Instructions For Trustee For Form 706-Gs(D-1) - Notification Of Distribution From A Generation-Skipping Trust

ADVERTISEMENT

Alaska, Arizona, California

Department of the Treasury

(counties of Alpine, Amador,

Internal Revenue Service

Butte, Calaveras, Colusa,

Contra Costa, Del Norte, El

Dorado, Glenn, Humboldt,

Instructions for Trustee for

Lake, Lassen, Marin,

Mendocino, Modoc, Napa,

Nevada, Placer, Plumas,

Sacramento, San Joaquin,

Ogden, UT 84201

Form 706-GS(D-1)

Shasta, Sierra, Siskiyou,

Solano, Sonoma, Sutter,

Tehama, Trinity, Yolo, and

Yuba), Colorado, Idaho,

(Rev. March 1995)

Montana, Nebraska,

Nevada, North Dakota,

Notification of Distribution From a Generation-Skipping

Oregon, South Dakota,

Utah, Washington,

Trust

Wyoming

California (all other

Section references are to the Internal Revenue Code unless otherwise noted.

Fresno, CA 93888

counties), Hawaii

Paperwork Reduction

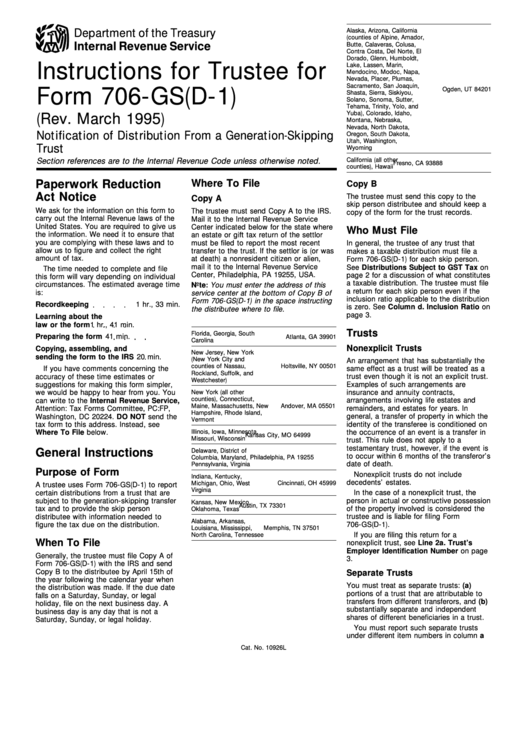

Where To File

Copy B

Act Notice

The trustee must send this copy to the

Copy A

skip person distributee and should keep a

We ask for the information on this form to

The trustee must send Copy A to the IRS.

copy of the form for the trust records.

carry out the Internal Revenue laws of the

Mail it to the Internal Revenue Service

United States. You are required to give us

Center indicated below for the state where

Who Must File

the information. We need it to ensure that

an estate or gift tax return of the settlor

you are complying with these laws and to

must be filed to report the most recent

In general, the trustee of any trust that

allow us to figure and collect the right

transfer to the trust. If the settlor is (or was

makes a taxable distribution must file a

amount of tax.

at death) a nonresident citizen or alien,

Form 706-GS(D-1) for each skip person.

mail it to the Internal Revenue Service

See Distributions Subject to GST Tax on

The time needed to complete and file

Center, Philadelphia, PA 19255, USA.

page 2 for a discussion of what constitutes

this form will vary depending on individual

a taxable distribution. The trustee must file

circumstances. The estimated average time

Note: You must enter the address of this

a return for each skip person even if the

is:

service center at the bottom of Copy B of

inclusion ratio applicable to the distribution

Form 706-GS(D-1) in the space instructing

Recordkeeping

1 hr., 33 min.

is zero. See Column d. Inclusion Ratio on

the distributee where to file.

page 3.

Learning about the

law or the form

1 hr., 41 min.

Trusts

Florida, Georgia, South

Preparing the form

41 min.

Atlanta, GA 39901

Carolina

Nonexplicit Trusts

Copying, assembling, and

New Jersey, New York

sending the form to the IRS

20 min.

(New York City and

An arrangement that has substantially the

counties of Nassau,

Holtsville, NY 00501

same effect as a trust will be treated as a

If you have comments concerning the

Rockland, Suffolk, and

accuracy of these time estimates or

trust even though it is not an explicit trust.

Westchester)

suggestions for making this form simpler,

Examples of such arrangements are

we would be happy to hear from you. You

New York (all other

insurance and annuity contracts,

counties), Connecticut,

can write to the Internal Revenue Service,

arrangements involving life estates and

Maine, Massachusetts, New

Andover, MA 05501

Attention: Tax Forms Committee, PC:FP,

remainders, and estates for years. In

Hampshire, Rhode Island,

Washington, DC 20224. DO NOT send the

general, a transfer of property in which the

Vermont

identity of the transferee is conditioned on

tax form to this address. Instead, see

Where To File below.

Illinois, Iowa, Minnesota,

the occurrence of an event is a transfer in

Kansas City, MO 64999

Missouri, Wisconsin

trust. This rule does not apply to a

testamentary trust, however, if the event is

General Instructions

Delaware, District of

to occur within 6 months of the transferor’s

Columbia, Maryland,

Philadelphia, PA 19255

date of death.

Pennsylvania, Virginia

Purpose of Form

Nonexplicit trusts do not include

Indiana, Kentucky,

decedents’ estates.

Michigan, Ohio, West

Cincinnati, OH 45999

A trustee uses Form 706-GS(D-1) to report

Virginia

certain distributions from a trust that are

In the case of a nonexplicit trust, the

person in actual or constructive possession

subject to the generation-skipping transfer

Kansas, New Mexico,

Austin, TX 73301

tax and to provide the skip person

of the property involved is considered the

Oklahoma, Texas

trustee and is liable for filing Form

distributee with information needed to

Alabama, Arkansas,

figure the tax due on the distribution.

706-GS(D-1).

Louisiana, Mississippi,

Memphis, TN 37501

If you are filing this return for a

North Carolina, Tennessee

When To File

nonexplicit trust, see Line 2a. Trust’s

Employer Identification Number on page

Generally, the trustee must file Copy A of

3.

Form 706-GS(D-1) with the IRS and send

Copy B to the distributee by April 15th of

Separate Trusts

the year following the calendar year when

You must treat as separate trusts: (a)

the distribution was made. If the due date

portions of a trust that are attributable to

falls on a Saturday, Sunday, or legal

transfers from different transferors, and (b)

holiday, file on the next business day. A

substantially separate and independent

business day is any day that is not a

shares of different beneficiaries in a trust.

Saturday, Sunday, or legal holiday.

You must report such separate trusts

under different item numbers in column a

Cat. No. 10926L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4