:

•

Nonrecourse . . . . . . . . . . . . . .

$

|

(1)

Individual

(5)

General Partnership

(8)

LLC

•

(2)

S Corporation

(6)

Limited Partnership

(9)

IRA/Keogh/SEP

Qualified nonrecourse financing . . . .

$

|

•

(3)

Estate/Trust

(7)

LLP

(10)

Exempt Organization

Other . . . . . . . . . . . . . . . . . .

$

|

(4)

C Corporation

•

E Tax shelter registration number

B Is this member a foreign member? . . . . . . .

Yes

No

F (1) Check here if this is a publicly traded partnership

C Enter member’s

(i) Before decrease

(ii) End of year

as defined in IRC Section 469(k)(2) . . . . . . . . . . . . . . . . .

percentage (without

or termination

regard to special

(2) Check here if this is an investment partnership

allocations) of:

(R&TC Section 17955 and 23040.1). . . . . . . . . . . . . . . . .

•

•

.

.

%

%

Profit sharing . . . . .

G Check here if this is:

•

.

.

%

%

Loss sharing . . . . .

(1)

a final Schedule K-1 (568) (2)

an amended Schedule K-1 (568)

•

•

.

.

%

%

Ownership of capital .

H Is this member a nonresident of California? . . . . .

Yes

No

I

Analysis of member’s capital account:

(c) Member’s share of

(d) Withdrawals and

(e) Capital account at end of year

(a) Capital account at

(b) Capital contributed

line 3, line 4 and line 7

distributions

(combine column (a) through

beginning of year

during year

Form 568, Schedule M-2

column (d))

•

•

•

•

(

)

Caution: Refer to Member’s Instructions for Schedule K-1 (568) before entering information from this schedule on your tax return.

(b) Amount from

(c) Adjustments

(d) Total amounts using

(e) California

(a) Distributive share item

federal Schedule K-1

California law (Combine

source amounts

(1065)

col. (b) and col. (c))

and credits

1 Ordinary income (loss) from trade or

•

business activities . . . . . . . . . . . . . .

2 Net income (loss) from rental real

•

estate activities. . . . . . . . . . . . . . . .

3 Net income (loss) from other rental

activities . . . . . . . . . . . . . . . . . . .

4 Portfolio income (loss):

Income

•

a Interest . . . . . . . . . . . . . . . . . .

(Loss)

•

b Dividends . . . . . . . . . . . . . . . . .

•

c Royalties . . . . . . . . . . . . . . . . .

•

d Net capital gain (loss) . . . . . . . . . .

e Other portfolio income (loss).

•

Attach schedule . . . . . . . . . . . . .

•

5 Guaranteed payments to members. . . . .

6 Net gain (loss) under IRC Section 1231

•

(other than due to casualty or theft) . . . .

•

7 Other income (loss). Attach schedule . . .

8 Charitable contributions . . . . . . . . . . .

9 Expense deduction for recovery

property (R&TC Sections 17266

17267.2, 17267.6 and 17268 and IRC

Deduc-

tions

Section 179). Attach schedule . . . . . . .

10 Deductions related to portfolio

income. Attach schedule . . . . . . . . . .

11 Other deductions. Attach schedule . . . . .

K156898109

Schedule K-1 (568) 1998 Side 1

1

1 2

2