Form 3555l - Request For Tax Clearance Certificate Limited Liability Company Or Limited Liability Partnership - California Secretary Of State

ADVERTISEMENT

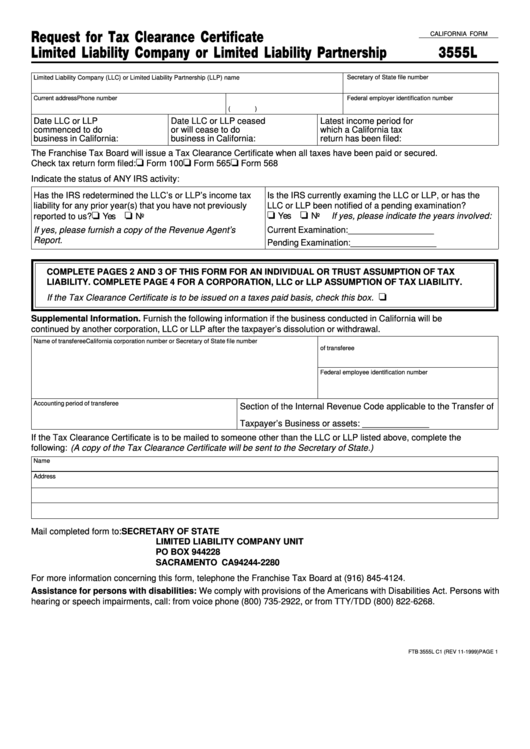

Request for Tax Clearance Certificate

CALIFORNIA FORM

Limited Liability Company or Limited Liability Partnership

3555L

Secretary of State file number

Limited Liability Company (LLC) or Limited Liability Partnership (LLP) name

Current address

Phone number

Federal employer identification number

(

)

Date LLC or LLP

Date LLC or LLP ceased

Latest income period for

commenced to do

or will cease to do

which a California tax

business in California:

business in California:

return has been filed:

The Franchise Tax Board will issue a Tax Clearance Certificate when all taxes have been paid or secured.

Check tax return form filed:

Form 100

Form 565

Form 568

Indicate the status of ANY IRS activity:

Has the IRS redetermined the LLC’s or LLP’s income tax

Is the IRS currently examing the LLC or LLP, or has the

LLC or LLP been notified of a pending examination?

liability for any prior year(s) that you have not previously

reported to us?

Yes

No

Yes

No If yes, please indicate the years involved:

If yes, please furnish a copy of the Revenue Agent’s

Current Examination:

__________________

Report.

Pending Examination:

__________________

COMPLETE PAGES 2 AND 3 OF THIS FORM FOR AN INDIVIDUAL OR TRUST ASSUMPTION OF TAX

LIABILITY. COMPLETE PAGE 4 FOR A CORPORATION, LLC or LLP ASSUMPTION OF TAX LIABILITY.

If the Tax Clearance Certificate is to be issued on a taxes paid basis, check this box.

Supplemental Information. Furnish the following information if the business conducted in California will be

continued by another corporation, LLC or LLP after the taxpayer’s dissolution or withdrawal.

Name of transferee

California corporation number or Secretary of State file number

of transferee

Federal employee identification number

Accounting period of transferee

Section of the Internal Revenue Code applicable to the Transfer of

Taxpayer’s Business or assets: ______________

If the Tax Clearance Certificate is to be mailed to someone other than the LLC or LLP listed above, complete the

following: (A copy of the Tax Clearance Certificate will be sent to the Secretary of State.)

Name

Address

Mail completed form to:

SECRETARY OF STATE

LIMITED LIABILITY COMPANY UNIT

PO BOX 944228

SACRAMENTO CA 94244-2280

For more information concerning this form, telephone the Franchise Tax Board at (916) 845-4124.

Assistance for persons with disabilities: We comply with provisions of the Americans with Disabilities Act. Persons with

hearing or speech impairments, call: from voice phone (800) 735-2922, or from TTY/TDD (800) 822-6268.

FTB 3555L C1 (REV 11-1999) PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4