Instructions For Maryland Form 510 - Pass-Through Entity Income Tax Return - 2002

ADVERTISEMENT

INSTRUCTiONS

sharehokiers.

Maryland

Qualii Sub-S Subsidiaries are treated as di-

File Form 510 by the

thetaxaMeyearorperiodifapartnershiporbythe

#there&-tparblersor~ders

Pass-throughentitiesarerequiradtopaytheper-

sonaiincometaxonbehatfofnon&de&;thetax

is4.75%ofthenomesidentpartne&orshamhokl-

ers’distribuWwproratashareoftncome

alkxa-

ble to Maryland. When the tax is expected to ex-

for instructions.

i s s u b j e c t

- Corporation Income Tax Return to calculate

modification

;nent of the balance due to the front of Form

enttty must submit Form 510E

- Application for

lnwme Tax Return.

orbythe15thdayofthe3rdmonthforScor-

-

poratons.

mitted for each partner’s or shareholder’s income

FOR

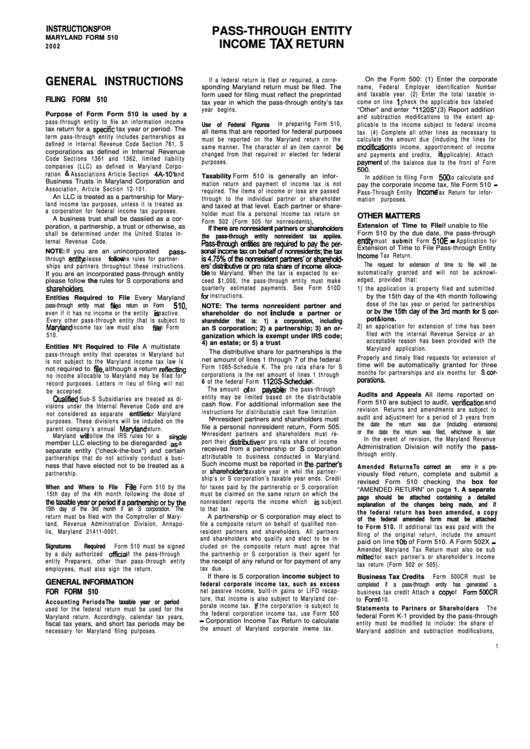

PASS-THROUGH ENTITY

MARYLAND FORM 510

INCOME TAX RETURN

2 0 0 2

GENERAL INSTRUCTIONS

On the Form 500: (1) Enter the corporate

If a federal return is filed or required, a corre-

sponding Maryland return must be filed. The

name, Federal Employer Identification Number

and taxable year. (2) Enter the total taxable in-

form used for filing must reflect the preprinted

FILING FORM 510

come on line 1, check the applicable box labeled

tax year in which the pass-through entity’s tax

year begins.

“Other” and enter ‘1120s”. (3) Report addition

Purpose of Form Form 510 is used by a

and subtraction modifications to the extent ap-

pass-through entity to file an information income

In preparing Form 510,

Use of Federal Figures

plicable to the income subject to federal income

tax return for a speciric tax year or period. The

all items that are reported for federal purposes

tax. (4) Complete all other lines as necessary to

term pass-through entity includes partnerships as

must be reported on the Maryland return in the

calculate the amount due (induding the lines for

defined in Internal Revenue Code Section 761, S

same manner. The character of an item cannot be

to income, apportionment of income

corporations as defined in Internal Revenue

changed from that required or elected for federal

and payments and credits, tf applicable). Attach

Code Sections 1361 and 1362, limited liability

purposes.

companies (LLC) as defined in Maryland Corpo-

ration 8. A s s o c i a t i o n s A r t i c l e S e c t i o n 4A-101

and

Taxability Form 510 is generally an infor-

In addition to filing Form 506 to calculate and

Business Trusts in Maryland Corporation and

mation return and payment of income tax is not

pay the corporate income tax, file Form 510 -

Association, Article Section 12-101.

required. The items of income or loss are passed

Pass-Through Entity Income

Tax Return for infor-

An LLC is treated as a partnership for Mary-

through to the individual partner or shareholder

mation purposes.

land income tax purposes, unless it is treated as

and taxed at that level. Each partner or share-

a corporation for federal income tax purposes.

holder must file a personal income tax return on

OTHER MMTERS

A business trust shall be dassiied as a cor-

Form 502 (Form 505 for nonresidents).

Extension of Time to File

If unable to file

poration, a partnership, a trust or otherwise, as

Form 510 by the due date, the pass-through

shall be determined under the United States in-

the pass-through entity nonresident tax appiies.

ternal Revenue Code.

