Form Nc K-1 - Shareholder'S Share Of N.c Income, Adjustments, And Credits - North Carolina Department Of Revenue

ADVERTISEMENT

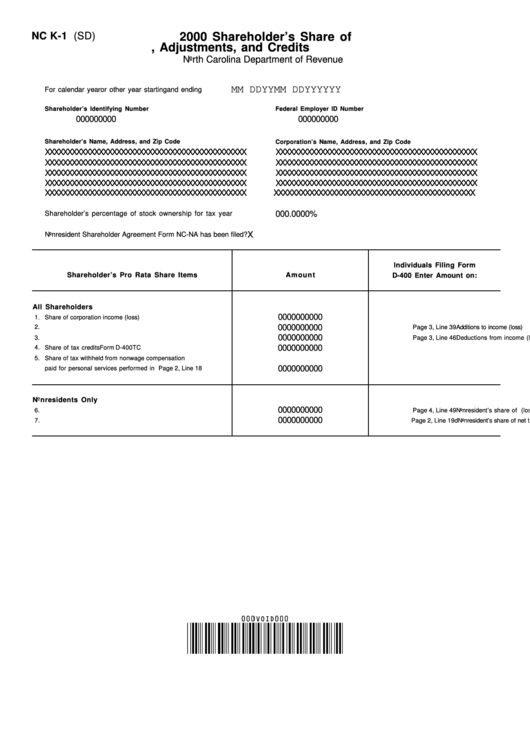

NC K-1 (SD)

2000 Shareholder’s Share of

N.C. Income, Adjustments, and Credits

North Carolina Department of Revenue

YYYY

MM DD YY

MM DD YY

For calendar year

or other year starting

and ending

Shareholder’s Identifying Number

Federal Employer ID Number

000000000

000000000

Shareholder’s Name, Address, and Zip Code

Corporation’s Name, Address, and Zip Code

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Shareholder’s percentage of stock ownership for tax year

000.0000%

X

Nonresident Shareholder Agreement Form NC-NA has been filed?

Individuals Filing Form

Shareholder’s Pro Rata Share Items

Amount

D-400 Enter Amount on:

All Shareholders

0000000000

1.

Share of corporation income (loss)

0000000000

2.

Additions to income (loss)

Page 3, Line 39

0000000000

3.

Deductions from income (loss)

Page 3, Line 46

0000000000

4.

Share of tax credits

Form D-400TC

5.

Share of tax withheld from nonwage compensation

0000000000

paid for personal services performed in N.C.

Page 2, Line 18

Nonresidents Only

0000000000

6.

Nonresident’s share of N.C. taxable income (loss)

Page 4, Line 49

0000000000

7.

Nonresident’s share of net tax paid by the S Corporation

Page 2, Line 19d

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1