Estimated Tax Statement City Of Springfield - 2013

ADVERTISEMENT

2013 ESTIMATED TAX STATEMENT

FOR OFFICE USE ONLY

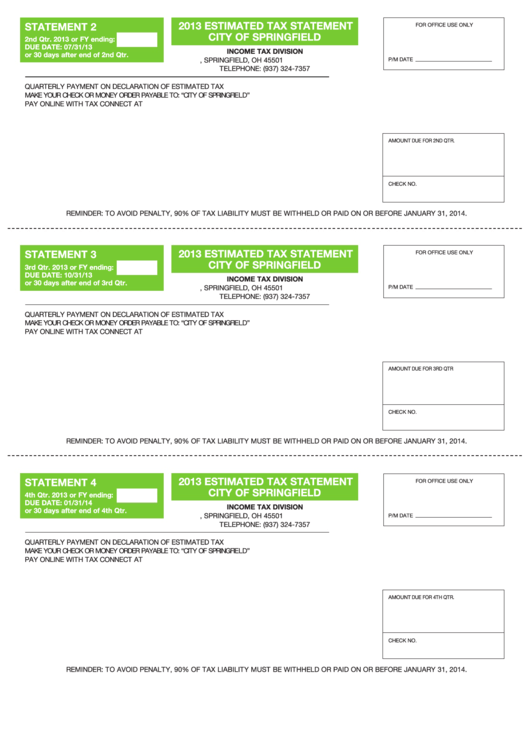

STATEMENT 2

CITY OF SPRINGFIELD

2nd Qtr. 2013 or FY ending:

DUE DATE: 07/31/13

INCOME TAX DIVISION

or 30 days after end of 2nd Qtr.

P.O. BOX 5200, SPRINGFIELD, OH 45501

P/M DATE

TELEPHONE: (937) 324-7357

QUARTERLY PAYMENT ON DECLARATION OF ESTIMATED TAX

MAKE YOUR CHECK OR MONEY ORDER PAYABLE TO: “CITY OF SPRINGFIELD”

PAY ONLINE WITH TAX CONNECT AT

AMOUNT DUE FOR 2ND QTR.

CHECK NO.

REMINDER: TO AVOID PENALTY, 90% OF TAX LIABILITY MUST BE WITHHELD OR PAID ON OR BEFORE JANUARY 31, 2014.

2013 ESTIMATED TAX STATEMENT

STATEMENT 3

FOR OFFICE USE ONLY

CITY OF SPRINGFIELD

3rd Qtr. 2013 or FY ending:

DUE DATE: 10/31/13

INCOME TAX DIVISION

or 30 days after end of 3rd Qtr.

P/M DATE

P.O. BOX 5200, SPRINGFIELD, OH 45501

TELEPHONE: (937) 324-7357

QUARTERLY PAYMENT ON DECLARATION OF ESTIMATED TAX

MAKE YOUR CHECK OR MONEY ORDER PAYABLE TO: “CITY OF SPRINGFIELD”

PAY ONLINE WITH TAX CONNECT AT

AMOUNT DUE FOR 3RD QTR

CHECK NO.

REMINDER: TO AVOID PENALTY, 90% OF TAX LIABILITY MUST BE WITHHELD OR PAID ON OR BEFORE JANUARY 31, 2014.

2013 ESTIMATED TAX STATEMENT

STATEMENT 4

FOR OFFICE USE ONLY

CITY OF SPRINGFIELD

4th Qtr. 2013 or FY ending:

DUE DATE: 01/31/14

INCOME TAX DIVISION

or 30 days after end of 4th Qtr.

P.O. BOX 5200, SPRINGFIELD, OH 45501

P/M DATE

TELEPHONE: (937) 324-7357

QUARTERLY PAYMENT ON DECLARATION OF ESTIMATED TAX

MAKE YOUR CHECK OR MONEY ORDER PAYABLE TO: “CITY OF SPRINGFIELD”

PAY ONLINE WITH TAX CONNECT AT

AMOUNT DUE FOR 4TH QTR.

CHECK NO.

REMINDER: TO AVOID PENALTY, 90% OF TAX LIABILITY MUST BE WITHHELD OR PAID ON OR BEFORE JANUARY 31, 2014.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1