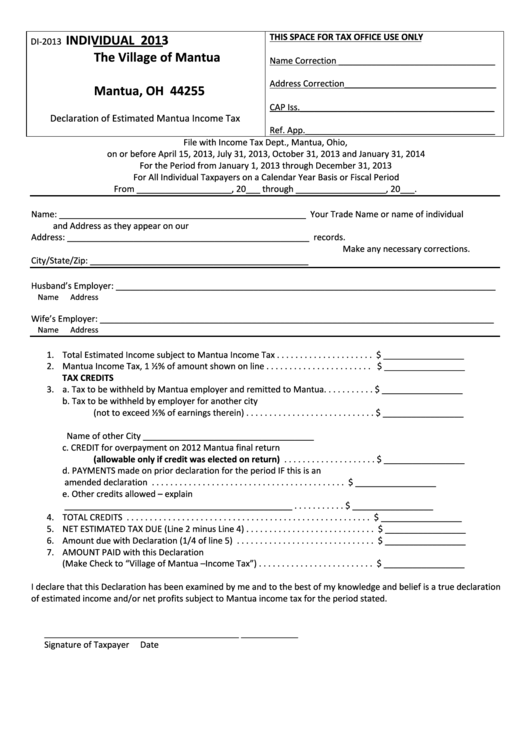

Form Di-2013 - Declaration Of Estimated Mantua Income Tax - 2013

ADVERTISEMENT

THIS SPACE FOR TAX OFFICE USE ONLY

INDIVIDUAL

2013

DI-2013

The Village of Mantua

Name Correction _________________________________

P.O. Box 775

Address Correction________________________________

Mantua, OH 44255

CAP Iss._________________________________________

Declaration of Estimated Mantua Income Tax

Ref. App.________________________________________

File with Income Tax Dept., Mantua, Ohio,

on or before April 15, 2013, July 31, 2013, October 31, 2013 and January 31, 2014

For the Period from January 1, 2013 through December 31, 2013

For All Individual Taxpayers on a Calendar Year Basis or Fiscal Period

From ____________________, 20___ through ___________________, 20___.

Name: ____________________________________________________

Your Trade Name or name of individual

and Address as they appear on our

Address: ___________________________________________________

records.

Make any necessary corrections.

City/State/Zip: ______________________________________________

Husband’s Employer: ________________________________________________________________________________

Name

Address

Wife’s Employer: ___________________________________________________________________________________

Name

Address

1. Total Estimated Income subject to Mantua Income Tax . . . . . . . . . . . . . . . . . . . . . $ _________________

2. Mantua Income Tax, 1 ½% of amount shown on line . . . . . . . . . . . . . . . . . . . . . . . $ _________________

TAX CREDITS

3. a. Tax to be withheld by Mantua employer and remitted to Mantua. . . . . . . . . . . $ _________________

b. Tax to be withheld by employer for another city

(not to exceed ½% of earnings therein) . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

Name of other City ____________________________________

c. CREDIT for overpayment on 2012 Mantua final return

(allowable only if credit was elected on return) . . . . . . . . . . . . . . . . . . . . $ _________________

d. PAYMENTS made on prior declaration for the period IF this is an

amended declaration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

e. Other credits allowed – explain

________________________________________________ . . . . . . . . . . . $ _________________

4. TOTAL CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

5. NET ESTIMATED TAX DUE (Line 2 minus Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

6. Amount due with Declaration (1/4 of line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

7. AMOUNT PAID with this Declaration

(Make Check to “Village of Mantua – Income Tax”) . . . . . . . . . . . . . . . . . . . . . . . . . $ _________________

I declare that this Declaration has been examined by me and to the best of my knowledge and belief is a true declaration

of estimated income and/or net profits subject to Mantua income tax for the period stated.

_________________________________________

____________

Signature of Taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1