Form Wrc Instructions - Worker Retraining Tax Credit Application - 1999

ADVERTISEMENT

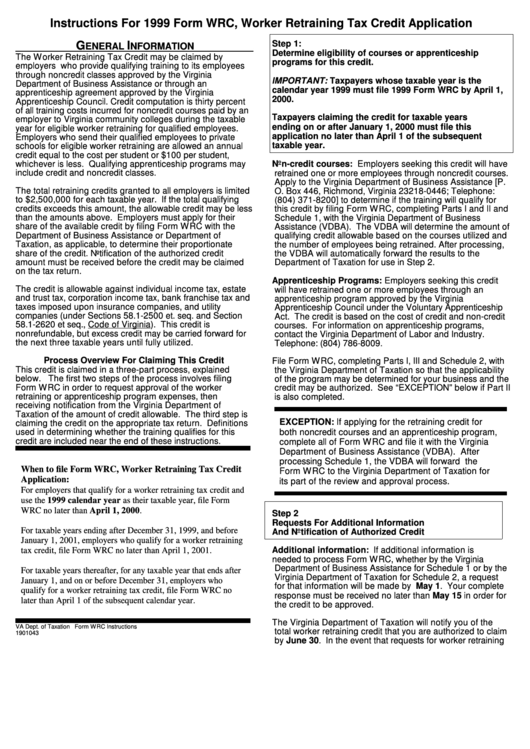

Instructions For 1999 Form WRC, Worker Retraining Tax Credit Application

Step 1:

G

I

ENERAL

NFORMATION

Determine eligibility of courses or apprenticeship

The Worker Retraining Tax Credit may be claimed by

programs for this credit.

employers who provide qualifying training to its employees

through noncredit classes approved by the Virginia

IMPORTANT: Taxpayers whose taxable year is the

Department of Business Assistance or through an

calendar year 1999 must file 1999 Form WRC by April 1,

apprenticeship agreement approved by the Virginia

2000.

Apprenticeship Council. Credit computation is thirty percent

of all training costs incurred for noncredit courses paid by an

Taxpayers claiming the credit for taxable years

employer to Virginia community colleges during the taxable

ending on or after January 1, 2000 must file this

year for eligible worker retraining for qualified employees.

application no later than April 1 of the subsequent

Employers who send their qualified employees to private

taxable year.

schools for eligible worker retraining are allowed an annual

credit equal to the cost per student or $100 per student,

whichever is less. Qualifying apprenticeship programs may

Non-credit courses: Employers seeking this credit will have

include credit and noncredit classes.

retrained one or more employees through noncredit courses.

Apply to the Virginia Department of Business Assistance [P.

The total retraining credits granted to all employers is limited

O. Box 446, Richmond, Virginia 23218-0446; Telephone:

to $2,500,000 for each taxable year. If the total qualifying

(804) 371-8200] to determine if the training will qualify for

credits exceeds this amount, the allowable credit may be less

this credit by filing Form WRC, completing Parts I and II and

than the amounts above. Employers must apply for their

Schedule 1, with the Virginia Department of Business

share of the available credit by filing Form WRC with the

Assistance (VDBA). The VDBA will determine the amount of

Department of Business Assistance or Department of

qualifying credit allowable based on the courses utilized and

Taxation, as applicable, to determine their proportionate

the number of employees being retrained. After processing,

share of the credit. Notification of the authorized credit

the VDBA will automatically forward the results to the

amount must be received before the credit may be claimed

Department of Taxation for use in Step 2.

on the tax return.

Apprenticeship Programs: Employers seeking this credit

The credit is allowable against individual income tax, estate

will have retrained one or more employees through an

and trust tax, corporation income tax, bank franchise tax and

apprenticeship program approved by the Virginia

taxes imposed upon insurance companies, and utility

Apprenticeship Council under the Voluntary Apprenticeship

companies (under Sections 58.1-2500 et. seq. and Section

Act. The credit is based on the cost of credit and non-credit

58.1-2620 et seq., Code of Virginia). This credit is

courses. For information on apprenticeship programs,

nonrefundable, but excess credit may be carried forward for

contact the Virginia Department of Labor and Industry.

the next three taxable years until fully utilized.

Telephone: (804) 786-8009.

Process Overview For Claiming This Credit

File Form WRC, completing Parts I, III and Schedule 2, with

This credit is claimed in a three-part process, explained

the Virginia Department of Taxation so that the applicability

below. The first two steps of the process involves filing

of the program may be determined for your business and the

Form WRC in order to request approval of the worker

credit may be authorized. See “ EXCEPTION” below if Part II

retraining or apprenticeship program expenses, then

is also completed.

receiving notification from the Virginia Department of

Taxation of the amount of credit allowable. The third step is

EXCEPTION: If applying for the retraining credit for

claiming the credit on the appropriate tax return. Definitions

used in determining whether the training qualifies for this

both noncredit courses and an apprenticeship program,

credit are included near the end of these instructions.

complete all of Form WRC and file it with the Virginia

Department of Business Assistance (VDBA). After

processing Schedule 1, the VDBA will forward the

When to file Form WRC, Worker Retraining Tax Credit

Form WRC to the Virginia Department of Taxation for

Application:

its part of the review and approval process.

For employers that qualify for a worker retraining tax credit and

use the 1999 calendar year as their taxable year, file Form

WRC no later than April 1, 2000.

Step 2

Requests For Additional Information

For taxable years ending after December 31, 1999, and before

And Notification of Authorized Credit

January 1, 2001, employers who qualify for a worker retraining

Additional information: If additional information is

tax credit, file Form WRC no later than April 1, 2001.

needed to process Form WRC, whether by the Virginia

Department of Business Assistance for Schedule 1 or by the

For taxable years thereafter, for any taxable year that ends after

Virginia Department of Taxation for Schedule 2, a request

January 1, and on or before December 31, employers who

for that information will be made by May 1. Your complete

qualify for a worker retraining tax credit, file Form WRC no

response must be received no later than May 15 in order for

later than April 1 of the subsequent calendar year.

the credit to be approved.

The Virginia Department of Taxation will notify you of the

VA Dept. of Taxation Form WRC Instructions

total worker retraining credit that you are authorized to claim

1901043

by June 30. In the event that requests for worker retraining

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3