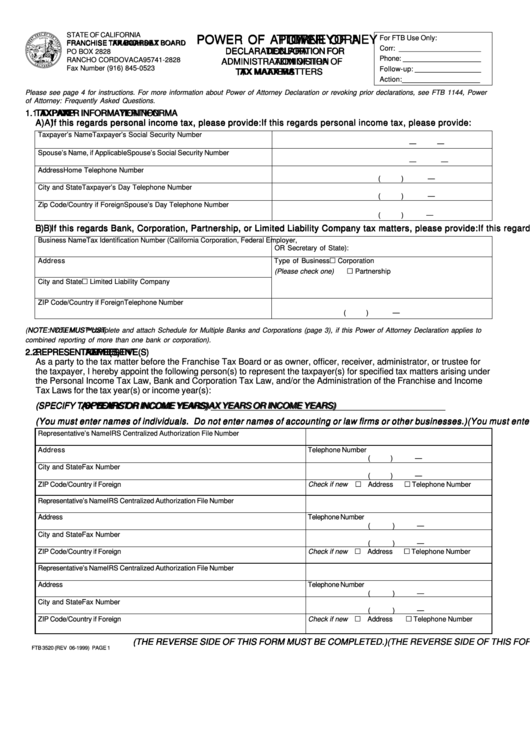

Form Ftb 3520 - Power Of Attorney - Declaration Of Administration Of Tax Matters - 1999

ADVERTISEMENT

STATE OF CALIFORNIA

POWER OF A

POWER OF ATT

POWER OF A

TT

TTORNEY

TT

ORNEY

ORNEY

ORNEY

For FTB Use Only:

POWER OF A

POWER OF A

TT

ORNEY

FRANCHISE T

FRANCHISE T

AX BOARD

AX BOARD

FRANCHISE T

FRANCHISE TAX BOARD

FRANCHISE T

AX BOARD

AX BOARD

Corr: _____________________

DECLARA

DECLARATION FOR

DECLARA

TION FOR

TION FOR

TION FOR

DECLARA

DECLARA

TION FOR

PO BOX 2828

Phone: ____________________

RANCHO CORDOVA CA 95741-2828

ADMINISTRA

ADMINISTRA

TION OF

TION OF

ADMINISTRA

ADMINISTRATION OF

ADMINISTRA

TION OF

TION OF

Fax Number (916) 845-0523

Follow-up: _________________

T T T T T AX MA

AX MA

AX MA

AX MA

AX MATTERS

TTERS

TTERS

TTERS

TTERS

Action: ____________________

Please see page 4 for instructions. For more information about Power of Attorney Declaration or revoking prior declarations, see FTB 1144, Power

of Attorney: Frequently Asked Questions.

1. 1. 1. 1. 1. T T T T T AXP

AXP

AXP

AXPA A A A A YER INFORMA

AXP

YER INFORMA

YER INFORMA

YER INFORMA

YER INFORMATION

TION

TION

TION

TION

A) A) A) A) A) If this regards personal income tax, please provide:

If this regards personal income tax, please provide:

If this regards personal income tax, please provide:

If this regards personal income tax, please provide:

If this regards personal income tax, please provide:

Taxpayer’s Name

Taxpayer’s Social Security Number

—

—

Spouse’s Name, if Applicable

Spouse’s Social Security Number

—

—

Address

Home Telephone Number

(

)

—

City and State

Taxpayer’s Day Telephone Number

(

)

—

Zip Code/Country if Foreign

Spouse’s Day Telephone Number

(

)

—

B) B) B) B) B) If this regards Bank, Corporation, Partnership, or Limited Liability Company tax matters, please provide:

If this regards Bank, Corporation, Partnership, or Limited Liability Company tax matters, please provide:

If this regards Bank, Corporation, Partnership, or Limited Liability Company tax matters, please provide:

If this regards Bank, Corporation, Partnership, or Limited Liability Company tax matters, please provide:

If this regards Bank, Corporation, Partnership, or Limited Liability Company tax matters, please provide:

Business Name

Tax Identification Number (California Corporation, Federal Employer,

OR Secretary of State):

Address

Type of Business

Corporation

(Please check one)

Partnership

City and State

Limited Liability Company

ZIP Code/Country if Foreign

Telephone Number

(

)

—

(NOTE:

NOTE:

NOTE:

NOTE:

NOTE: You MUST

MUST

MUST

MUST

MUST complete and attach Schedule for Multiple Banks and Corporations (page 3), if this Power of Attorney Declaration applies to

combined reporting of more than one bank or corporation).

2. 2. 2. 2. 2. REPRESENT

REPRESENT

REPRESENT

REPRESENT

REPRESENTA A A A A TIVE(S)

TIVE(S)

TIVE(S)

TIVE(S)

TIVE(S)

As a party to the tax matter before the Franchise Tax Board or as owner, officer, receiver, administrator, or trustee for

the taxpayer, I hereby appoint the following person(s) to represent the taxpayer(s) for specified tax matters arising under

the Personal Income Tax Law, Bank and Corporation Tax Law, and/or the Administration of the Franchise and Income

Tax Laws for the tax year(s) or income year(s):

(SPECIFY T

(SPECIFY T

(SPECIFY T

(SPECIFY T

(SPECIFY TAX YEARS OR INCOME YEARS)

AX YEARS OR INCOME YEARS)

AX YEARS OR INCOME YEARS)

AX YEARS OR INCOME YEARS)

AX YEARS OR INCOME YEARS) _________________________________________________

(You must enter names of individuals. Do not enter names of accounting or law firms or other businesses.)

(You must enter names of individuals. Do not enter names of accounting or law firms or other businesses.)

(You must enter names of individuals. Do not enter names of accounting or law firms or other businesses.)

(You must enter names of individuals. Do not enter names of accounting or law firms or other businesses.)

(You must enter names of individuals. Do not enter names of accounting or law firms or other businesses.)

Representative’s Name

IRS Centralized Authorization File Number

Address

Telephone Number

(

)

—

City and State

Fax Number

(

)

—

Check if new

ZIP Code/Country if Foreign

Address

Telephone Number

Representative’s Name

IRS Centralized Authorization File Number

Address

Telephone Number

(

)

—

City and State

Fax Number

(

)

—

ZIP Code/Country if Foreign

Check if new

Address

Telephone Number

Representative’s Name

IRS Centralized Authorization File Number

Address

Telephone Number

(

)

—

City and State

Fax Number

(

)

—

ZIP Code/Country if Foreign

Check if new

Address

Telephone Number

(THE REVERSE SIDE OF THIS FORM MUST BE COMPLETED.)

(THE REVERSE SIDE OF THIS FORM MUST BE COMPLETED.)

(THE REVERSE SIDE OF THIS FORM MUST BE COMPLETED.)

(THE REVERSE SIDE OF THIS FORM MUST BE COMPLETED.)

(THE REVERSE SIDE OF THIS FORM MUST BE COMPLETED.)

FTB 3520 (REV 06-1999) PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3