Extension of Time to File Pass-through Entity

NOTE: If you are an unincorporated pass-

through entity please fottow the rules for partner-

The request for extension of time to file will be

ships and partners throughout these instructions.

automatically granted and will not be acknowl-

If you are an incorporated pass-through entity

edged, provided that:

please follow the rules for S corporations and

ceed $1,000, the pass-through entity must make

quarterly estimated payments. See Form 510D

1) the application is property filed and submitted

by the 15th day of the 4th month following

Entities Required to File Every Maryland

dose of the tax year or period for partnerships

pass-through entity must Me

a return on Form 510.

NOTE: The terms nonresident partner and

even if it has no income or the entity is inactive.

shareholder do not in&de

a partner or

pot&ions.

Every other pass-through entity that is subject to

sharehdder that is: 1) a corporation, including

2) an application for extension of time has been

income tax law must also ftle on Form

an S corporation; 2) a partnership; 3) an or-

filed with the internal Revenue Service or an

510.

ganization which is exempt under IRS code;

acceptable reason has been provided with the

4) an estate; or 5) a trust

Entities Not Required to File A multistate

Maryland application.

The distributive share for partnerships is the

pass-through entity that operates in Maryland but

Properly and timely filed requests for extension of

net amount of lines 1 through 7 of the federal

is not subject to the Maryland income tax law is

time will be automatically granted for three

Form 1065-Schedule K. The pro rata share for S

not required to file, although a return reflecting

months for partnerships and six months for S wr-

corporations is the net amount of lines 1 through

no income allocable to Maryland may be filed for

6 of the federal Form 112OSSchedule

K.

record purposes. Letters in lieu of filing will not

The amount of tax payabie

by the pass-through

be accepted.

Audits and Appeals All items reported on

entity may be limited based on the distributable

Form 510 are subject to audit, veritication

and

cash flow. For additional information see the

visions under the Internal Revenue Code and are

revision. Returns and amendments are subject to

instructions for distributable cash flow limitation.

not considered as separate entkies

for Maryland

audit and adjustment for a period of 3 years from

Nonresident partners and shareholders must

purposes. These divisions will be induded on the

the date the return was due (including extensions)

file a personal nonresident return, Form 505.

parent company’s annual Marytand

return.

or the date the return was filed, whichever is later.

Nonresident partners and shareholders must re-

Maryland witl follow the IRS rules for a sinole

In the event of revision, the Maryland Revenue

port their distnbutiie

or pro rata share of income

member LLC electing to be disregarded a< a

Administration Division will notify the pass-

received from a partnership or S corporation

separate entity (“check-the-box”) and certain

through entity.

attributable to business conducted in Maryland.

partnerships that do not actively conduct a busi-

Such income must be reported in the.partner’s

ness that have elected not to be treated as a

Amended Returns

To correct an error in a pre-

or sharehokierk

taxable year in whii the partner-

partnership.

viously filed return, complete and submit a

ship’s or S corporation’s taxable year ends. Credii

revised Form 510 checking the box for

When and Where to File

for taxes paid by the partnership or S corporation

“AMENDED RETURN” on page 1. A separate

15th day of the 4th month following the dose of

must be claimed on the same return on which the

page should be attached containing a detailed

nonresident reports the income which

explanation of the changes being made, and if

15th day of the 3rd month if an S corporation. The

to that tax.

the federal return has been amended, a copy

return must be filed with the Comptroller of Mary-

A partnership or S corporation may elect to

of the federal amended form must be attached

land, Revenue Administration Division, Annapo-

file a composite return on behalf of qualified non-

to Form 510. If additional tax was paid with the

lis, Maryland 21411-0001.

resident partners and shareholders. All partners

filing of the original return, include the amount

and shareholders who qualify and elect to be in-

paid on line IOb of Form 510. A Form 502X -

Signatures

Required

Form 510 must be signed

cluded on the composite return must agree that

Amended Maryland Tax Return must also be sub

by a duly authorized official

of the pass-through

the partnenhip or S corporation is their agent for

entity Preparers, other than pass-through entity

the receipt of any refund or for payment of any

tax return (Form 502 or 505).

tax due.

employees, must also sign the return.

If there is S corporation income subject to

Business Tax Credits

Form 500CR must be

GENERAL INFORMATION

federal corporate income tax, such as excess

completed if a pass-through entity has generated a

FOR FORM 510

net passive income, built-in gains or LIFO recap-

business tax credit Attach a copy of Form 5OOCR

ture, that income is also subject to Maryland cor-

to Form 510.

Accounting Periods The taxable year or period

porate income tax. l f the corporation is subject to

Statements to Partners or Shareholders

T h e

used for the federal return must be used for the

the federal corporation income tax, use Form 500

federal Form K-1 provided by the pass-through

Maryland return. Accordingly, calendar tax years,

entity must be modified to include: the share of

fiscal tax years, and short tax periods may be

the amount of Maryland corporate inwme tax.

necessary for Maryland filing purposes.

Maryland addition and subtraction modifications,

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4