California Form 541-Es - Estimated Tax For Fiduciaries - 2012

ADVERTISEMENT

E Failure to Make Estimated Tax

F Other Information

Telephone assistance is available year-round from

7 a.m. until 5 p.m. Monday through Friday. We

Payments

Filing 54-ES on Magnetic Media. Fiduciaries

may modify these hours without notice to meet

that make estimated tax payments for more than

If the estate or trust is required to make estimated

operational needs.

200 taxable trusts may submit the estimated tax

tax payments and does not, or if it underpays

Access by Internet. You can download, view, and

information on magnetic media or composite

any installment, a penalty will be assessed for

print California tax forms and publications

listing. For additional information, our general

that portion of estimated tax that was underpaid

at ftb.ca.gov.

toll-free service is available from within the

from the due date of the installment to the date

United States 800.852.5711 or from outside the

Access other state agencies’ websites at ca.gov.

of payment or the due date of the tax return,

United States 916.845.6500.

whichever is earlier. For more information, get

2011 form FTB 5805.

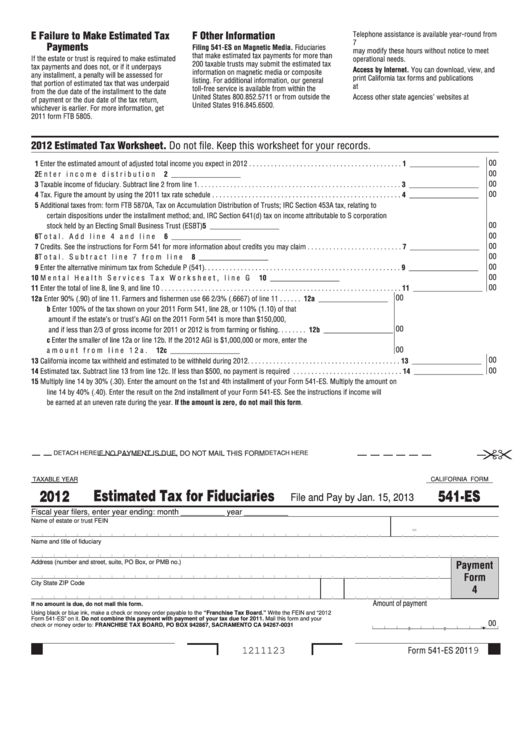

2012 Estimated Tax Worksheet. Do not file. Keep this worksheet for your records.

00

Enter the estimated amount of adjusted total income you expect in 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

___________________

00

2

Enter income distribution deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 ___________________

00

3

Taxable income of fiduciary. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 ___________________

00

4

Tax. Figure the amount by using the 2011 tax rate schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 ___________________

5

Additional taxes from: form FTB 5870A, Tax on Accumulation Distribution of Trusts; IRC Section 453A tax, relating to

certain dispositions under the installment method; and, IRC Section 641(d) tax on income attributable to S corporation

00

stock held by an Electing Small Business Trust (ESBT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 ___________________

00

6

Total. Add line 4 and line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 ___________________

00

7

Credits. See the instructions for Form 541 for more information about credits you may claim . . . . . . . . . . . . . . . . . . . . . . . . . .

7 ___________________

00

8

Total. Subtract line 7 from line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 ___________________

00

9

Enter the alternative minimum tax from Schedule P (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 ___________________

00

0

Mental Health Services Tax Worksheet, line G . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 ___________________

00

Enter the total of line 8, line 9, and line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ___________________

00

2

a Enter 90% (.90) of line 11. Farmers and fishermen use 66 2/3% (.6667) of line 11 . . . . . . 2a ___________________

b Enter 100% of the tax shown on your 2011 Form 541, line 28, or 110% (1.10) of that

amount if the estate’s or trust’s AGI on the 2011 Form 541 is more than $150,000,

00

and if less than 2/3 of gross income for 2011 or 2012 is from farming or fishing . . . . . . . . 2b ___________________

c Enter the smaller of line 12a or line 12b. If the 2012 AGI is $1,000,000 or more, enter the

00

amount from line 12a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c ___________________

00

3

California income tax withheld and estimated to be withheld during 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 ___________________

00

4

Estimated tax. Subtract line 13 from line 12c. If less than $500, no payment is required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 ___________________

5

Multiply line 14 by 30% (.30). Enter the amount on the 1st and 4th installment of your Form 541-ES. Multiply the amount on

line 14 by 40% (.40). Enter the result on the 2nd installment of your Form 541-ES. See the instructions if income will

be earned at an uneven rate during the year. If the amount is zero, do not mail this form.

DETacH HErE

if no PaYmEnT iS DUE, Do noT mail THiS form

DETacH HErE

california form

TaXaBlE YEar

Estimated Tax for Fiduciaries

2012

541-ES

file and Pay by Jan. 15, 2013

fiscal year filers, enter year ending: month __________ year __________

name of estate or trust

fEin

-

name and title of fiduciary

Payment

address (number and street, suite, Po Box, or PmB no.)

Form

city

State

ZiP code

4

amount of payment

If no amount is due, do not mail this form.

Using black or blue ink, make a check or money order payable to the “Franchise Tax Board.” Write the fEin and “2012

form 541-ES” on it. Do not combine this payment with payment of your tax due for 2011. mail this form and your

00

.

,

,

check or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0031

Form 541-ES 2011

1211123

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2