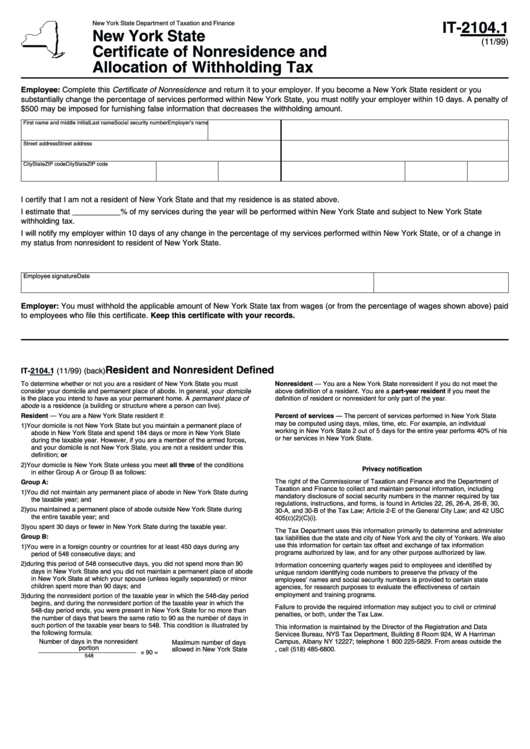

New York State Department of Taxation and Finance

IT-2104.1

New York State

(11/99)

Certificate of Nonresidence and

Allocation of Withholding Tax

Employee: Complete this Certificate of Nonresidence and return it to your employer. If you become a New York State resident or you

substantially change the percentage of services performed within New York State, you must notify your employer within 10 days. A penalty of

$500 may be imposed for furnishing false information that decreases the withholding amount.

First name and middle initial

Last name

Social security number

Employer’s name

Street address

Street address

City

State

ZIP code

City

State

ZIP code

I certify that I am not a resident of New York State and that my residence is as stated above.

I estimate that ___________% of my services during the year will be performed within New York State and subject to New York State

withholding tax.

I will notify my employer within 10 days of any change in the percentage of my services performed within New York State, or of a change in

my status from nonresident to resident of New York State.

Employee signature

Date

Employer: You must withhold the applicable amount of New York State tax from wages (or from the percentage of wages shown above) paid

to employees who file this certificate. Keep this certificate with your records.

Resident and Nonresident Defined

IT-2104.1 (11/99) (back)

To determine whether or not you are a resident of New York State you must

Nonresident — You are a New York State nonresident if you do not meet the

consider your domicile and permanent place of abode. In general, your domicile

above definition of a resident. You are a part-year resident if you meet the

is the place you intend to have as your permanent home. A permanent place of

definition of resident or nonresident for only part of the year.

abode is a residence (a building or structure where a person can live).

Resident — You are a New York State resident if:

Percent of services — The percent of services performed in New York State

may be computed using days, miles, time, etc. For example, an individual

1) Your domicile is not New York State but you maintain a permanent place of

working in New York State 2 out of 5 days for the entire year performs 40% of his

abode in New York State and spend 184 days or more in New York State

or her services in New York State.

during the taxable year. However, if you are a member of the armed forces,

and your domicile is not New York State, you are not a resident under this

definition; or

2) Your domicile is New York State unless you meet all three of the conditions

Privacy notification

in either Group A or Group B as follows:

The right of the Commissioner of Taxation and Finance and the Department of

Group A:

Taxation and Finance to collect and maintain personal information, including

1) You did not maintain any permanent place of abode in New York State during

mandatory disclosure of social security numbers in the manner required by tax

the taxable year; and

regulations, instructions, and forms, is found in Articles 22, 26, 26-A, 26-B, 30,

2) you maintained a permanent place of abode outside New York State during

30-A, and 30-B of the Tax Law; Article 2-E of the General City Law; and 42 USC

the entire taxable year; and

405(c)(2)(C)(i).

3) you spent 30 days or fewer in New York State during the taxable year.

The Tax Department uses this information primarily to determine and administer

Group B:

tax liabilities due the state and city of New York and the city of Yonkers. We also

use this information for certain tax offset and exchange of tax information

1) You were in a foreign country or countries for at least 450 days during any

programs authorized by law, and for any other purpose authorized by law.

period of 548 consecutive days; and

2) during this period of 548 consecutive days, you did not spend more than 90

Information concerning quarterly wages paid to employees and identified by

days in New York State and you did not maintain a permanent place of abode

unique random identifying code numbers to preserve the privacy of the

in New York State at which your spouse (unless legally separated) or minor

employees’ names and social security numbers is provided to certain state

children spent more than 90 days; and

agencies, for research purposes to evaluate the effectiveness of certain

employment and training programs.

3) during the nonresident portion of the taxable year in which the 548-day period

begins, and during the nonresident portion of the taxable year in which the

Failure to provide the required information may subject you to civil or criminal

548-day period ends, you were present in New York State for no more than

penalties, or both, under the Tax Law.

the number of days that bears the same ratio to 90 as the number of days in

such portion of the taxable year bears to 548. This condition is illustrated by

This information is maintained by the Director of the Registration and Data

the following formula:

Services Bureau, NYS Tax Department, Building 8 Room 924, W A Harriman

Number of days in the nonresident

Campus, Albany NY 12227; telephone 1 800 225-5829. From areas outside the

Maximum number of days

portion

U.S. and outside Canada, call (518) 485-6800.

allowed in New York State

× 90 =

548

1

1