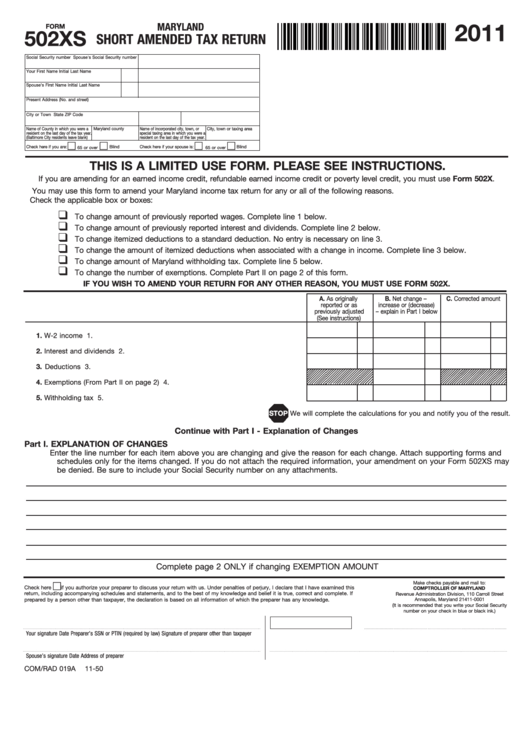

2011

MARYLAND

FORM

502XS

SHORT AMENDED TAX RETURN

11502W050

Social Security number

Spouse's Social Security number

Your First Name

Initial

Last Name

Spouse's First Name

Initial

Last Name

Present Address (No . and street)

City or Town

State

ZIP Code

Name of County in which you were a

Maryland county

Name of incorporated city, town, or

City, town or taxing area

resident on the last day of the tax year .

special taxing area in which you were a

(Baltimore City residents leave blank)

resident on the last day of the tax year .

Check here if you are:

Blind

Check here if your spouse is:

Blind

65 or over

65 or over

THIS IS A LIMITED USE FORM. PLEASE SEE INSTRUCTIONS.

If you are amending for an earned income credit, refundable earned income credit or poverty level credit, you must use Form 502X .

You may use this form to amend your Maryland income tax return for any or all of the following reasons .

Check the applicable box or boxes:

❑

To change amount of previously reported wages . Complete line 1 below .

❑

To change amount of previously reported interest and dividends . Complete line 2 below .

❑

To change itemized deductions to a standard deduction . No entry is necessary on line 3 .

❑

To change the amount of itemized deductions when associated with a change in income . Complete line 3 below .

❑

To change amount of Maryland withholding tax . Complete line 5 below .

❑

To change the number of exemptions . Complete Part II on page 2 of this form .

IF YOU WISH TO AMEND YOUR RETURN FOR ANY OTHER REASON, YOU MUST USE FORM 502X.

A. As originally

B. Net change –

C. Corrected amount

reported or as

increase or (decrease)

previously adjusted

– explain in Part I below

(See instructions)

1. W-2 income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 .

2. Interest and dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 .

3. Deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 .

4. Exemptions (From Part II on page 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 .

5. Withholding tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 .

STOP

We will complete the calculations for you and notify you of the result .

Continue with Part I - Explanation of Changes

Part I. EXPLANATION OF CHANGES

Enter the line number for each item above you are changing and give the reason for each change . Attach supporting forms and

schedules only for the items changed . If you do not attach the required information, your amendment on your Form 502XS may

be denied . Be sure to include your Social Security number on any attachments .

Complete page 2 ONLY if changing EXEMPTION AMOUNT

Make checks payable and mail to:

Check here

if you authorize your preparer to discuss your return with us . Under penalties of perjury, I declare that I have examined this

COMPTROLLER OF MARYLAND

return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and complete . If

Revenue Administration Division, 110 Carroll Street

prepared by a person other than taxpayer, the declaration is based on all information of which the preparer has any knowledge .

Annapolis, Maryland 21411-0001

(It is recommended that you write your Social Security

number on your check in blue or black ink .)

Your signature

Date

Preparer’s SSN or PTIN (required by law) Signature of preparer other than taxpayer

Spouse’s signature

Date

Address of preparer

COM/RAD 019A

11-50

1

1 2

2