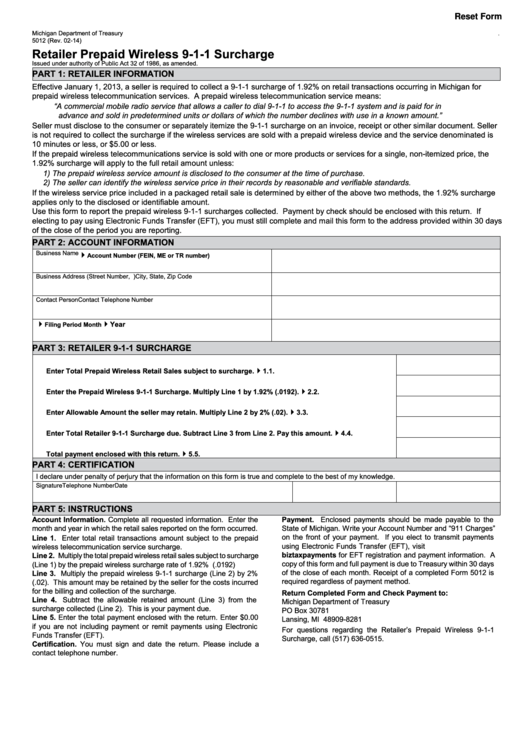

Reset Form

Michigan Department of Treasury

.

5012 (Rev. 02-14)

Retailer Prepaid Wireless 9-1-1 Surcharge

Issued under authority of Public Act 32 of 1986, as amended.

PART 1: RETAILER INFORMATION

Effective January 1, 2013, a seller is required to collect a 9-1-1 surcharge of 1.92% on retail transactions occurring in Michigan for

prepaid wireless telecommunication services. A prepaid wireless telecommunication service means:

“A commercial mobile radio service that allows a caller to dial 9-1-1 to access the 9-1-1 system and is paid for in

advance and sold in predetermined units or dollars of which the number declines with use in a known amount.”

Seller must disclose to the consumer or separately itemize the 9-1-1 surcharge on an invoice, receipt or other similar document. Seller

is not required to collect the surcharge if the wireless services are sold with a prepaid wireless device and the service denominated is

10 minutes or less, or $5.00 or less.

If the prepaid wireless telecommunications service is sold with one or more products or services for a single, non-itemized price, the

1.92% surcharge will apply to the full retail amount unless:

1) The prepaid wireless service amount is disclosed to the consumer at the time of purchase.

2) The seller can identify the wireless service price in their records by reasonable and verifiable standards.

If the wireless service price included in a packaged retail sale is determined by either of the above two methods, the 1.92% surcharge

applies only to the disclosed or identifiable amount.

Use this form to report the prepaid wireless 9-1-1 surcharges collected. Payment by check should be enclosed with this return. If

electing to pay using Electronic Funds Transfer (EFT), you must still complete and mail this form to the address provided within 30 days

of the close of the period you are reporting.

PART 2: ACCOUNT INFORMATION

Business Name

4

Account Number (FEIN, ME or TR number)

Business Address (Street Number, P.O. Box)

City, State, Zip Code

Contact Person

Contact Telephone Number

4

4

Year

Filing Period Month

PART 3: RETAILER 9-1-1 SURCHARGE

1.

Enter Total Prepaid Wireless Retail Sales subject to surcharge. .............................................................

4

1.

2.

Enter the Prepaid Wireless 9-1-1 Surcharge. Multiply Line 1 by 1.92% (.0192). ......................................

4

2.

3.

Enter Allowable Amount the seller may retain. Multiply Line 2 by 2% (.02). ............................................

4

3.

4.

Enter Total Retailer 9-1-1 Surcharge due. Subtract Line 3 from Line 2. Pay this amount. .....................

4

4.

5.

Total payment enclosed with this return. ....................................................................................................

4

5.

PART 4: CERTIFICATION

I declare under penalty of perjury that the information on this form is true and complete to the best of my knowledge.

Signature

Telephone Number

Date

PART 5: INSTRUCTIONS

Account Information. Complete all requested information. Enter the

Payment. Enclosed payments should be made payable to the

month and year in which the retail sales reported on the form occurred.

State of Michigan. Write your Account Number and “911 Charges”

on the front of your payment. If you elect to transmit payments

Line 1. Enter total retail transactions amount subject to the prepaid

using Electronic Funds Transfer (EFT), visit

wireless telecommunication service surcharge.

biztaxpayments for EFT registration and payment information. A

Line 2. Multiply the total prepaid wireless retail sales subject to surcharge

copy of this form and full payment is due to Treasury within 30 days

(Line 1) by the prepaid wireless surcharge rate of 1.92% (.0192)

of the close of each month. Receipt of a completed Form 5012 is

Line 3. Multiply the prepaid wireless 9-1-1 surcharge (Line 2) by 2%

required regardless of payment method.

(.02). This amount may be retained by the seller for the costs incurred

for the billing and collection of the surcharge.

Return Completed Form and Check Payment to:

Line 4. Subtract the allowable retained amount (Line 3) from the

Michigan Department of Treasury

surcharge collected (Line 2). This is your payment due.

PO Box 30781

Line 5. Enter the total payment enclosed with the return. Enter $0.00

Lansing, MI 48909-8281

if you are not including payment or remit payments using Electronic

For questions regarding the Retailer’s Prepaid Wireless 9-1-1

Funds Transfer (EFT).

Surcharge, call (517) 636-0515.

Certification. You must sign and date the return. Please include a

contact telephone number.

1

1