Form Dr-308 - Application For Waiver And Release Of Florida Estate Tax Lien - 1998

ADVERTISEMENT

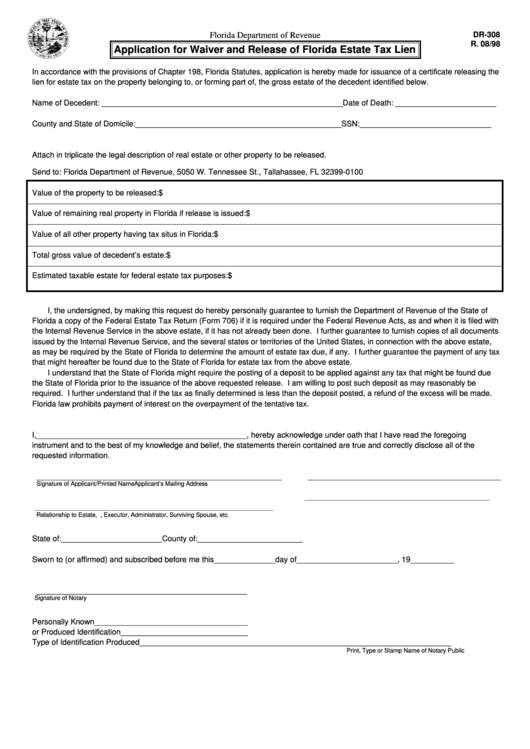

DR-308

Florida Department of Revenue

R. 08/98

Application for Waiver and Release of Florida Estate Tax Lien

In accordance with the provisions of Chapter 198, Florida Statutes, application is hereby made for issuance of a certificate releasing the

lien for estate tax on the property belonging to, or forming part of, the gross estate of the decedent identified below.

Name of Decedent: _______________________________________________________ Date of Death: _______________________

County and State of Domicile: _______________________________________________ SSN: ______________________________

Attach in triplicate the legal description of real estate or other property to be released.

Send to: Florida Department of Revenue, 5050 W. Tennessee St., Tallahassee, FL 32399-0100

Value of the property to be released:

$

Value of remaining real property in Florida if release is issued:

$

Value of all other property having tax situs in Florida:

$

Total gross value of decedent’s estate:

$

Estimated taxable estate for federal estate tax purposes:

$

I, the undersigned, by making this request do hereby personally guarantee to furnish the Department of Revenue of the State of

Florida a copy of the Federal Estate Tax Return (Form 706) if it is required under the Federal Revenue Acts, as and when it is filed with

the Internal Revenue Service in the above estate, if it has not already been done. I further guarantee to furnish copies of all documents

issued by the Internal Revenue Service, and the several states or territories of the United States, in connection with the above estate,

as may be required by the State of Florida to determine the amount of estate tax due, if any. I further guarantee the payment of any tax

that might hereafter be found due to the State of Florida for estate tax from the above estate.

I understand that the State of Florida might require the posting of a deposit to be applied against any tax that might be found due

the State of Florida prior to the issuance of the above requested release. I am willing to post such deposit as may reasonably be

required. I further understand that if the tax as finally determined is less than the deposit posted, a refund of the excess will be made.

Florida law prohibits payment of interest on the overpayment of the tentative tax.

I, ________________________________________________ , hereby acknowledge under oath that I have read the foregoing

instrument and to the best of my knowledge and belief, the statements therein contained are true and correctly disclose all of the

requested information.

________________________________________________________

____________________________________________

Signature of Applicant/Printed Name

Applicant’s Mailing Address

____________________________________________________________________________

__________________________________________________________________________________________________

Relationship to Estate, i.e., Executor, Administrator, Surviving Spouse, etc.

State of: _______________________ County of: ________________________

Sworn to (or affirmed) and subscribed before me this ______________ day of _______________________ , 19 __________

________________________________________________

Signature of Notary

Personally Known ___________________________________

or Produced Identification _____________________________

Type of Identification Produced _________________________

______________________________________________

Print, Type or Stamp Name of Notary Public

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1